- BNB drops 12% after reaching an all-time excessive of $1,370.

- Analysts count on assist round $1,000, with upside targets close to $2,000.

- Bull flag sample and on-chain power recommend long-term momentum stays bullish.

BNB has slipped roughly 12% from its all-time excessive of $1,370, cooling off after a blistering rally that made it the third-largest cryptocurrency by market cap. The dip comes amid a broader risk-off shift within the crypto market, with merchants taking income following final week’s large volatility.

Brief-Time period Pullback or Finish of the Rally?

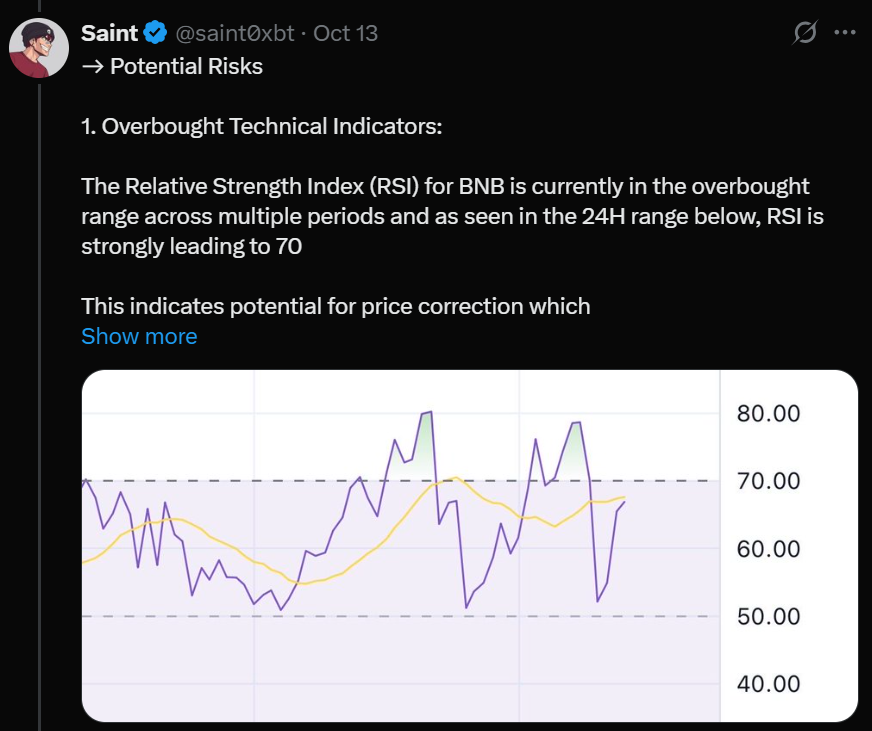

On the day by day chart, BNB’s RSI stays within the overbought zone, dropping from 81 to 71 — a sign typically adopted by temporary corrections. Analysts warn {that a} transfer towards the $1,000 psychological degree seems possible because the market resets from overheated situations. Traditionally, related setups in 2021 and 2024 led to 40–70% retracements earlier than the subsequent leg greater.

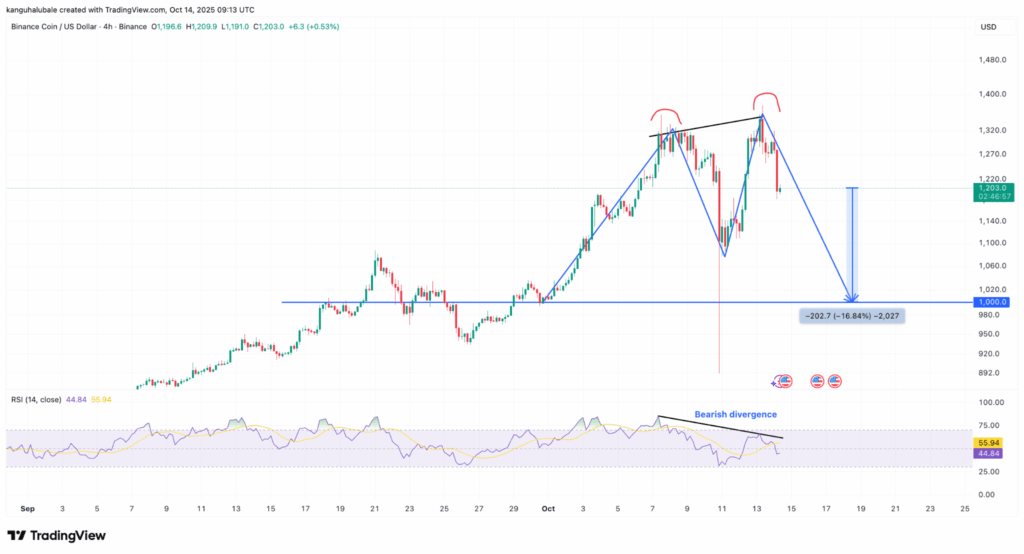

The four-hour chart additionally paints a cautious image, exhibiting a double-top sample that initiatives a doable retest of $1,000 as assist. If promoting continues, deeper retracements towards the $860–$730 zone might observe, the place key transferring averages at present sit.

Why Analysts Nonetheless See $2,000 in Play

Regardless of the correction, the broader development nonetheless seems bullish. On greater timeframes, BNB continues to respect a multi-month bull flag sample courting again to late 2023 — one that means the subsequent main goal might be round $2,100, or roughly 73% greater from present costs.

Market observers additionally level to sturdy fundamentals: excessive BNB Chain exercise, ongoing price burns, and Binance’s current $283 million person compensation marketing campaign, all of which assist reinforce investor confidence. Some merchants even speculate BNB might “flip ETH” in market cap if the present tempo continues.

The Backside Line

BNB’s current pullback seems extra like a wholesome cooldown than a full reversal. With the broader market stabilizing and robust ecosystem demand, analysts imagine the bull run isn’t over — simply catching its breath earlier than the subsequent leg up.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.