Ethereum’s market sentiment continues to battle following final Friday’s market crash, regardless of gradual indicators of broader market enchancment.

As institutional buyers scale back participation, spot market individuals have additionally trimmed their holdings. This might end in continued consolidation or a definitive breakdown of the crucial $4,000 resistance degree round which the coin at present trades.

Sponsored

Sponsored

Ethereum Market Hits Pause Amid File ETF Redemptions

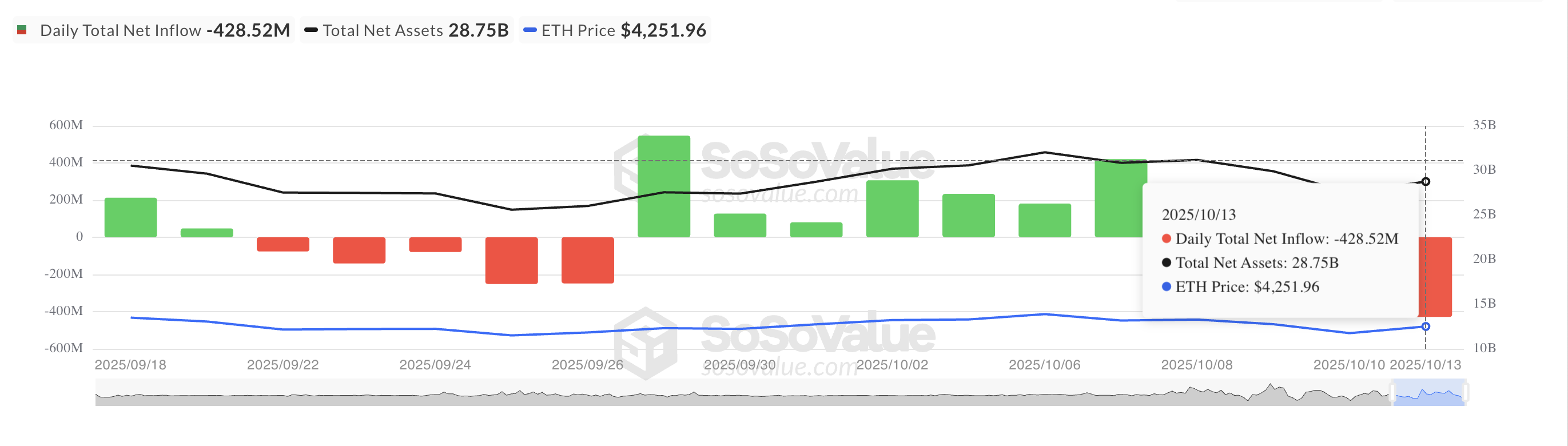

ETH-backed exchange-traded funds (ETFs) have recorded vital outflows since final Friday’s market-wide liquidation occasion. In keeping with knowledge from SosoValue, these funds registered $428.52 million in outflows on Monday.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

BlackRock’s iShares Ethereum Belief (ETHA) led ETF outflows with $310.13 million in redemptions, adopted by Grayscale’s Ethereum Belief (ETHE) at $20.99 million and Constancy’s Ethereum Fund (FETH) at $19.12 million.

Bitwise’s Ethereum ETF (ETHW) and VanEck’s Ethereum ETF (ETHV) recorded smaller declines of $12.18 million and $9.34 million, respectively, on the identical day.

In keeping with the info supplier, Monday’s outflows marked the biggest single-day capital exit from these funds since August 4, highlighting the decline in institutional curiosity following the liquidation occasion.

This development could additional dampen market sentiment across the altcoin and add extra downward strain on its value, limiting the coin’s capability to get well within the quick time period.

Sponsored

Sponsored

Bearish Alerts Mount for Ethereum Amid Technical Weak spot

Readings from the ETH/USD each day chart present the altcoin buying and selling under its Tremendous Pattern indicator, which now acts as dynamic resistance at $4,561. For context, ETH is at present buying and selling properly under this degree, at $3,986.

The Tremendous Pattern indicator helps merchants establish the market’s route by putting a line above or under the worth chart primarily based on the asset’s volatility.

When an asset’s value trades above the Tremendous Pattern line, it indicators a bullish development, indicating that the market is in an uptrend and shopping for strain is dominant.

Conversely, as with ETH, when an asset trades under this line, it indicators that the market is beneath bearish management. Merchants often interpret a place under the Tremendous Pattern as a warning that downward momentum may proceed, making it more durable for ETH to regain energy within the close to time period.

Bears Goal Decrease Ranges Whereas Patrons Wait

If bullish sentiment stays elusive, ETH may lengthen its decline under the crucial $4,000 value degree, probably dropping to $3,626. If this degree weakens, it may give solution to a deeper decline towards $3,215.

Nevertheless, a rebound in new demand for the main altcoin may invalidate this bearish outlook. In that state of affairs, the coin’s value may climb to $4,211.