- Jim Cramer warns that crypto hypothesis is now influencing the S&P 500.

- Bitcoin and U.S. shares each dropped amid commerce tensions and Fed uncertainty.

- The “Inverse Cramer” meme resurfaces, with merchants joking his bearish views may sign a crypto rebound.

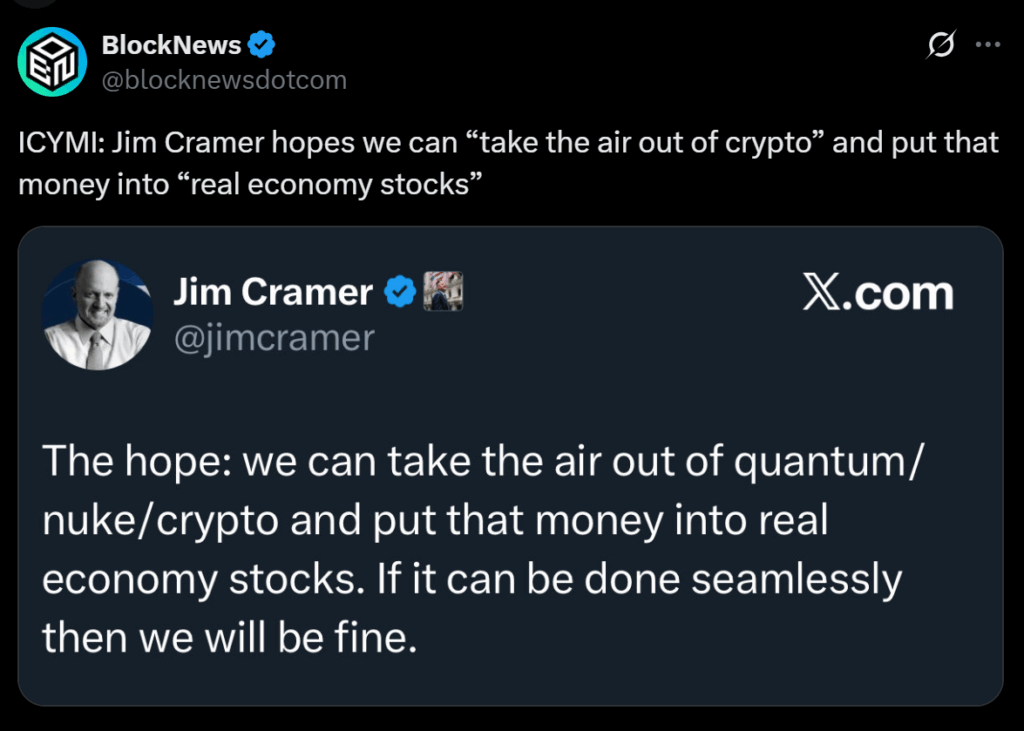

CNBC’s Mad Cash host Jim Cramer has raised contemporary considerations over what he calls the rising affect of cryptocurrency hypothesis on the normal monetary system. In a current submit on X, Cramer described the connection between crypto and the S&P 500 as “the tail wagging the canine” — implying that risky digital property are actually dictating the path of U.S. equities, not the opposite method round.

Cramer advised that when crypto costs surge, Wall Avenue follows with features, and when the crypto market crashes, conventional shares typically tumble too. “I’ve been anxious this may occur for weeks,” he wrote, highlighting how intently correlated the 2 markets have change into. His feedback come amid renewed turbulence triggered by U.S.-China commerce tensions and rising uncertainty across the Federal Reserve’s subsequent charge transfer.

Bitcoin and Shares Fall in Sync

Cramer’s remarks coincided with a contemporary market dip. Bitcoin fell greater than 4%, sliding from $115,500 to $110,343, whereas the S&P 500 dropped 1.34% over the identical interval. Analysts attribute a lot of this weak spot to escalating tariff threats between Washington and Beijing, which not too long ago despatched shockwaves by each crypto and conventional markets.

Nonetheless, Cramer argues that the connection between these declines is not any coincidence. In line with him, speculative enthusiasm — or panic — within the crypto sector is now sturdy sufficient to ripple by institutional portfolios and ETFs, influencing how main fairness indices behave. “The tail is now wagging the canine,” he reiterated, suggesting that crypto sentiment could also be steering the broader market narrative.

“Inverse Cramer” Meme Returns

Predictably, the web had a area day. Inside hours of his submit, X customers revived the “Inverse Cramer” meme, a long-running joke that market strikes typically go in the wrong way of his predictions.

Commentators joked that Cramer’s warnings may really be a bullish sign for digital property. “Each time he requires a crash, Bitcoin rallies,” one consumer quipped. Others urged him to make extra bearish calls — like declaring that Bitcoin won’t ever attain $200K or that Ethereum and XRP are doomed — hoping that the “Cramer impact” would possibly as soon as once more spark the alternative final result.

Crypto’s Rising Grip on Wall Avenue

Whatever the memes, Cramer’s level faucets into an actual and rising concern: crypto markets are actually deeply intertwined with conventional finance. With institutional funds, ETFs, and publicly traded corporations holding important publicity to Bitcoin and Ethereum, volatility in digital property can shortly spill over into equities.

Whereas Cramer stays skeptical concerning the affect of “speculative” crypto conduct, others see it as an indication of mainstream integration — a brand new period the place digital property not sit on the sidelines however actively form Wall Avenue’s temper swings.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.