Be part of Our Telegram channel to remain updated on breaking information protection

Metaplanet’s enterprise worth has slumped under the worth of its Bitcoin reserves because the crypto’s value plunge pressures Asia’s largest BTC treasury agency.

The Japan-based firm’s mNAV — the ratio of market capitalization plus debt to the worth of its crypto holdings — dropped to 0.99 throughout at this time’s buying and selling session, Bloomberg reported, citing information from Metaplanet’s web site.

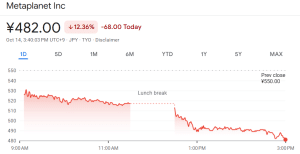

Metaplanet’s share value plunged greater than 12% up to now 24 hours, extending a dizzying 70% correction since June, in accordance with Google Finance.

Metaplanet share value (Supply: Google Finance)

Metaplanet’s shares are additionally down greater than 19% over the previous week

The declining share value is without doubt one of the most important drivers for the corporate’s falling mNAV, and the inventory stays below strain.

Trying on the each day chart for Metaplanet’s share value, a serious bearish technical flag has been triggered up to now couple of days, with the 50 Easy Shifting Common (SMA) crossing under the 200 SMA throughout this era, TradingView information exhibits.

Day by day chart for Metaplanet inventory (Supply: TradingView)

Normally, a brief SMA just like the 50-day crossing under an extended indicator just like the 200-day SMA is seen as a continuation sign for a downtrend.

Metaplanet Suspends Inventory Warrants For 20 Days

Metaplanet is ranked fourth globally amongst Bitcoin treasury firms, with holdings of 30,823 BTC, in accordance with information from Bitcoin Treasuries. This BTC was gathered at a median value of $108,036 per coin, and has achieved an unrealized revenue of three.73% since April 23, 2024.

The greenback worth of that BTC dropped after the crypto market suffered a $19 billion liquidation on Friday. Throughout the market correction, BTC’s value additionally briefly slid under the $110K mark.

Since then, Bitcoin’s value has recovered to face at $112,120.71 as of three:18 a.m. EST after tumbling 2% up to now 24 hours, in accordance with CoinMarketCap information. Nonetheless, the king of cryptos has plunged nearly 10% up to now week.

Metaplanet introduced on Oct. 10 that it has suspended the train of its Twentieth to Twenty second sequence of inventory acquisition rights. These rights are monetary devices that give traders the appropriate, however not the duty, to purchase or promote an organization’s inventory at a strike value that adjusts over time.

That pause implies that Metaplanet is actually halting the sale of frequent inventory to fund extra Bitcoin purchases.

Metaplanet has a robust basis for progress and has developed the power to harness quite a lot of financing instruments. We at the moment are briefly suspending the Twentieth-Twenty second Sequence of Inventory Acquisition Rights as we optimize our capital elevating methods in our relentless pursuit of… https://t.co/f8q1TLZN5l

— Simon Gerovich (@gerovich) October 10, 2025

Metaplanet CEO Simon Gerovich stated this can allow the corporate to optimize its capital elevating methods in its “relentless pursuit” to increase its Bitcoin holdings

“Metaplanet has a robust basis for progress and has developed the power to harness quite a lot of financing instruments,” he stated.

Different Firms Proceed To Purchase Bitcoin

Whereas Metaplanet could also be hitting the brakes on its BTC accumulation, the alternative is true for MARA Holdings and Technique, which each not too long ago introduced contemporary purchases.

Technique stated yesterday that it acquired 220 BTC for round $27.2 million. In the meantime, MARA Holdings acquired 400 Bitcoin value $46.29 million from FalconX earlier this week.

Technique is the most important Bitcoin treasury firm with its 640,250 BTC, whereas crypto miner MARA Holdings is ranked second with reserve of 53,250 BTC.

The remaining firms within the high 5 listing are XXI with 43,514 BTC, and Bitcoin Customary Treasury Firm, which is ranked one place under Metaplanet with its holdings of 30,021 BTC.

MARA and Technique shares each gained up to now 24 hours.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection