- Cardano (ADA) is defending key help at $0.70, hinting at a possible 40% rally.

- Analysts see a potential transfer towards $0.82–$0.92 quick time period and $1.20 if the breakout confirms.

- Derivatives knowledge reveals $62M in liquidation clusters, signaling volatility and potential upside stress.

Cardano (ADA) has been holding agency after one in all its sharpest pullbacks this quarter, defending key help ranges and flashing indicators of renewed shopping for momentum. Regardless of widespread promote stress, merchants seem optimistic that ADA’s worth construction stays intact — and that the subsequent leg increased could possibly be forming if bulls proceed to guard the $0.70 help zone.

Cardano’s Technical Setup Factors to Restoration

Technical charts from Growk Finance spotlight that ADA remains to be buying and selling inside a four-year symmetrical triangle, a consolidation sample that has traditionally preceded main breakouts. The present construction reveals ADA repeatedly defending the $0.70–$0.72 vary, confirming this zone as robust short-term help.

Momentum indicators are additionally shifting upward from oversold ranges, signaling that consumers could also be regaining management. Analysts recommend that if ADA holds above $0.68, the latest flush might function the ultimate shakeout earlier than a sustained rebound. A confirmed breakout from the higher trendline of the sample might propel ADA towards $1.10–$1.20, aligning with the highest boundary of its long-term formation.

Worth Targets and Brief-Time period Outlook

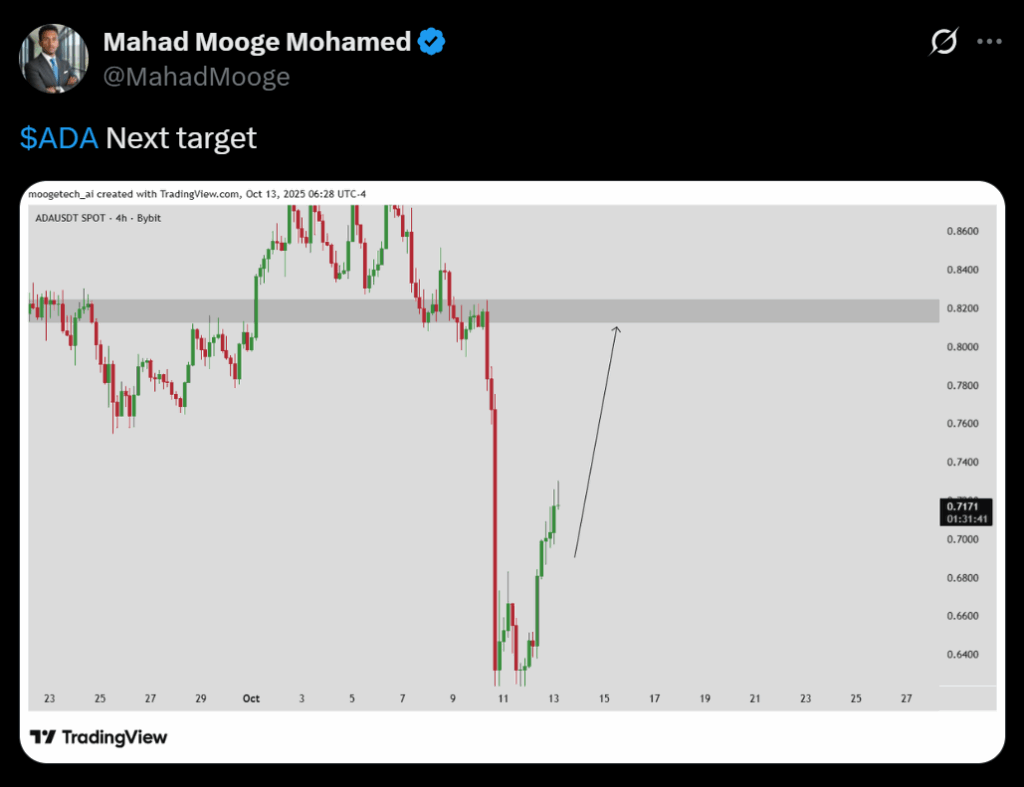

Within the quick time period, ADA is forming a V-shaped restoration, reclaiming key worth ranges after briefly dipping under $0.65. Charts shared by Mahad Mooge present ADA focusing on $0.82 as the subsequent resistance zone — an space that coincides with historic provide and buying and selling quantity imbalances. If consumers handle to keep up energy above $0.70, analysts count on a transfer towards $0.92, which might full a full retrace of final week’s decline.

Nevertheless, failure to carry the $0.70 help might set off renewed draw back stress, pushing costs again towards $0.65. The response round $0.82 will probably decide whether or not ADA enters a brand new bullish part or stays range-bound by means of the tip of October.

Derivatives Knowledge Indicators Incoming Volatility

Knowledge from TapTools reveals that greater than $62 million in leveraged ADA positions sit close to the $0.81 stage, making it a key liquidity zone. If worth strikes increased, these positions could possibly be liquidated, resulting in a brief squeeze and amplifying ADA’s upside momentum.

Analyst Deezy added that almost all lengthy positions from the November 2024 rally have been worn out, resetting open curiosity and creating very best circumstances for a clear structural rebound. This reset might pave the best way for a protracted squeeze-driven rally, with volatility anticipated to rise sharply between $0.78 and $0.82.

Historic Parallels and Lengthy-Time period Outlook

When in comparison with ADA’s 2020–2021 cycle, present patterns present exceptional similarities. Each phases function deep corrections adopted by months of tight consolidation inside descending channels. Traditionally, such formations have preceded explosive upward strikes as soon as momentum returns.

Technically, the ADA/BTC pair can also be sitting close to a significant help zone that beforehand marked macro bottoms. A breakout above diagonal resistance might reestablish ADA’s longer-term uptrend towards Bitcoin, doubtlessly setting the stage for a broader bull rotation into altcoins.

Closing Ideas: ADA’s Path Forward

Cardano’s worth stays in a restoration part, with merchants watching the $0.70 help because the make-or-break stage. Sustained shopping for above this zone might drive ADA towards the $0.82–$0.92 hall within the coming weeks, with a longer-term goal of $1.20–$1.40 if the 4-year triangle lastly breaks to the upside.

At press time, ADA trades close to $0.72, up 0.66% in 24 hours — a small however regular signal that the market could also be stabilizing earlier than its subsequent transfer.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.