The sudden and violent market correction triggered by geopolitical shockwaves served as an unprecedented stress check for all the cryptocurrency ecosystem, exposing essential variations in community structure. Whereas the multi-billion-dollar liquidation occasion despatched costs plunging throughout the board, Solana demonstrated outstanding resilience, whereas the Ethereum community and liquidity thinned throughout the peak volatility.

Why Solana Excessive-Efficiency Design Continues To Shine

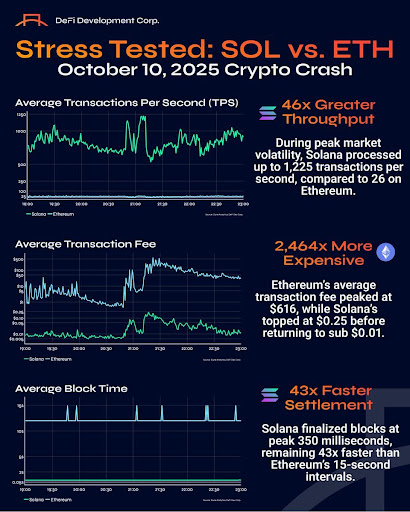

In an X publish, the Nasdaq-listed go-to Solana Digital Asset Treasury (DAT), DefDevCorp, has revealed that when the biggest liquidation occasion in crypto historical past hit final Friday, a lot of the market froze, and Ethereum stumbled. Nevertheless, Solana didn’t flinch, powering via one of the chaotic buying and selling periods ever recorded.

Associated Studying

On the peak of volatility, Solana sustained 1,225 transactions per second, finalized blocks in simply 350 milliseconds, and noticed transaction charges briefly rise to $0.25 earlier than normalizing under $0.01. In the meantime, ETH’s infrastructure buckled underneath demand because the community struggled to course of past 26 TPS. Its block instances prolonged to fifteen seconds, and noticed common gasoline charges explode to $616, successfully locking out customers and rendering the chain unusable throughout the disaster. ETH turned unreliable, impractical, and successfully unusable throughout the chaos.

As DefiDevCorp famous, when customers are priced out and transactions can’t clear, the community may as properly be offline. In moments of excessive load, the core promise of a blockchain to stay accessible, reasonably priced, and dependable should maintain. Nevertheless, after almost 20 months of uninterrupted uptime, weathering its busiest moments, it’s abundantly clear that SOL’s continued upgrades and optimizations have paid off dramatically.

DefiDevCorp concluded that no different chain presently comes near dealing with world worth switch at this scale, underneath such excessive circumstances, with the identical stage of efficiency. The takeaway from the agency’s publish is that solely SOL stays quick, low-cost, and usable, even when world markets soften down.

Why SOL Value Doesn’t Match Its Reliability

A Researcher at alphapleaseHQ and Advisor at KaminoFinance, Aylo, has additionally talked about that he had belongings and Decentralized Finance (DeFi) positions open on each Solana and Ethereum when the crypto market collapsed final Friday. Throughout this time, he had zero points utilizing the SOL community, whereas the ETH community was unusable as a result of prices, which regularly led to market crashes, and the Rabby pockets additionally went down.

Associated Studying

Aylo added that the ETH maxis must be a lot angrier concerning the efficiency of their L1. With this improvement, SOL continues to show it’s probably the most performant and dependable blockchain underneath real-world stress that we’ve got in crypto. He identified that SOL’s valuation doesn’t replicate the resilience it’s proving within the digital world.

Featured picture from Adobe Inventory, chart from Tradingview.com