Be a part of Our Telegram channel to remain updated on breaking information protection

The Solana value surged 4.8% prior to now 24 hours to commerce at $204.72 as of 6:10 a.m. EST on buying and selling quantity that plunged 9% to $11.6 billion.

This comes as VanEck filed its fifth modification for its spot Solana ETF (VSOL) with the US Securities and Change Fee, introducing a 0.30% administration charge and a regulated staking characteristic that’s the primary of its variety for a US digital asset fund.

🚨JUST IN: @vaneck_us has filed an up to date S-1 for its spot @Solana ETF, setting the administration charge at 0.30%.

The submitting provides particulars on staking, noting plans to probably delegate SOL to a number of third-party staking suppliers, with allocations primarily based on efficiency, uptime,… pic.twitter.com/lR02YtK40U

— SolanaFloor (@SolanaFloor) October 14, 2025

The agency is ready to make use of a number of third-party staking suppliers, together with SOL Methods, to handle Solana delegation and yield era.

In the meantime, Gemini Belief Firm and Coinbase Custodian would be the custodians of the ETF and retailer the Solana holdings of the fund in an insured and controlled method. VanEck’s staking mannequin features a 5% liquidity buffer to handle redemption dangers throughout market volatility.

In different developments, the Fantasy sports activities crypto platform Sorare is getting ready emigrate from Ethereum to Solana after 6 years.

✨ We’re shifting to @solana 🚀

Our aim is to speed up our imaginative and prescient of an open & on-chain sports activities platform for Sorare, the place pace, liquidity and utility are at a core of a brand new digital sports activities economic system.

It’s not a substitute, it’s an improve

A thread 🧵 pic.twitter.com/VVhRik7gU5

— Sorare (@Sorare) October 8, 2025

In line with Niclas Julia, CEO of Sorare, he stays assured in Ethereum at the same time as the corporate prepares emigrate to Solana, which he refers to as an “improve.”

Solana simply climbed again above the $200 degree, because it sustains its restoration from Friday’s flash crash that pushed costs down beneath $170.

Whilst the value rises, Solana’s on-chain metrics reveal a persistent lack of bullish momentum. As an illustration, decentralized purposes (dApps) on Solana generated $35.9 million in weekly income, whereas community charges totaled $6.5 million, which is a 35% drop from the earlier month, in response to DefiLlama information.

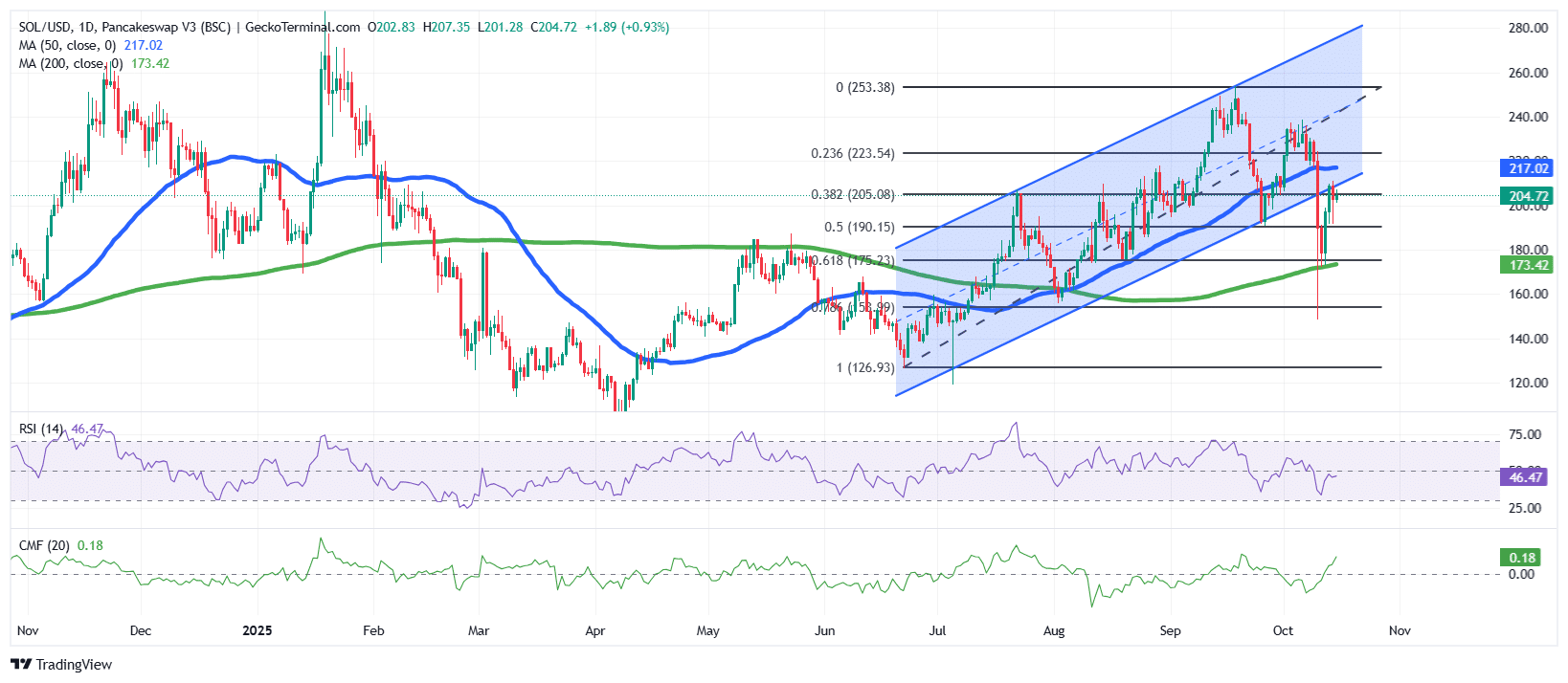

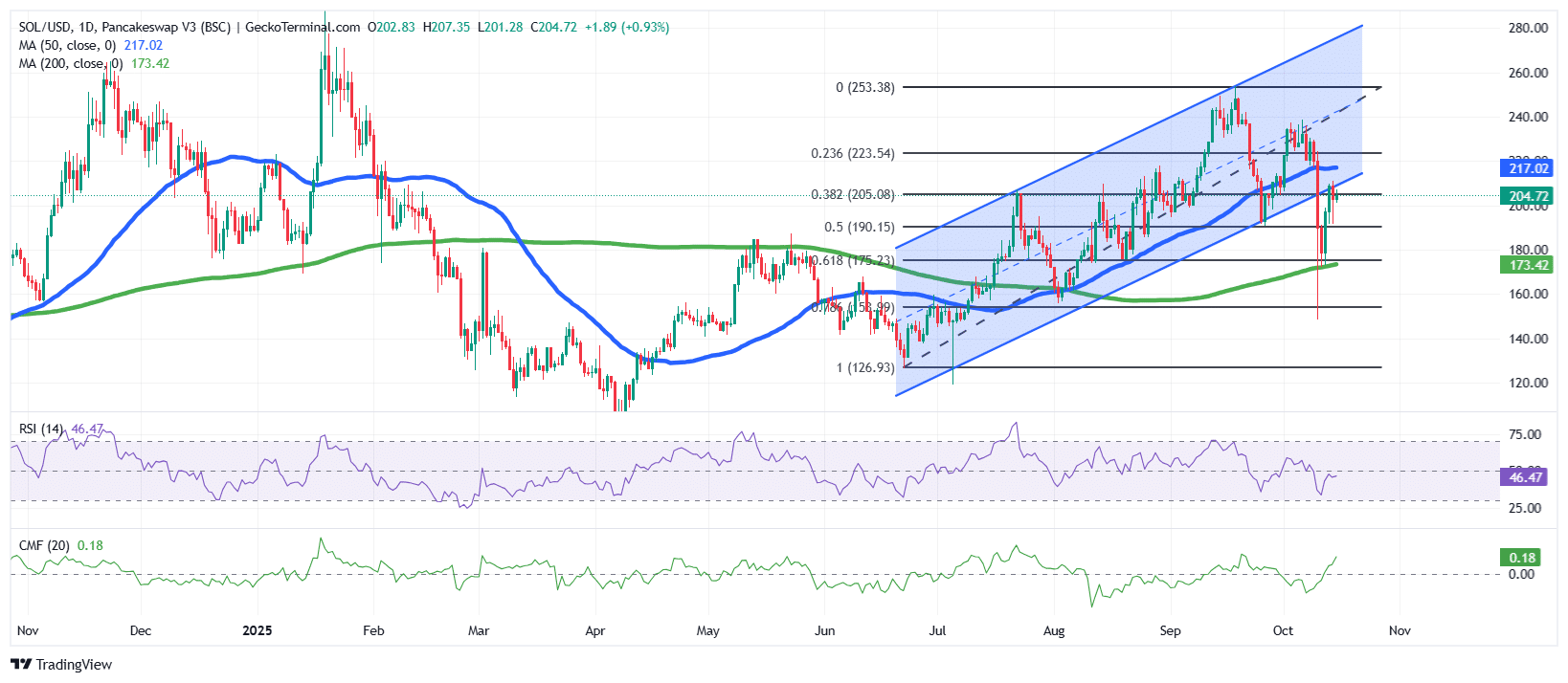

Solana Value Regains Steadiness After Channel Breakdown

The SOL value has been trying to get better after a current breakdown from its rising channel sample.

From June, the Solana value traded inside this rising channel, marking a gradual bullish development that started round mid-June 2025. The value of SOL revered each the higher and decrease channel boundaries, forming a constant sequence of upper highs and better lows.

Nevertheless, current promoting stress, because of the flash crash, pushed the value of Solana briefly beneath the decrease trendline, testing the power of bulls across the $175–$180 vary.

Presently, Solana trades close to $204.72, exhibiting resilience because it bounces from the 200-day Easy Shifting Common (SMA) ($173), a vital long-term help. This rebound can be accompanied by an try to reclaim the 50-day shifting common at $217, a degree that now acts as short-term resistance.

The Fibonacci retracement locations SOL across the 0.382 retracement degree ($205), suggesting a possible inflection level the place a decisive transfer may set the tone for the following development.

SOL Technical Indicators Trace Consolidation Earlier than The Subsequent Surge

The Relative Energy Index (RSI) is hovering round 46.47, a impartial zone indicating that neither consumers nor sellers have full management. Ought to the RSI transfer above 50, it will reinforce bullish momentum, whereas a dip towards 40 may sign a return to downward stress.

In the meantime, the Chaikin Cash Move (CMF) indicator sits barely optimistic at +0.18, suggesting gentle capital influx into Solana. This means that purchasing curiosity stays current, even after the current correction.

Contemplating the bullish indicators, the near-term outlook for the value of Solana leans towards cautious optimism. If the SOL value holds above the $190 degree and efficiently clears resistance at $217, it may advance towards $223 and ultimately retest $253.

Conversely, failure to maintain above $190 may result in one other dip towards $175 and even the 0.618 Fibonacci degree at $175.23.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection