- Trump–Xi assembly alerts potential commerce de-escalation and market aid.

- Jim Cramer warns of crypto’s rising affect on conventional equities.

- Binance’s $400M initiative goals to revive consumer confidence and liquidity.

Crypto markets remained tense however lively over the previous 24 hours as merchants navigated a mixture of geopolitical developments, institutional strikes, and shifting sentiment. With world leaders hinting at de-escalation and main exchanges stepping in to revive confidence, the day delivered equal doses of warning and optimism. So, allow us to take a better take a look at what formed the market motion.

Commerce Truce Hopes Carry Market Temper

The long-awaited assembly between Donald Trump and Xi Jinping in South Korea stays on schedule, calming fears of a full-blown commerce rupture. Each Washington and Beijing signaled a softer stance, with Treasury Secretary Bessent hinting that the one hundred pc tariff risk could possibly be prevented. The diplomatic tone helped regular danger sentiment after weeks of turbulence pushed by tariff threats and capital outflows.

Markets responded with cautious aid, although volatility lingered as new sanctions and cross-border coverage uncertainty weighed on merchants. Crypto belongings mirrored conventional markets, with Bitcoin hovering close to assist and altcoins seeing selective recoveries.

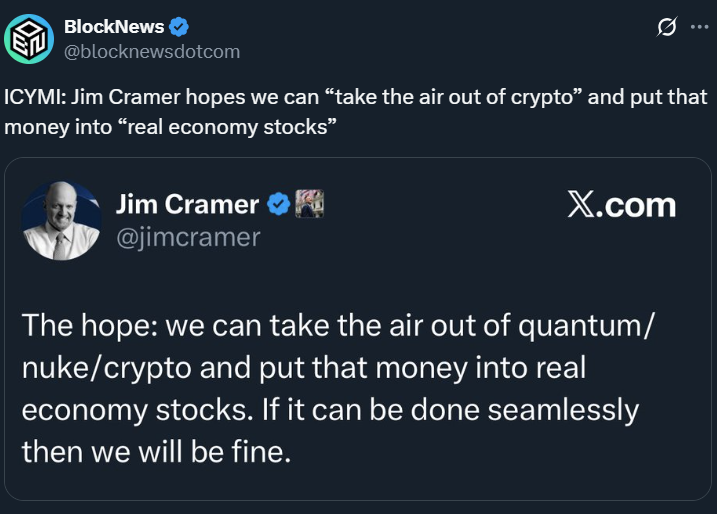

Cramer Calls Out Crypto’s Rising Grip on Wall Road

Market commentator Jim Cramer raised alarms in regards to the rising affect of crypto hypothesis over U.S. equities. His remarks adopted a session the place Bitcoin and the S&P 500 each slipped, underscoring how intertwined digital and conventional markets have turn out to be. Cramer’s warning highlighted what many analysts have been noting quietly — crypto sentiment is now a driver of inventory market volatility, not a bystander.

Whereas his warning drew consideration, merchants shortly revived the “Inverse Cramer” meme, suggesting his bearish tone would possibly really mark a neighborhood market backside. Whatever the jokes, the overlap between crypto and equities is deepening as extra establishments maintain digital belongings on their steadiness sheets.

Binance Steps In to Rebuild Confidence

Binance rolled out a $400 million “Collectively Initiative” aimed toward stabilizing post-crash situations and restoring consumer belief. The plan allocates $300 million in token vouchers and $100 million in institutional loans to bolster liquidity and assist ecosystem companions. The transfer alerts a coordinated push by the world’s largest alternate to strengthen the market’s basis throughout a interval of lingering uncertainty.

Business analysts view this as a big step towards rebuilding confidence after current volatility. By specializing in each retail and institutional restoration, Binance positions itself as a stabilizing pressure at a time when sentiment stays fragile. The initiative might mark an essential turning level for liquidity and participation because the trade seems to be to recuperate misplaced floor.

Ultimate Ideas

To conclude, the previous 24 hours confirmed a market nonetheless on edge however more and more resilient. Between geopolitical progress, shifting investor psychology, and main gamers taking initiative, crypto continues to reflect world finance extra intently than ever. Total, the subsequent strikes by policymakers and exchanges might outline whether or not this rebound turns into sustainable or fades into one other aid rally.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.