Binance returns to South Korea

Binance is returning to South Korea practically 5 years after exiting the market in December 2020, following the Monetary Intelligence Unit’s (FIU) approval of its acquisition of Gopax — considered one of solely 5 native exchanges approved to supply crypto-to-fiat companies.

In line with a Maeil Enterprise Newspaper unique, the FIU granted closing approval on Wednesday, ending greater than two years of uncertainty over Binance’s reentry. The change acquired a majority stake in Gopax in 2023, however the deal stalled amid regulatory scrutiny and Binance’s authorized troubles within the US.

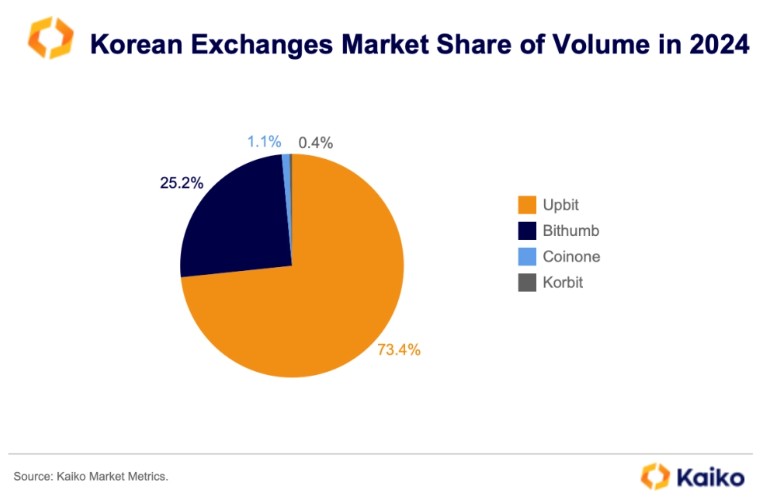

The return of the world’s largest cryptocurrency change might shake up South Korea’s long-standing duopoly of Upbit and Bithumb. Beneath the nation’s crypto rules, exchanges should accomplice with a home financial institution to supply real-name verified accounts. Although the system is designed to strengthen Anti-Cash Laundering and Know-Your-Buyer compliance, it has made market entry troublesome for newcomers.

The approval additionally comes throughout a turbulent week for Binance. The corporate confronted backlash over an oracle malfunction that critics allege triggered a $19 billion liquidation cascade throughout a pointy market downturn. Binance has denied that its technical glitch was the basis explanation for the mass liquidation occasion, however dedicated to a $283 million compensation marketing campaign.

High Japanese financial institution’s new token platform

Mitsubishi UFJ Morgan Stanley Securities has launched a brand new digital asset division centered on blockchain-based finance and launched a retail platform for tokenized investments as its flagship service.

The brand new division has begun dealing with bond-type safety tokens and plans to increase into tokens backed by actual property.

It’s a consolidated subsidiary of Japan’s largest financial institution by whole property, Mitsubishi UFJ Monetary Group. A consolidated subsidiary is one wherein the mum or dad group holds a controlling stake — on this case 60% — and totally contains its monetary ends in group-wide stories. The opposite 40% is owned by Morgan Stanley within the US.

The transfer aligns with the banking big’s broader technique to combine blockchain-based property into mainstream finance. The group has already been increasing into Web3 by initiatives involving stablecoins, tokenized deposits, and asset tokenization through its Progmat platform.

There’s been a wider institutional shift towards Web3 amongst Japan’s conventional finance and company giants. Nomura Group, Japan’s largest funding banking and brokerage conglomerate, stated its Switzerland-based digital asset arm Laser Digital is in talks with native regulators to use for a license to serve institutional crypto buyers.

Elsewhere, SoftBank’s fee platform lately introduced it had acquired a 40% stake in Binance Japan, whereas SBI’s three way partnership with Ripple is creating a fee system on the XRP Ledger for the nation’s booming tour business.

Learn additionally

Options

From Director of the USA Mint to the Very First Bitcoin IRA Buyer

Options

Sexual Violence in India: Blockchain’s Position in Empowering Survivors

Crypto franchises purchase out native exchanges to increase

A number of the world’s largest exchanges are deepening their presence in rising markets. Whereas earlier growth efforts typically concerned organising native operations from scratch, the brand new technique now facilities on buying or investing in already licensed exchanges — as seen in Binance’s return to South Korea by its buy of Gopax.

Coinbase, the biggest US-based change by buying and selling quantity, can be following this mannequin. The corporate introduced Wednesday that it invested in India’s CoinDCX, valued at round $2.45 billion. Coinbase has been eyeing a return to India after scaling again operations in 2022 as a result of regulatory hurdles and fee processing restrictions. CoinDCX, in the meantime, expanded into Dubai with its acquisition of BitOasis in July 2024.

The identical blueprint is rising in Hong Kong. On Tuesday, HashKey introduced a partnership with Malaysian change HATA to deepen its growth into Southeast Asia. The transfer follows OSL’s current acquisition of Indonesia’s licensed change Koinsayang. HashKey and OSL are Hong Kong’s first two licensed cryptocurrency service suppliers.

In distinction, regulators throughout Asia are intensifying crackdowns on unlicensed exchanges. In late Could, Thai authorities blocked entry to Bybit, OKX, and a number of other others for working with out native approval. Quickly after, the Philippines issued warnings to 10 exchanges for a similar motive. Even Singapore, typically considered as a regional crypto hub, expelled unlicensed companies earlier this yr.

Learn additionally

Options

Slumdog billionaire 2: ‘High 10… brings no satisfaction’ says Polygon’s Sandeep Nailwal

Options

Altcoin season 2025 is sort of right here… however the guidelines have modified

Yonsei alumni affiliation introduces crypto funds for membership charges

South Korea’s Yonsei College’s alumni affiliation has launched a system that enables members to pay charges in cryptocurrency. Alumni can now pay each common and particular membership charges utilizing Bitcoin, USDT or USDC.

The college’s alumni affiliation stated it adopted the brand new fee choice to make worldwide transfers extra handy for abroad alumni.

For graduates of prime universities like Yonsei, participation within the alumni community is usually thought-about a worthwhile social {and professional} asset.

In South Korea, alumni associations play a serious position in skilled networking, profession development and social standing. Membership charges assist fund alumni occasions, pupil scholarships and college applications, however additionally they reinforce essential connections that usually carry weight in skilled networks.

Yonsei is considered one of South Korea’s most prestigious personal universities and a part of the so-called “SKY” trio (Seoul Nationwide College, Korea College and Yonsei College) whose alumni dominate the nation’s elite circles, together with prime authorities posts and management roles in main conglomerates.

Blockchain information reveals that somebody has already paid $315 in USDC to the alumni affiliation’s Ethereum pockets.

In 2025, South Korea eased guidelines to section in institutional crypto participation, beginning with sure non-profit entities, together with universities, to promote or convert cryptocurrencies.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist protecting blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has coated Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.