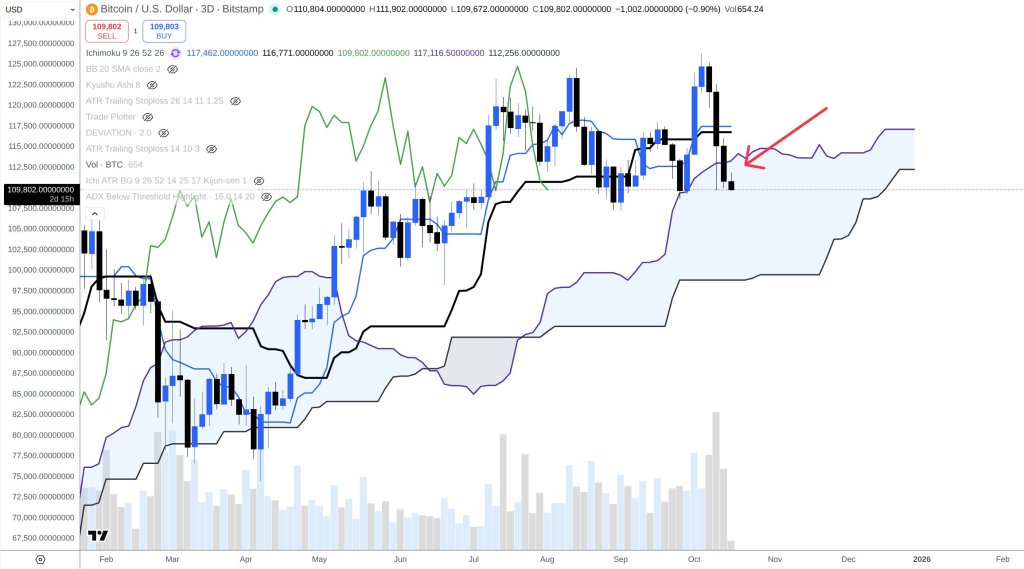

Bitcoin slipped under three-day Ichimoku cloud help on Wednesday, prompting market technician Dr Cat (@DoctorCatX) to flag the primary decisive warning for bulls whereas outlining a good sequence of conditional indicators into month-end. Sharing a chart on X, he wrote: “Bulls lastly misplaced the 3D kumo help which is the primary clear pink flag to search for.” He cautioned that the breakdown doesn’t assure a straight-line slide, including that “the kumo could be very thick right here which implies the worth will be very spiky/turbulent and even additional down strikes could also be ‘bumpy’ for bears with bounces and so on…”

Why Bitcoin’s Subsequent Bull Window Opens October 31

The analyst framed the following exams by means of the lens of Ichimoku’s time-price construction and the weekly baseline. “In all probability the clearest indication for now to observe for can be the time cycles and whether or not the weekly Kijun Sen will maintain,” he stated, specifying ranges at $105.700 for the present week and “$109,559” for subsequent week. In Ichimoku methodology, the weekly Kijun Sen capabilities as a mean-reversion axis; sustained closes under it sometimes affirm momentum deterioration, whereas defenses of the road can reassert pattern management with out requiring a direct new excessive.

Dr Cat’s near-term line within the sand on day by day closing circumstances is evident: “If right now closes above $113K we don’t have a sign for a direct hazard of a bearish continuation.” That threshold sits alongside his broader stance that separates time horizons. He reiterated that his “Long run = Bullish with the identical targets I’ve shared many instances,” however recast the shorter outlook as “Quick to mid time period = Impartial, vary between ~$100K and prev ATH.”

Associated Studying

Reasonably than declaring a tough backside, he now views sentiment as a threat consider its personal proper: “I stated not too long ago that the underside ought to be put by the thirteenth of October — and even already in. However right now after observing the sentiment I’ve robust considerations about pink flags… I haven’t seen in a really very long time a lot mass bullish confidence and even conceitedness throughout Twitter. So at this level I’ll merely not attempt to guess whether or not the underside is in or not.”

He mapped out escalation factors if draw back resumes. “Quick time period bearish triggers can be a renew of the crash low briefly after the thirteenth of October, mid-term bearish set off: the identical however after the nineteenth, even higher after the twenty sixth of October.” In different phrases, a swift retest instantly after October 13 would elevate short-term alarms, whereas recent lows registered after October 19 or October 26 would strengthen the case that the corrective part has extra to run. He additionally downplayed the chances of a straight snapback, warning that “even when the underside is in, a V-shaped restoration stays extraordinarily unlikely.”

Associated Studying

Towards that warning, Dr Cat nonetheless identifies a particular window for bullish validation. Anchoring to Ichimoku’s Chikou Span alignment on the day by day and three-day timeframes, he stated “the earliest window of alternative for a bull breakout above ATH is the thirty first of October.” That timing caveat is important: the October 31 marker is a primary attainable opening, not a assure, contingent on value stabilizing round or above the weekly Kijun and avoiding these date-based bearish triggers.

The shared chart underscores the nuance: value slipping beneath the three-day cloud is a mechanical unfavorable, however the thickness of the cloud and proximity of higher-timeframe helps suggest uneven discovery slightly than a clear pattern decision earlier than the tip of the month.

Taken collectively, Dr Cat’s framework is binary however conditional. A day by day shut again above $113,000 would blunt “fast” continuation threat and preserve the weekly Kijun defenses in play at $105,700 this week and $109,559 subsequent week. Failure to carry these rails — significantly if accompanied by renewed lows after the nineteenth or twenty sixth — would harden the corrective bias and defer any credible breakout try.

Because the calendar tightens, the market now has a transparent guidelines into October 31, when, per his mannequin, the primary “window of alternative” opens for a transfer that would credibly threaten and surpass the earlier all-time excessive.

At press time, Bitcoin stood at $111,479.

Featured picture created with DALL.E, chart from TradingView.com