One other day, one other new all-time excessive for Gold.

The XAU/USD worth hit a brand new all-time excessive of $4,300 on Thursday, now up by practically 63% because the begin of the 12 months.

Pushed largely by relentless central financial institution accumulation and surging ETF inflows, gold’s rally continues to draw each institutional and retail consumers searching for security amid international uncertainty.

Nonetheless, there are additionally rising indicators of peak euphoria, with distinguished analysts warning that gold could also be approaching a macro prime.

Lengthy queues at bullion sellers and jewelry outlets, coupled with file retail demand for bodily gold, are being cited as basic late-cycle alerts, proof that the rally could also be getting into its last, overheated part earlier than a possible correction.

As soon as XAU tops out and begins to tug again, specialists imagine that the capital will rotate to threat property like Bitcoin and large-cap crypto altcoins. Outstanding analysts imagine the BTC worth may probably hit $150,000 by year-end.

BTC-themed altcoins like Bitcoin Hyper may additionally generate engaging returns, with sensible cash traders viewing HYPER as the following 10x crypto.

Is Gold Close to Its Macro High?

Gold is at present witnessing its largest bull run, rallying by practically 63% because the begin of the 12 months.

In response to CompaniesMarketCap, Gold’s market cap is extraordinarily near hitting the $30 trillion mark.

Gold’s historic 2025 rally is being powered by central banks and institutional traders. Between January and August 2025, central banks gathered roughly 152 tonnes of gold, led by China, Poland, Kazakhstan, Turkey, and India, persevering with a multiyear de-dollarization drive.

Since 2018, official gold demand has risen to its highest in 5 many years, with over 1,000 tonnes bought in each 2023 and 2024, based on the World Gold Council.

In the meantime, bodily backed gold ETFs have posted file inflows of US$26 billion in Q3 2025, together with US$17.3 billion in September, the strongest month ever.

In India, ETF inflows surged sixfold year-on-year to ₹8,363 crore, signalling broad-based institutional and retail participation behind gold’s meteoric rise.

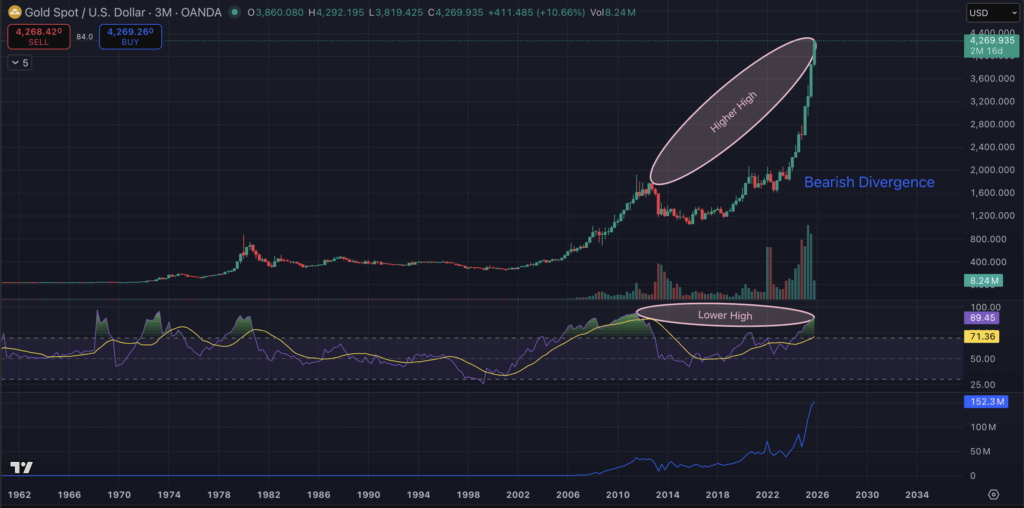

Nonetheless, the Gold worth has now reached the overbought territory in each key timeframe: every day, weekly, month-to-month, quarterly, and even yearly. Furthermore, it has even shaped a bearish divergence with its Relative Power Index within the 3-month timeframe.

Furthermore, Gold is exhibiting basic late-cycle alerts, together with the heavy retail involvement. Particularly, the lengthy queues at bullion sellers and jewelry outlets have led many specialists to imagine that the highest is close to.

Crypto analysts have even drawn comparisons to the height Bitcoin euphoria in 2017 and 2021 earlier than the market hit a macro prime and entered a bear market.

The present chart of Gold jogs my memory of #Bitcoin in 2017 or the height in 2021.

The truth that individuals are lining as much as be shopping for Gold is similar retail mindset as individuals shopping for #Bitcoin throughout the peak in that interval.

They do not imagine that issues can right, till they do.…

— Michaël van de Poppe (@CryptoMichNL) October 16, 2025

Notably, gold doesn’t have to crash for Bitcoin and the broader crypto market to learn. Even a gentle cool-off or consolidation part may set off capital rotation, as traders look to reallocate income from gold’s historic run into higher-beta property like BTC and main altcoins.

Bitcoin Value Prediction: How Excessive Can BTC Go In 2025?

Outdoors of the bear market years of 2013, 2018 and 2022, Gold has by no means outperformed Bitcoin since 2012.

At the moment, nevertheless, BTC is up by simply 16% year-to-date, whereas XAU is up over 63%. Unsurprisingly, even establishments like JPMorgan are anticipating an upside repricing in Bitcoin, with JPM analysts projecting it to hit $160,000 by year-end.

In the meantime, the World M2 cash provide mannequin is indicating that the BTC worth may rally as much as $180,000 – $190,000 earlier than the tip of the bull market.

BITCOIN IS LAGGING BEHIND GLOBAL LIQUIDITY AND GOLD.

M2 is surging.

Gold is ripping.

Bitcoin is sleeping.This divergence by no means lasts.

Liquidity at all times finds threat.The catch-up rally will likely be brutal. pic.twitter.com/VQXAqhUUEH

— Merlijn The Dealer (@MerlijnTrader) October 16, 2025

Is Bitcoin Hyper The Subsequent 10x Crypto?

Bitcoin Hyper (HYPER) has emerged as one of many prime BTC-themed altcoins available on the market.

A real low-cap asset, HYPER, has already raised practically $24 million in its presale funding. It has been a favorite of whales and sensible cash traders because the begin of its ICO and continues to file a string of excessive six-figure investments.

Bitcoin Hyper is the most recent BTC layer-2 undertaking, powered by the Solana Digital Machine and zero-knowledge structure.

It has already impressed analysts with its cutting-edge layer-2 design, due to its distinctive rollup mannequin, a BTC-based settlement pathway, next-gen sequencer and sound observability and indexing.

Consultants imagine that Bitcoin Hyper can play a key function in addressing the efficiency points related to the BTC community, together with its poor scalability and lacklustre programmability. It may emerge because the hub for brand new DeFi merchandise getting into the Bitcoin ecosystem.

Unsurprisingly, HYPER is in excessive demand, particularly as the highest layer-2 cash have a tendency to achieve multibillion-dollar valuations. Contemplating its low beginning market cap, many are viewing it as the following 10x crypto.