- SOL trades at $201.87, up barely however nonetheless down 9% weekly, as quantity cools earlier than one other potential transfer.

- VanEck’s up to date Solana ETF proposal might draw contemporary institutional cash and enhance long-term demand.

- Solana’s subsequent key breakout degree sits at $250, with short-term help forming close to $200.

Solana (SOL) is quietly bouncing again after a shaky week, discovering its footing once more as investor curiosity returns throughout the broader crypto house. The token’s value rose 1.18% within the final 24 hours, although it nonetheless sits down about 9.2% on the week, reflecting combined sentiment after days of volatility.

At press time, SOL trades round $201.87, giving it a market cap of roughly $110.3 billion. Every day buying and selling quantity dipped greater than 21% to $10.7 billion, an indication that merchants could be pausing earlier than making their subsequent transfer — type of a relaxed earlier than the following wave.

VanEck’s Solana ETF Replace Sparks Institutional Pleasure

Crypto analyst Coin Bureau revealed that VanEck has revised its Solana Staking ETF proposal, including a 0.30% administration price that might make it some of the cost-effective merchandise of its form. The ETF — set to commerce underneath the ticker VSOL — would mix Solana’s value publicity with staking rewards, which means buyers might earn passive yield straight by way of validator participation.

The submitting additionally outlines threat protections like regulated custody and liquidity buffers, addressing a few of the predominant issues which have saved establishments on the sidelines. Though the SEC hasn’t authorized it but, the transfer alerts clear institutional urge for food for Solana publicity. If greenlit, this ETF might funnel critical capital into the Solana ecosystem, pushing each liquidity and adoption to new highs.

Solana Breaks Free — $250 Might Be the Subsequent Goal

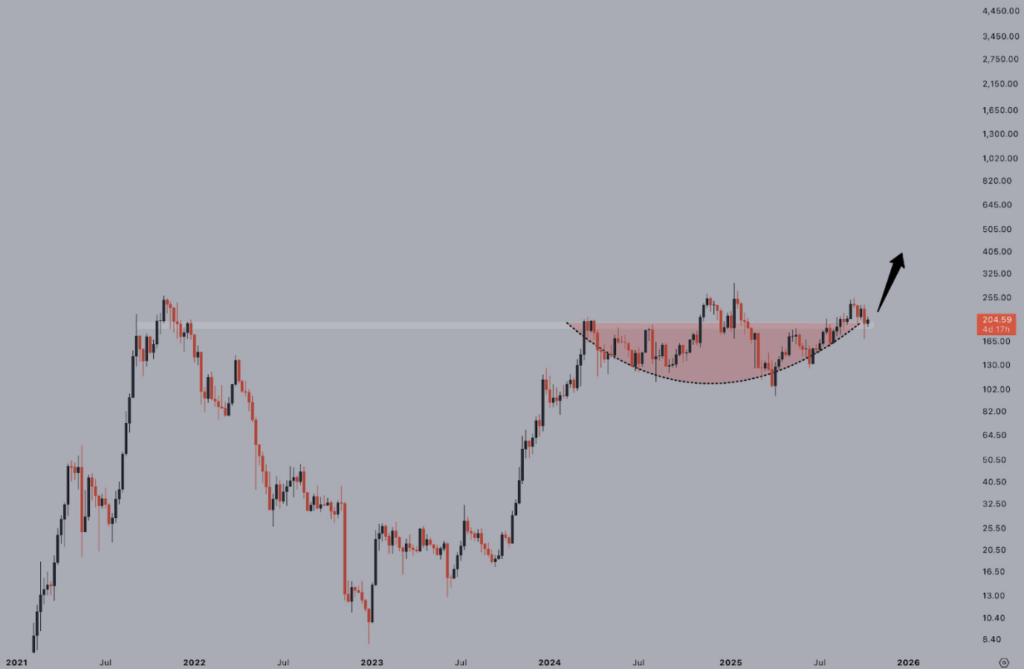

Analyst Jelle identified that Solana lately broke out of an 18-month reaccumulation vary, signaling a shift from stagnation to development. The token’s clear retest above $200 confirms renewed bullish energy after months of sideways motion.

With momentum returning, $250 stands out as the following key resistance. If SOL breaks that degree decisively, it might kick off a contemporary rally — probably getting into value discovery territory. Analysts consider this setup mirrors Solana’s 2021 breakout sample, the place related accumulation zones led to explosive positive factors. As on-chain exercise retains rising and market sentiment stabilizes, Solana’s subsequent leg might come ahead of most anticipate.

Solana’s Technical Setup Factors to Quick-Time period Warning

Regardless of its renewed energy, Solana’s short-term chart hints at consolidation. The value at the moment sits beneath each the 20-day ($210.70) and 50-day ($211.22) EMAs, which suggests bulls nonetheless have work to do earlier than reclaiming momentum. Alternatively, the 100-day ($199.93) and 200-day ($186.88) EMAs function robust help zones — the security web for any pullback.

The RSI sits at 44.8, exhibiting weak shopping for momentum, whereas the MACD stays bearish however is starting to flatten out — a attainable trace that promoting strain is fading. A break above $211 might reignite an rise, whereas dropping underneath $199 may pull costs again towards $186.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.