As Bitcoin turns into a strategic asset class in public markets, a brand new class of company entity is rising: the Bitcoin treasury firm. These are corporations that accumulate Bitcoin on their steadiness sheet as a core a part of their capital technique, leveraging it to unlock uneven upside, monetary sturdiness, and institutional credibility.

However not all Bitcoin treasury corporations are the identical. In actual fact, Michael Saylor, Government Chairman of Technique (previously MicroStrategy), not too long ago outlined a transparent taxonomy for understanding the panorama: a three-tiered hierarchy that separates dabblers from dominators.

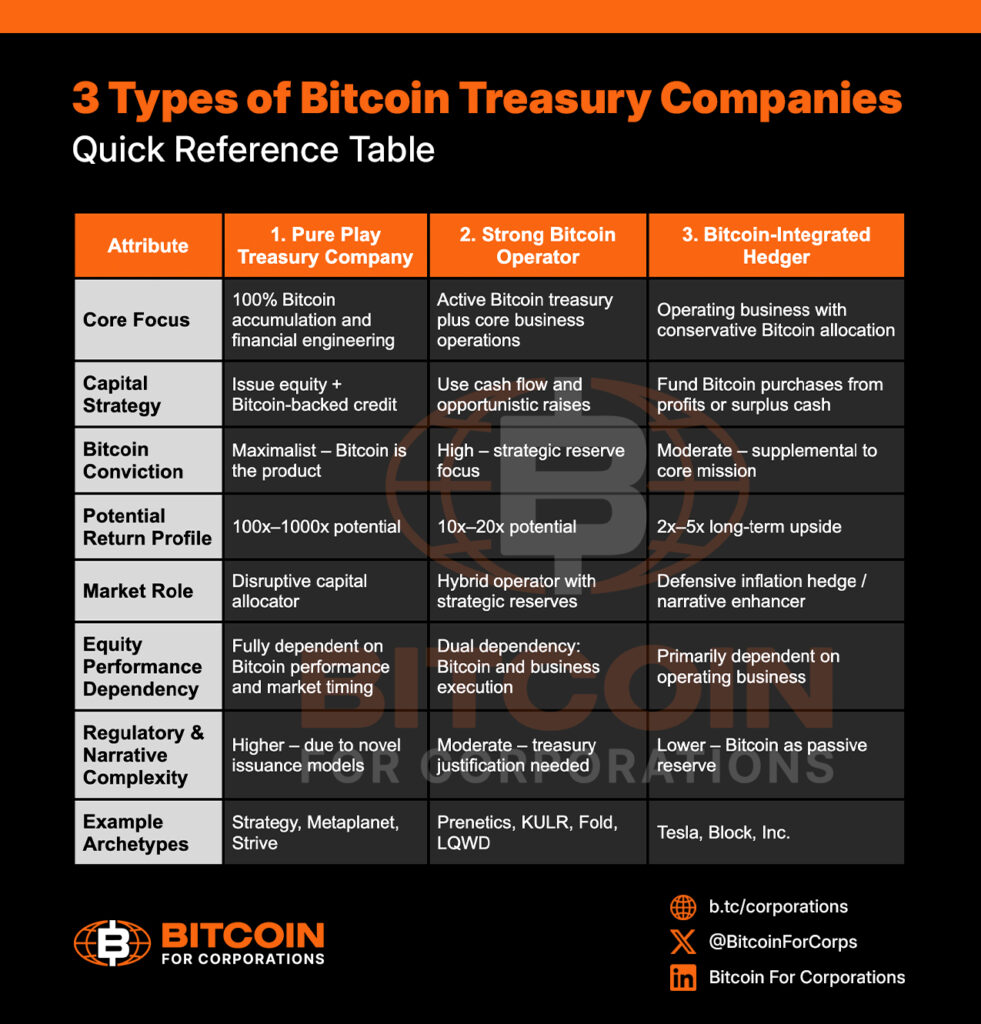

Every tier comes with distinct incentives, dangers, and anticipated outcomes. For traders, analysts, and executives, understanding this framework is crucial for evaluating capital technique within the age of Bitcoin.

1. The Pure Play Bitcoin Treasury Firm

That is the highest-conviction mannequin—an organization that’s solely centered on accumulating and optimizing Bitcoin as its core strategic asset. Bitcoin isn’t just a reserve asset; it’s the enterprise.

Pure performs are engineered for one factor: capital transformation by Bitcoin. They increase fairness and challenge Bitcoin-backed credit score, utilizing the proceeds to build up much more Bitcoin. Their development isn’t tethered to conventional enterprise fashions or fiat efficiency metrics. It flows instantly from superior financial structure.

Defining Traits:

- Bitcoin is the product, treasury, and technique

- No legacy enterprise to subsidize or distract

- Capital raised = Bitcoin bought

- Engineered to function in low-yield or negative-yield fiat environments

Strategic Benefit:

- Potential to challenge high-yield credit score merchandise in fiat-deprived markets (e.g. Swiss francs, yen, euros)

- Class dominance in nationwide capital markets (e.g. Smarter Internet within the UK, Metaplanet in Japan)

- Scalable mannequin: fairness issuance + short-duration BTC-backed credit score = perpetual BTC accumulation

Examples:

Saylor’s View:

“These are the subsequent Magazine-7 shares. They will go from a billion to 100 billion, even a trillion.”

Pure performs are the apex predators of Bitcoin capital markets. They will obtain 100x or 1,000x returns as a result of they personal their class and multiply Bitcoin-denominated worth by disciplined issuance and strategic readability.

2. The Robust Bitcoin Operator

This tier displays a hybrid strategy—corporations with actual Bitcoin publicity and strategic intent, however not full alignment.

Robust Bitcoin operators keep an current enterprise mannequin whereas additionally accumulating BTC and probably issuing Bitcoin-backed devices. Their conviction is significant, however their operational complexity or regulatory constraints stop full conversion.

Defining Traits:

- BTC is a major factor, however not the core enterprise

- Some issuance of Bitcoin-backed devices

- Continued funding in non-Bitcoin operations

Strategic Benefit:

- Broader attraction to traders searching for publicity with diversified threat

- Potential to evolve right into a pure play over time

- Good place in fairness markets with upside linked to BTC

Anticipated Consequence:

- Strong fairness appreciation (10x–20x over cycle)

- Not more likely to change into mega-cap disruptors

- Sturdy, however not dominant

These corporations are able to successful within the Bitcoin period, however their upside is constrained by competing priorities. They’re usually caught between conventional shareholder expectations and Bitcoin-native capital innovation.

3. The Bitcoin-Built-in Hedger

On the base of the hierarchy are corporations that maintain Bitcoin on the steadiness sheet as a passive hedge. They aren’t actively constructing round it, issuing Bitcoin-backed debt, or educating the market. They merely maintain it.

This mannequin is more and more frequent amongst corporations that need long-term publicity with out vital operational modifications. Over time, as Bitcoin appreciates, it turns into a ballast for market cap—supporting fairness worth even when the core enterprise underperforms.

Defining Traits:

- No issuance or BTC-native technique

- Bitcoin handled as treasury reserve

- Core enterprise continues as traditional

Strategic Function:

- Optionality with minimal threat

- Provides resilience to steadiness sheet

- Serves as long-dated name possibility on Bitcoin

Anticipated Consequence:

- Low draw back, reasonable upside

- 2x–4x returns over lengthy horizons

- Fairness efficiency more and more tied to BTC, however passively

This mannequin doesn’t rework capital markets. But it surely does provide a superior hedge versus holding fiat or underperforming mounted revenue.

Why It Issues

This hierarchy isn’t simply semantic. It determines who thrives within the Bitcoin period.

- Pure performs drive the reinvention of economic infrastructure. They don’t simply retailer worth—they reshape the price of capital.

- Robust operators profit from Bitcoin’s rise, however stay constrained by fiat-era constructions.

- Hedgers insulate themselves from fiat decay, however lack the strategic posture to steer.

The delta between tiers is very large. A hedger may protect worth. A robust operator may outperform. However solely a pure play rewrites the sport.

The Larger Image: Bitcoin because the New Base Layer

Saylor doesn’t see this as a company development. He sees it as a full-spectrum transformation of credit score, fairness, and capital markets.

“Bitcoin treasury corporations are the engines, the drivers, the dynamos powering up that community.”

In his view, a brand new monetary system is rising the place:

- Financial savings accounts yield 8%, not 0%

- Credit score is backed by Bitcoin, not fiat or actual property

- Fairness indexes embody Bitcoin-native capital constructions

The businesses that embrace the pure play mannequin as we speak will anchor this future. They’ll change into the brand new monetary establishments—issuing digital credit score, shaping capital flows, and compounding Bitcoin-denominated worth sooner than conventional fashions enable.

Watch the Full Interview

George Mekhail, Managing Director of Bitcoin For Firms sits down with Michael Saylor to debate Bitcoin disrupting capital, redefining steadiness sheets, and shaping Twenty first-century economics.

Disclaimer: This content material was written on behalf of Bitcoin For Firms. This text is meant solely for informational functions and shouldn’t be interpreted as an invite or solicitation to accumulate, buy or subscribe for securities.