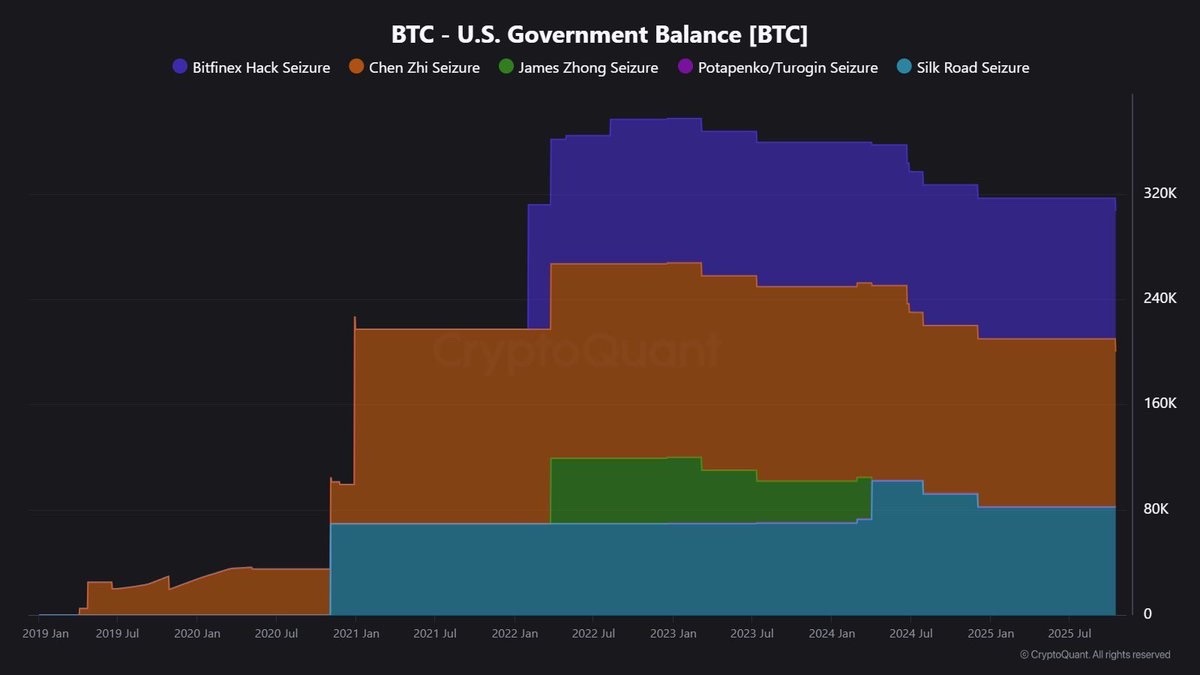

The USA, as soon as seen as a skeptic of digital belongings, has now change into the biggest state holder of Bitcoin. This place was not reached by direct accumulation however by a sequence of regulation enforcement seizures and asset recoveries that introduced over 316,000 BTC into federal custody. But, the result carries highly effective symbolism.

The identical authorities that when handled crypto as a speculative menace now not directly owns one of many largest reserves of Bitcoin on this planet. With President-backed reserves and regulatory frameworks evolving, this milestone reinforces crypto’s legitimacy as an asset class and will mark a turning level for altcoins poised for institutional consideration.

America’s Bitcoin Holdings and the Institutional Ripple Impact

The U.S. authorities’s Bitcoin reserves now stand at an estimated 325,000 BTC, value roughly $36 billion. This accumulation will not be a matter of policy-driven funding however the results of a sequence of regulation enforcement seizures that collectively reshaped the narrative round state involvement in crypto.

Probably the most vital of those got here by the Division of Justice’s historic restoration of 127,271 BTC, a case that marked the biggest digital asset forfeiture in American historical past. But, what started as an act of enforcement has advanced right into a structural place that inadvertently locations america among the many greatest sovereign Bitcoin holders on this planet.

This actuality carries extra which means than mere numbers. It highlights the evolution of notion inside the world’s most influential financial system, the place digital belongings as soon as considered speculative or fringe are actually undeniably a part of the monetary framework.

The U.S. authorities, even not directly, has change into a custodian of Bitcoin’s future stability. Such a place sends a message that institutional publicity to Bitcoin will not be a fringe alternative however a matter of strategic foresight.

Companies have echoed this sentiment. The variety of publicly listed corporations holding Bitcoin grew almost 40% within the third quarter of 2025, rising to 172. Collectively, they now personal a couple of million BTC, valued at over $117 billion. These figures sign the depth of institutional conviction forming across the asset.

As Bitcoin continues to mature right into a macro-level retailer of worth, capital rotation into rising altcoins appears inevitable. Institutional acknowledgment of Bitcoin’s resilience tends to open gateways for secondary markets to thrive.

Altcoins that mix utility, neighborhood engagement, and scalable expertise may gain advantage from this shift, capturing the liquidity that inevitably follows Bitcoin’s upward trajectory. On this atmosphere, early accumulation of high quality tasks could show to be one of the crucial advantageous methods within the coming section of market growth.

Greatest Crypto to Purchase Now Earlier than the Market Picks Up Tempo

Snorter

Within the more and more aggressive subject of Telegram-based instruments, Snorter has managed to create a class of its personal. It’s an AI-powered bot ecosystem designed to make buying and selling, analytics, and engagement accessible immediately inside Telegram’s native atmosphere.

As a substitute of customers leaping between browser dashboards and exchanges, Snorter simplifies that course of into one chat interface the place orders, alerts, and automatic methods may be executed in actual time. The bot reads market sentiment, tracks whale actions, and compiles on-chain knowledge, giving merchants prompt context directly.

Snorter’s strategy has attracted each retail merchants and seasoned traders. The presale alone raised greater than $4 million, reflecting the market’s robust perception in Telegram-integrated options. Past easy buying and selling automation, Snorter introduces social intelligence.

Customers can analyze how influencers, teams, and communities transfer liquidity, then mirror or counter these patterns by programmable instructions. The design brings analytics and resolution execution below one ecosystem, a uncommon mixture in right this moment’s fragmented crypto market.

This alignment with a platform as lively as Telegram offers Snorter a pure benefit. Tens of millions of merchants already focus on worth motion day by day inside that atmosphere, and Snorter turns these conversations into actionable perception.

Because the U.S. authorities’s increasing Bitcoin holdings push broader legitimacy into the crypto market, instruments like Snorter may change into important in serving to customers reply quicker to institutional and retail shifts alike. Its mix of comfort, real-time knowledge, and neighborhood utility positions it as one of many standout AI tasks of this cycle.

Greatest Pockets Token

Greatest Pockets Token represents the evolution of what a crypto pockets may be. It isn’t solely a storage software however a multi-chain ecosystem constructed for interplay, rewards, and id throughout the Web3 house.

The platform connects networks like Ethereum, Solana, and BNB Chain, providing customers one atmosphere the place they will maintain, stake, and transact with out juggling a number of purposes. Each interplay contained in the pockets contributes to a points-based system that rewards customers for real engagement, making a bridge between performance and incentive.

This mannequin offers Greatest Pockets a sensible edge. The pockets integrates native swap choices, real-time portfolio analytics, and early-stage token discovery options. It additionally introduces verified listings to make sure that customers interact solely with professional belongings, lowering the dangers related to rip-off tokens. The token itself performs a key position, enabling entry to premium options, precedence launches, and staking rewards that tie into the pockets’s rising ecosystem.

Greatest Pockets Token’s ongoing growth into Solana and different high-throughput networks reveals that it’s positioning itself as an infrastructure-level participant somewhat than a distinct segment app. In a local weather the place america has change into one of many largest state holders of Bitcoin, curiosity in dependable and feature-rich self-custody options has grown quickly.

Greatest Pockets Token advantages immediately from that momentum by providing an ecosystem that blends usability with monetary independence. Its capacity to merge safe self-custody with lively on-chain participation makes it one of the crucial utility-driven belongings amongst present presales.

Bitcoin Hyper

Bitcoin Hyper represents a technical development of Bitcoin’s legacy. As a Bitcoin-based Layer 2 community, it goals to unlock quicker transactions, larger scalability, and a brand new layer of interoperability for decentralized purposes.

As a substitute of constructing a completely separate chain, Bitcoin Hyper extends Bitcoin’s capabilities whereas sustaining its core rules of safety and decentralization. Builders can deploy good contracts, launch tokens, and even create dApps that decide on Bitcoin’s trusted community whereas working at increased velocity and decrease price by Hyper’s secondary infrastructure.

The undertaking’s regular progress has caught the eye of main figures within the house, together with protection by Austin Hilton and different high analysts. This visibility has turned Bitcoin Hyper into one of the crucial adopted Bitcoin-linked tasks of the yr.

What makes it notably fascinating is that it doesn’t compete with Bitcoin, it enhances it. The community successfully transforms Bitcoin from a retailer of worth into an lively computational layer, permitting innovation to happen on high of its immutable base.

Institutional recognition of Bitcoin’s scale, highlighted by america’ huge holdings, not directly strengthens Bitcoin Hyper’s narrative. As conventional entities deepen their connection to Bitcoin, curiosity naturally flows towards protocols that broaden its performance. Bitcoin Hyper stands at that intersection, merging utility with lineage.

For traders in search of publicity to the Bitcoin ecosystem with out the restrictions of its most important chain, it affords a sophisticated but sensible path, aligning completely with the renewed momentum surrounding state and company Bitcoin adoption.

Pepenode

Pepenode approaches the meme coin class with an sudden degree of technical construction. Behind its humorous aesthetic lies a mine-to-earn framework that rewards customers for operating light-weight mining nodes that contribute to community validation.

As a substitute of relying solely on speculative buying and selling, Pepenode builds a participation-based financial system the place holders can actively generate worth by securing and sustaining the system. Every node produces rewards within the type of tokens, and customers can enhance output by staking tiers and referral engagement, making a dynamic that blends neighborhood spirit with measurable utility.

This method has captured consideration throughout Telegram and X, the place miners and retail customers have begun treating Pepenode as each an funding and a participation recreation. The mannequin lowers entry limitations to mining, permitting anybody with a typical gadget to contribute with out costly {hardware}. It transforms the method right into a community-driven effort that reinforces each decentralization and engagement.

Pepenode’s referral construction additionally builds viral traction, as customers broaden the community by inviting others to activate new nodes, resulting in pure ecosystem progress somewhat than paid advertising and marketing.

What makes Pepenode notably related within the present atmosphere is its mixture of meme tradition and infrastructure-level participation. As state and institutional Bitcoin holdings reshape the notion of digital belongings, tasks that bridge leisure with technical substance stand out. Pepenode achieves that stability.

It channels the power of meme tradition right into a functioning mining community that rewards contribution over hypothesis, representing a type of crypto utility that feels playful but economically significant.

Conclusion

The rising recognition of Bitcoin on the state degree marks a defining shift in how digital belongings are seen. With america now holding huge reserves, legitimacy has moved from debate to acceptance. As this confidence filters by establishments and markets, the eye naturally turns towards the belongings that construct, innovate, and broaden utility throughout the ecosystem.

That is the section the place early participation usually yields the best rewards. The market’s basis has been bolstered, sentiment is rebuilding, and high-quality altcoins with real perform are starting to face out. For strategic traders, the window to build up has hardly ever seemed stronger.