Crypto markets are tense right this moment as practically $6 billion in Bitcoin and Ethereum choices attain expiration, fueling nervousness over additional draw back after a risky week.

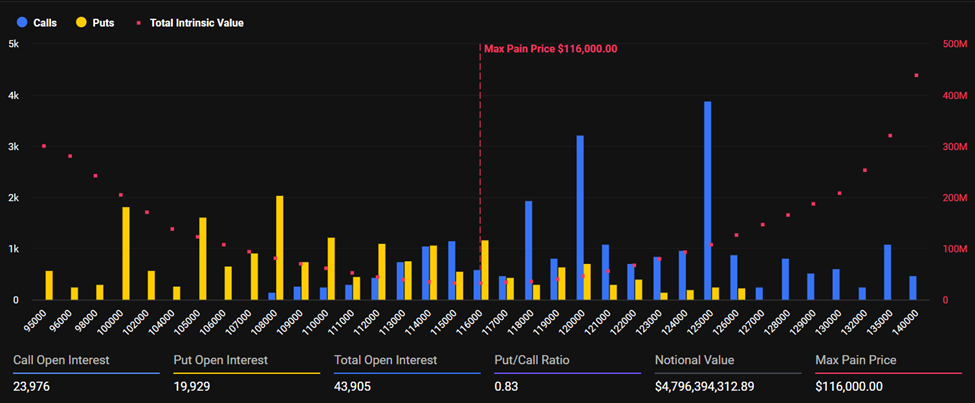

Bitcoin trades round $107,900, clinging to key assist whereas derivatives information level to rising bearish strain. In accordance with Deribit, roughly $4.8 billion in Bitcoin contracts are expiring, with a put-to-call ratio of 0.83. The “max ache” degree sits close to $116,000, suggesting restricted near-term optimism.

Market makers are bracing for turbulence as political and macroeconomic uncertainty intensifies. Unpredictable feedback from the Trump administration on commerce and power have shaken investor confidence, pushing merchants to hedge aggressively fairly than chase rebounds.

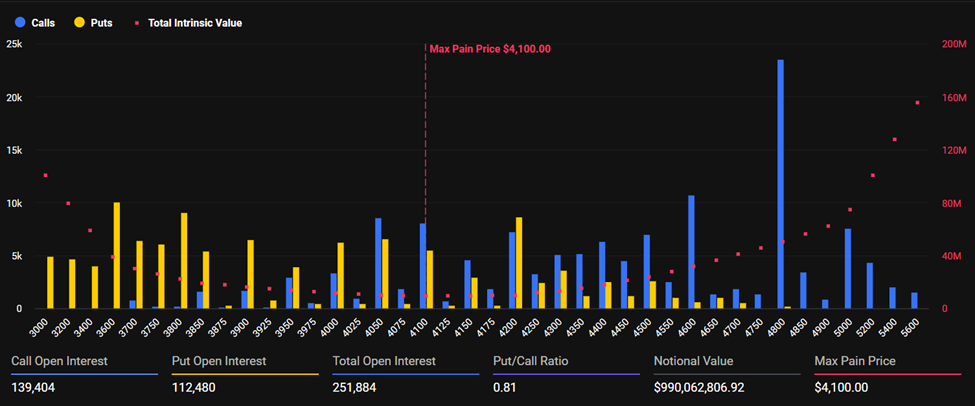

Ethereum mirrors the identical defensive setup. It at present trades close to $3,880, slightly below its $4,100 “max ache” level, with open curiosity above 250,000 ETH and a put-to-call ratio of 0.81.

Sentiment additionally stays fragile after studies that Selini Capital misplaced $50 million on a failed derivatives commerce. The incident has pressured liquidity suppliers and bolstered a cautious stance throughout exchanges.

Analysts now view $93,500 as potential backside assist for Bitcoin and $100,000 because the short-term rebound zone. However with choices skew deep in damaging territory and macro tensions unresolved, most merchants are sticking to hedges – an indication that crypto’s subsequent main transfer may nonetheless tilt decrease.