Bitcoin is as soon as once more testing investor conviction because it fights to remain above the $110,000 stage following final Friday’s sharp correction that triggered a large leverage wipeout throughout the market. After one of the risky classes of the quarter, merchants are watching intently to see whether or not BTC can stabilize or if extra draw back strain will emerge.

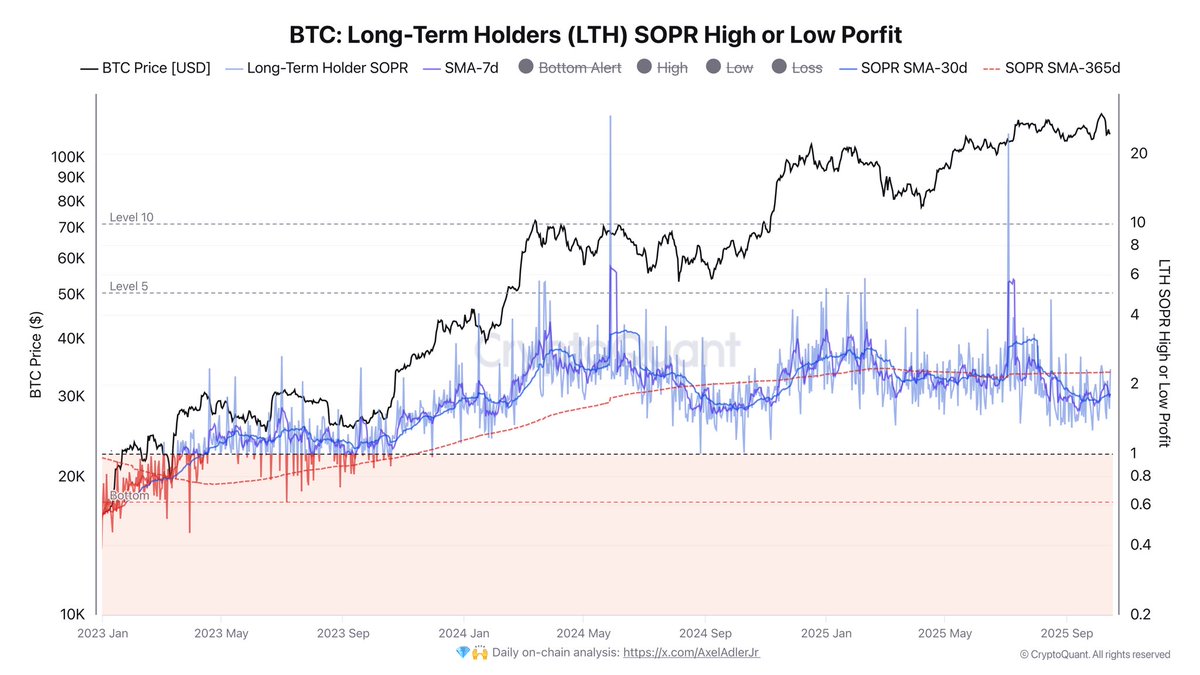

In line with on-chain knowledge shared by Darkfost, Lengthy-Time period Holders (LTHs) are persevering with to exert vital strain in the marketplace. Their Spent Output Revenue Ratio (SOPR) — a key metric monitoring realized income — at present stands at 2.32, exhibiting that this group is promoting cash at a median achieve of over 130%.

Such elevated profitability ranges usually coincide with phases the place long-term buyers take income after prolonged rallies, contributing to promoting strain and short-term weak point. Regardless of this, Bitcoin’s means to defend its present vary suggests underlying demand stays resilient.

Lengthy-Time period Holders Nonetheless Taking Income, However Indicators of Exhaustion Emerge

Analyst Darkfost factors out that whereas the Lengthy-Time period Holders’ (LTH) SOPR at present sits at 2.32, the shorter-term averages are beginning to soften. The weekly SOPR (7-day transferring common) has fallen to 1.82, and the month-to-month SOPR (30-day) sits at 1.79, each trending downward for the reason that summer season. Though these figures stay beneath the annual common of two.25, they point out a gradual cooling of realized income — an indication that promoting strain could also be easing.

This dynamic displays an important transition level for Bitcoin’s market construction. As long-term holders proceed to comprehend income above 1.0, they’re promoting cash at a achieve, successfully capping momentum and weighing on value restoration. But, the present decline in SOPR averages hints that this wave of profit-taking could also be nearing exhaustion. Traditionally, such drops in realized revenue ranges have preceded market stabilization and, finally, restoration phases.

Darkfost highlights that the present setup intently resembles the October 2024 correction, when Bitcoin’s SOPR bottomed close to related ranges earlier than the subsequent main upswing. If historical past rhymes, the continued contraction in LTH profitability might sign that the worst of the correction is behind us. Nonetheless, additional moderation in SOPR stays key for the market to completely reset and for sustainable upside momentum to re-emerge.

Bulls Defend $110K Zone Amid Weak Momentum

Bitcoin continues to hover round $111,500, exhibiting indicators of stabilization after final Friday’s steep sell-off. The 8-hour chart highlights a fragile restoration construction, with BTC struggling to regain key transferring averages and momentum fading beneath the $117,500 resistance, which stays a significant provide zone.

The 50-day (blue), 100-day (inexperienced), and 200-day (pink) transferring averages are starting to converge — an indication of compression that usually precedes a robust directional transfer. For now, BTC is buying and selling beneath all three, suggesting that sellers nonetheless dominate the mid-term pattern. Holding above $110,000 is essential; a decisive break beneath might open the door to retesting the $105,000–$106,000 vary, the place robust demand beforehand emerged.

Reclaiming $114,000–$115,000 could be the primary signal of power, probably triggering a push towards the $117,500 barrier. Nonetheless, quantity stays muted, implying that merchants are cautious because the market digests current volatility.

Bitcoin’s value motion factors to a consolidation section, with patrons and sellers in non permanent equilibrium. If bulls can shield the $110K area and momentum rebuilds, BTC might try a gradual restoration, however failure to take action dangers extending the correction additional.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.