In 2025, crypto token buybacks surged as Hyperliquid and friends repurchased tokens to tighten provide and sign monetary energy.

What are token buyback methods and month-to-month buyback spending developments?

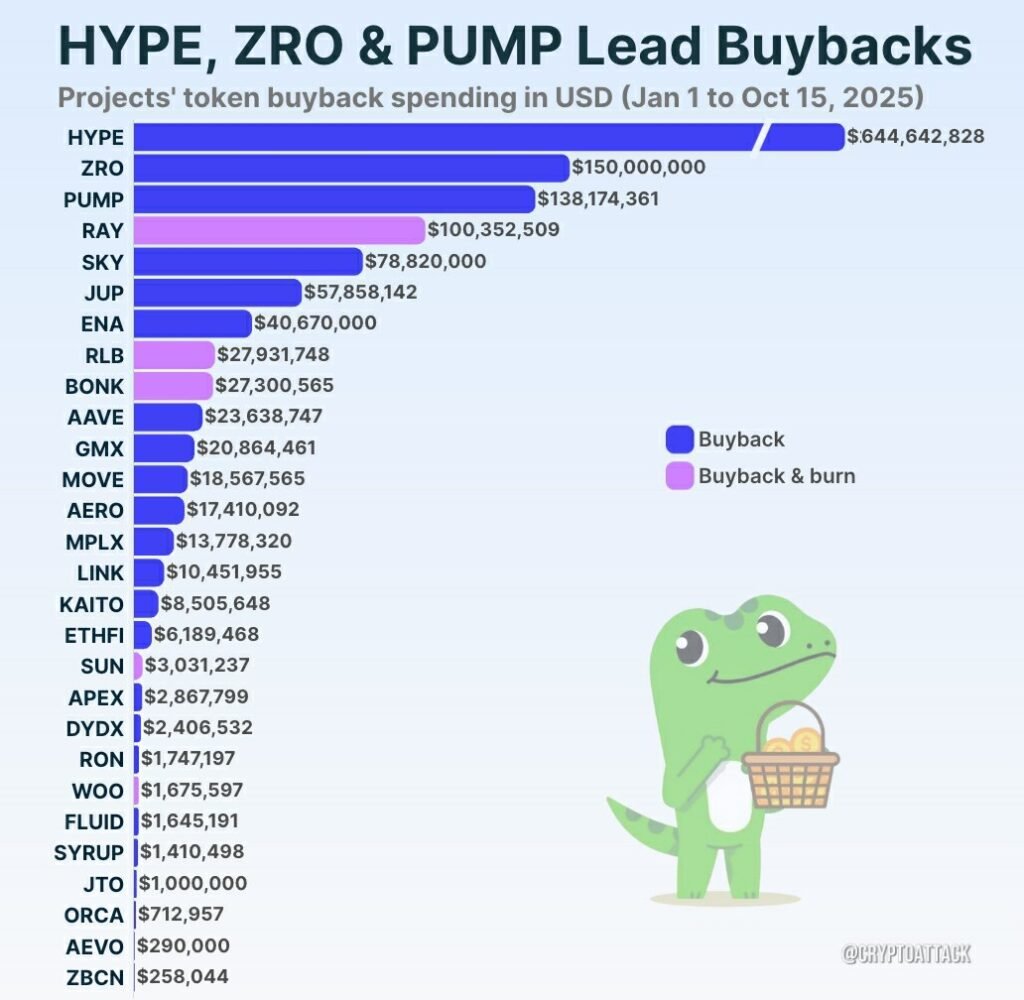

Printed reporting paperwork a cumulative $1.4 billion in repurchases in 2025, led by concentrated applications and a July spike that recorded an 85% month-over-month improve. Month-to-month spending averaged $145.9 million, up from a first-half common of $99.3 million.

Market analysts say giant, sliced orders and OTC execution are frequent token buyback methods to restrict slippage throughout giant repurchases. These patterns level to extra formalised repurchase insurance policies relatively than purely tactical interventions.

Tip: Observe on-chain flows and treasury disclosures to verify whether or not reported repurchases symbolize burns, locks or treasury retention.

Briefly: Repurchases accelerated via mid-2025, lifting month-to-month averages and signalling a shift towards structured buyback methods.

Hyperliquid leads token buyback methods, LayerZero and Pump.enjoyable comply with the pattern

In accordance with the report by Kelvin Munene revealed on Oct 17, 2025, the biggest contributors have been Hyperliquid with roughly $645 million, LayerZero with $150 million, and Pump.enjoyable with $138 million, collectively forming the majority of the $1.4B whole.

Focus in repurchases means a number of initiatives can materially compress circulating provide. Whether or not that interprets to lasting value results depends upon execution: everlasting burns, vesting changes or treasury holdings every have totally different implications for shortage.

Tip: Assessment governance notices and transaction proofs related to every repurchase to evaluate permanence.

Briefly: A small set of initiatives account for many repurchase quantity, amplifying their affect on token provide.

How do tokenomics shortage fashions react to concentrated crypto mission buybacks?

Buybacks can tighten provide however outcomes rely upon mechanics: burns take away tokens completely, whereas treasury-held repurchases could also be redeployed. Tax remedy and governance selections additional form the investor influence.

CoinGecko analysis analyst Yuqian Lim famous:

“Though a soar in token buyback spending was attributed to September, this was as a result of one-off LayerZero repurchase announcement”,

highlighting how single occasions can skew month-to-month figures.

Word: Deal with buybacks as one enter in tokenomics; utility, adoption and liquidity fundamentals stay central to long-term worth.

Briefly: Repurchases can improve shortage however require clear, verifiable mechanics to transform provide reductions into sturdy worth for holders.