- Over 40% of ETH is locked in staking, ETFs, and treasuries, tightening liquidity.

- Open curiosity has dropped to its 2025 low, clearing leverage for more healthy value motion.

- The Ethereum Basis’s deposit into Morpho Vaults alerts deeper belief in DeFi and open-source methods.

Ethereum (ETH) is quietly setting the stage for what might be one in every of its most structurally bullish cycles but. On the time of writing, ETH trades round $3,948, nonetheless about 19.9% beneath its August 2025 peak of $4,953. However beneath the floor, one thing fascinating is occurring — greater than 40% of all Ethereum provide is now locked up, shrinking the obtainable liquidity out there.

A Tighter Market Than Ever Earlier than

On-chain analyst Taylor.eth shared that about 29.5% of ETH is presently staked in validator contracts, 7.3% is tied up in spot ETFs, and 3.4% sits in decentralized asset treasuries. Which means virtually half the circulating provide isn’t actually circulating in any respect. This shift, they argue, makes the present cycle very totally different from these earlier than it — much less liquid, extra institutionally anchored, and sure slower-moving however stronger in construction.

The institutional footprint continues to develop. Public firms now maintain over 4 million ETH in treasuries, whereas spot ETFs collectively handle near 9 million ETH, an enormous soar from 2.5 million only a yr in the past. Staking, which now locks up practically a 3rd of the community, ensures constant yield era — and limits how a lot ETH is on the market for buying and selling.

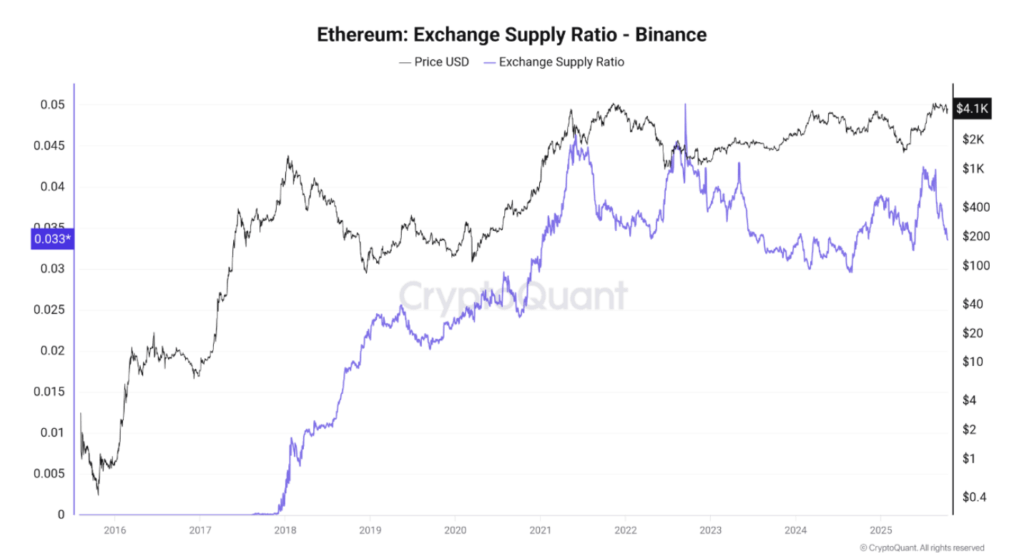

Knowledge from CryptoQuant reinforces this development. The alternate provide ratio on Binance has dropped to simply 0.033, the bottom it’s been in months. Every time alternate reserves shrink like this, it’s normally an indication that traders are pulling cash into self-custody or staking — usually a precursor to accumulation phases and future value growth.

Technicals Present Power Regardless of Falling Open Curiosity

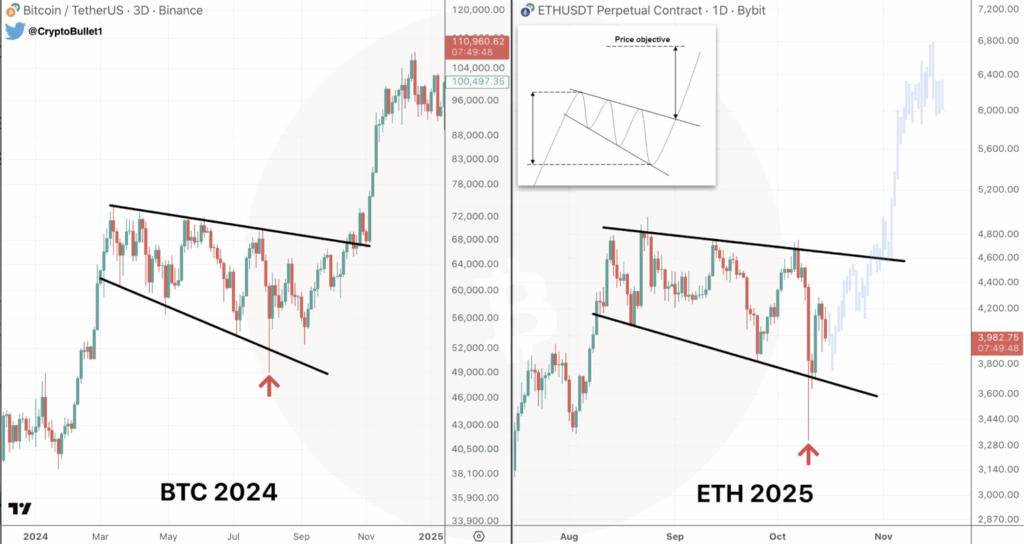

Analyst CryptoBullet in contrast Ethereum’s present construction to Bitcoin’s pre-breakout setup from 2024. On the chart, ETH appears to be shifting inside a falling wedge, with resistance sitting close to $4,600–$4,800 and help round $3,200–$3,400. Traditionally, when these wedges break upward, it sparks explosive strikes — on this case, targets between $6,000–$7,000 are on the desk.

On the similar time, open curiosity has fallen to $46 billion, its lowest since July 2025. That’s down sharply from greater than $60 billion in early September, based on Coinglass. Funding charges have flattened out, and long-to-short ratios are balanced, suggesting leverage has flushed from the system. In different phrases — the market’s cleaned up. And a clear market tends to get better stronger as soon as momentum returns.

Ethereum Basis Provides 2,400 ETH to Morpho Vaults

In a quieter however significant transfer, the Ethereum Basis deposited 2,400 ETH (roughly $9.5 million) together with $6 million in stablecoins into Morpho’s yield vaults. The transfer exhibits rising confidence in decentralized finance’s danger controls and infrastructure maturity.

Morpho is an open-source lending protocol that optimizes effectivity by pairing debtors and lenders instantly — chopping out extra spreads. With ETH and stablecoins now working as complementary belongings (progress vs. yield), the Basis appears to be diversifying each publicity and returns inside DeFi.

Much more fascinating, Morpho’s tech stack — together with MetaMorpho and Vault v2 — runs underneath the GPL-2.0 license, which permits builders to freely fork, audit, and construct on the protocol. Morpho Blue (v1) may even swap to GPL-2.0 by January 1, 2026, boosting transparency and strengthening open-source DeFi ecosystems.

The Larger Image

Ethereum’s fundamentals look stronger than ever, even when short-term value motion feels unsure. With over 40% of provide locked, institutional adoption accelerating, and on-chain liquidity tightening, ETH is likely to be establishing for a delayed however highly effective subsequent leg up.

The short-term would possibly wobble — however long-term? Ethereum seems prefer it’s quietly constructing the spine of the subsequent crypto growth part.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.