Keep within the loop with our weekly crypto digest as we get you on top of things on the most popular developments and occasions within the crypto house.

Right here’s what occurred in crypto this week:

Ocean Protocol Withdraws From AI Token Alliance With Fetch.ai And SingularityNET

Ocean Protocol has pulled out of the Synthetic Superintelligence Alliance (ASI) with Fetch.ai and SingularityNET, probably impacting the $OCEAN token and the alliance’s imaginative and prescient for decentralized AI.

The Synthetic Superintelligence Alliance (ASI) was fashioned in March 2024 by Fetch.ai, SingularityNET, and Ocean Protocol to unify their AI-focused ecosystems below a single token.

As a substitute of launching a brand new asset, the merger consolidated the OCEAN tokens into Fetch.ai’s, which turned the bottom token and was later rebranded as ASI.

Holders of AGIX and OCEAN might voluntarily convert their tokens into FET at fastened charges, whereas unconverted tokens remained legitimate on their unique contracts.

ASI added that Ocean Protocol’s departure wouldn’t have an effect on its core know-how stack, that improvement momentum stays robust, and the founding groups stay totally aligned of their mission.

Crypto Market Suffers Document $19 Billion Crash, Calling It ‘Worst Liquidation Occasion In Crypto Historical past’

The crypto market’s $19 billion liquidation final Friday was one for the document books. Actually, it’s twice the quantity liquidated within the subsequent greatest market rout, which came about in April 2021, per Coinglass information.

Based on Lucas Kiely, CEO of Future Digital Capital Administration, a digital asset wealth supervisor, the chance of such mass liquidation occasions is rising.

“This sell-off is a wake-up name for merchants that prime leverage is a really harmful sport in a market this illiquid and this near a cycle high,” he mentioned in a press release.

Liquidation is a course of that happens when a dealer’s account steadiness falls under a sure threshold, triggering the automated closure of their trades. It normally occurs when merchants tackle leverage. In different phrases, borrowing cash to juice the dimensions of their bets.

Airdrop Declare Portal For Monad Goes Stay

Monad, a high-performance EVM-compatible Layer 1 blockchain, has launched its airdrop declare portal for the $MON on October 14th, 2025, marking a big step towards its mainnet debut.

Notably, Monad is positioning itself as a rival to Ethereum and Solana by promising 10,000 TPS and 1-second block occasions.

The portal will likely be open till November third, 2025, and there’s no profit to claiming early, so take your time and be cautious.

Citibank Targets 2026 Launch For Crypto Asset Custody Providers

Citi is aiming to launch a service for the custody of crypto property in 2026, an govt on the financial institution informed CNBC, as Wall Road giants develop their footprint within the digital forex house.

The providing, focused at asset managers, hedge funds, and different institutional traders, goals to mix Citi’s repute for monetary safety with next-generation blockchain infrastructure.

The transfer comes after a number of years of groundwork inside Citi’s digital property division, which has centered on constructing compliance-ready, scalable custody know-how. The system will embrace institutional pockets infrastructure, superior non-public key administration, and on-chain verification instruments.

China Renaissance Seeks $600 Million For BNB Crypto Treasury

China Renaissance Holdings, a Beijing-based, Hong Kong-listed funding establishment, is in negotiations to boost round US$600 million to create a digital treasury car centered on BNB. YZi Labs, a department linked to Binance, is anticipated to take part on this endeavor alongside the Chinese language financial institution.

If the fundraising is profitable, a public firm will likely be established within the US devoted to the buildup of digital property. This mannequin follows a pattern amongst establishments in search of “crypto treasuries” centered on cryptocurrencies of nice relevance within the digital monetary ecosystem.

Notably, China Renaissance had already expressed its intention to take a position roughly US$100 million in BNB as a part of a strategic alliance with YZi Labs. This transaction made it one of many first Hong Kong-based entities to explicitly declare BNB as a part of its proprietary portfolio.

Japan To ban Cryptocurrency Insider Buying and selling With New Guidelines

Japan is about to ban insider buying and selling in cryptocurrencies, with the Monetary Providers Company (FSA) introducing strict rules and surcharges on illicit positive aspects, as reported by Nikkei Asia.

Japan’s FSA is aiming to categorise crypto as a monetary product below stricter oversight. This transfer targets shady insider offers, guaranteeing the market isn’t a playground for manipulators.

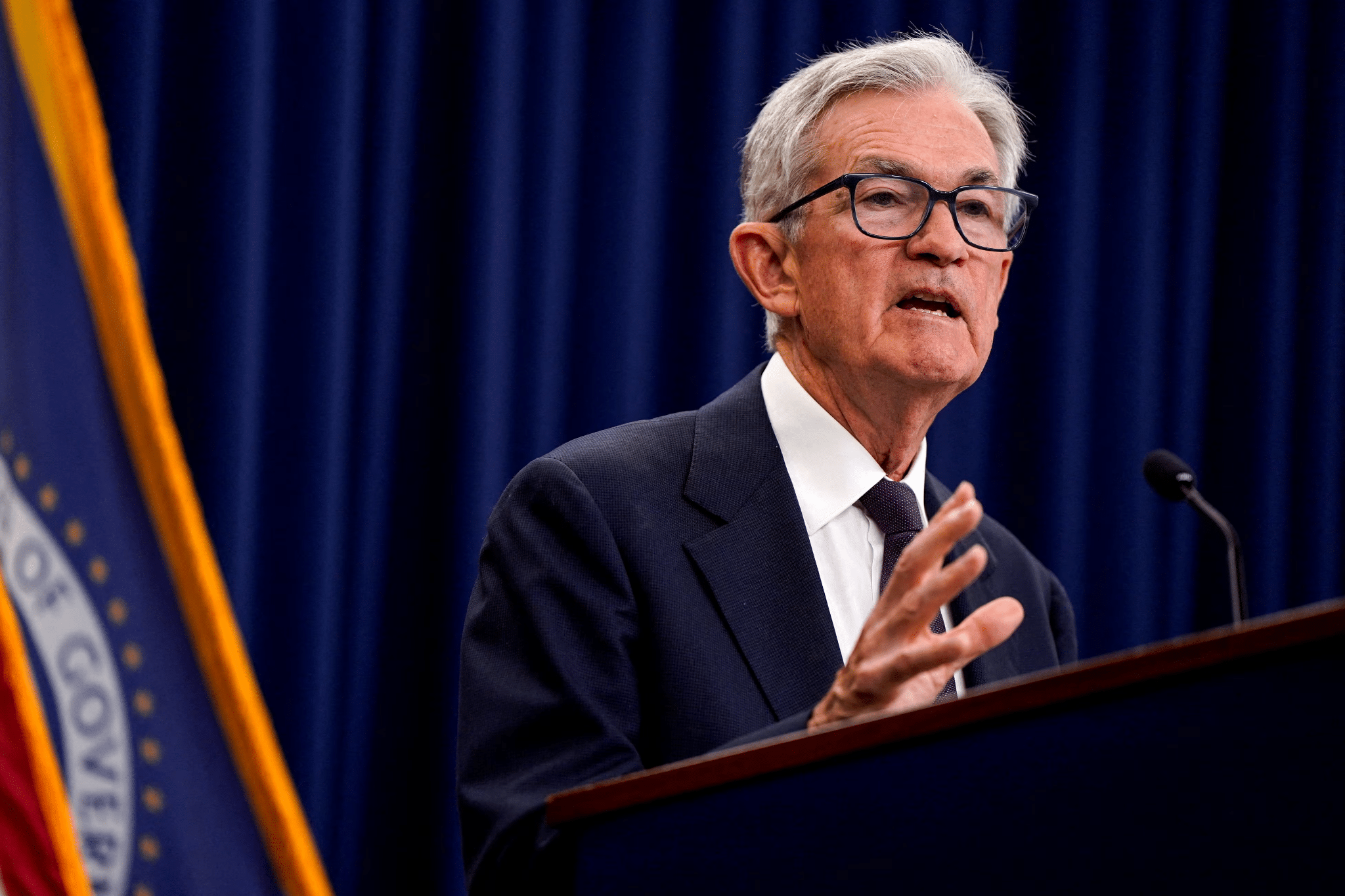

Federal Reserve Jerome Powell Suggests Tightening Program Might Finish Quickly

Federal Reserve Chair Jerome Powell instructed the central financial institution is nearing some extent the place it would cease decreasing the dimensions of its bond holdings, and offered a couple of hints that extra rate of interest cuts are within the playing cards.

Whereas he offered no particular date for when this system will stop, he mentioned there are indications the Fed is nearing its objective of “ample” reserves out there for banks.

On rates of interest, the central financial institution chief didn’t present particular steerage on a path decrease, however feedback about weak spot within the labor market indicated that easing is firmly on the desk, as monetary markets count on.

Different Fed officers have mentioned not too long ago that the falling labor market is taking priority of their considering, resulting in the chance of further charge cuts forward.

Last Ideas

In order that’s it for this week!

To remain forward of the sport with the freshest crypto information and insights delivered straight to your inbox, contemplate subscribing to UseTheBitcoin’s e-newsletter at the moment.

Have a implausible week forward!