- XRP’s 10-month correction could also be wrapping up, with indicators of a possible shift towards bullish momentum.

- TraderJB sees two paths: a accomplished double-three correction or an prolonged triple-three that lasts into 2026.

- The important thing stage to look at stays $2.80–$3.00 — a breakout there might affirm XRP’s subsequent rally section.

XRP’s been caught in a tug-of-war recently — bouncing again from early-October chaos however nonetheless struggling to reclaim that all-important $3.00 mark. Market strategist TraderJB thinks the token’s subsequent massive transfer is true across the nook, however which manner it breaks will rely upon how this lengthy correction section wraps up.

After plunging to round $1.50 throughout the October 10 selloff, XRP managed to claw again above $2.00. Since then, although, its momentum’s been muted. Each push larger will get swatted down close to resistance, leaving merchants questioning whether or not that is only a breather earlier than liftoff — or the calm earlier than one other dip.

The W–X–Y Correction Nears Its Finish

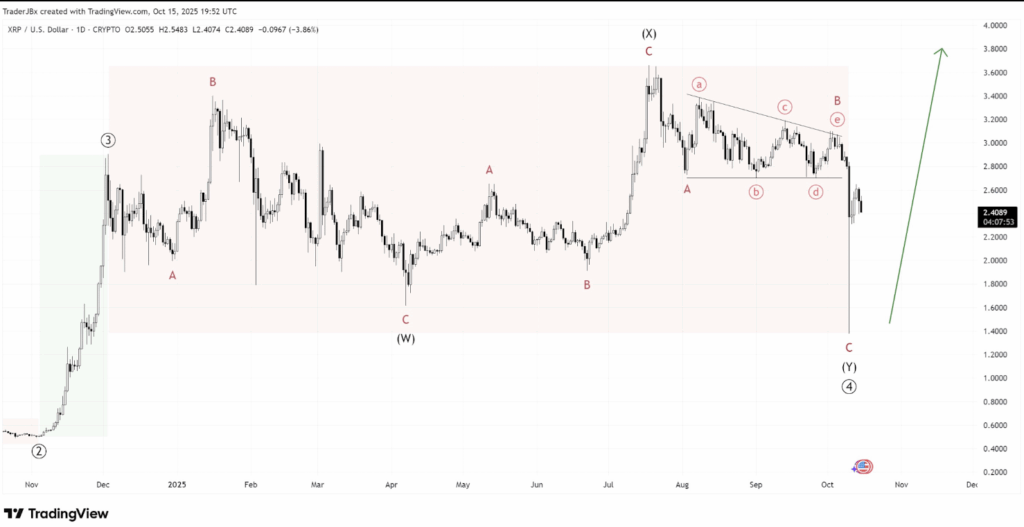

In accordance with TraderJB, XRP’s value motion during the last ten months suits neatly into what’s referred to as a W–X–Y corrective construction — three distinct waves of decline, rebound, and consolidation. It’s been an extended grind, every section lasting roughly three to 4 months, because the asset labored off the surplus from its earlier surge.

- Wave (W): From January to April, XRP tumbled from close to $3.40 to $1.80.

- Wave (X): Between Might and July, it bounced again sharply, reclaiming highs close to $3.60.

- Wave (Y): Spanning August by means of October, the token principally moved sideways earlier than that brutal October crash.

That remaining selloff — the one which drove XRP to $1.50 — could have marked the tip of the corrective sample. TraderJB believes this low level doubtless accomplished the (4) wave inside XRP’s bigger market cycle. Apparently, the drop flushed out a ton of leveraged lengthy positions, probably clearing the way in which for a more healthy restoration.

Two Situations: Restoration or One Extra Dip

From right here, TraderJB outlines two potential outcomes. The optimistic one says the correction is completed — a “double-three” sample that paves the way in which for a recent bullish leg. If that’s the case, XRP may lastly be gearing up for its subsequent upward impulse, particularly if quick positions begin unwinding.

The extra cautious situation, although, is that the token nonetheless has a bit extra work to do. On this model, XRP would carve out two smaller waves, (X) and (Z), forming what’s referred to as a “triple-three” correction. That might drag the consolidation out into mid-2026, delaying any significant rally till the sample absolutely resolves.

For now, each paths are nonetheless in play. TraderJB leans barely bullish, declaring that construction and sentiment appear to favor an eventual upside breakout — however provided that the token can clear key resistance close to $2.80–$3.00.

What Comes Subsequent for XRP?

In the intervening time, XRP trades round $2.38, caught between heavy resistance overhead and stable assist under. A robust transfer above $3.00 might sign that the market’s flipped in favor of patrons, kicking off a brand new rally cycle. But when it slips again below $1.50, that will affirm the correction isn’t fairly completed but.

Thus far, XRP’s resilience has stored merchants on their toes. Whether or not that is accumulation earlier than the following breakout or simply one other leg within the correction — the following few weeks ought to make it clear. For now, all eyes stay glued to that $2.80–$3.00 zone, the extent that would resolve XRP’s destiny heading into 2026.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.