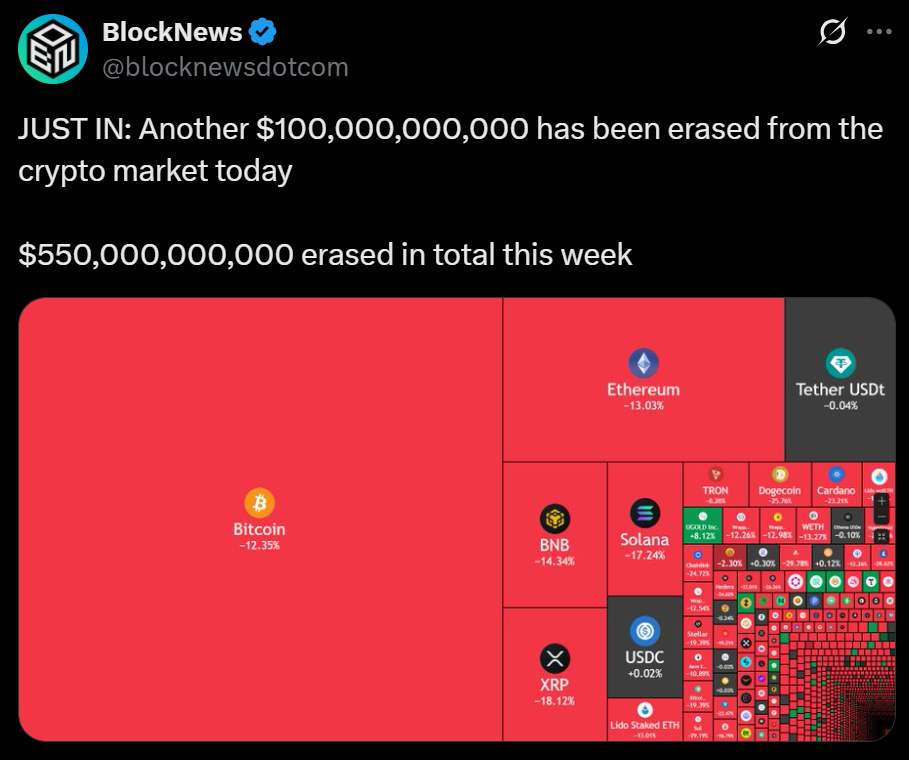

- $550 billion wiped from crypto’s market cap as risk-off panic returned.

- Gold and metals absorbed security flows, sidelining the “digital gold” commerce.

- ETF outflows and liquidation cascades deepened the selloff.

The crypto market simply worn out round $550 billion in worth, falling from the low-$4 trillion vary to roughly $3.57 trillion. Bitcoin dropped into the $104–107K pocket, Ethereum slipped under $4K, and altcoins bled throughout the board. There wasn’t one single spark—it was a messy overlap of macro concern, capital rotation, and structural unwinds. Right here’s what actually drove the selloff.

Trump–China Tensions Ignite Threat-Off Panic

Commerce battle chatter got here roaring again. Contemporary tariff threats and speak of tighter export controls between the U.S. and China reignited international market anxiousness. The sequence performed out predictably: tariff headlines hit → equities offered off → financial institution shares stumbled → crypto adopted the chance curve decrease. Bitcoin broke to a 3-month low close to $104.7K as U.S. and European indices sank on credit score issues. Although some officers tried to downplay “100% tariffs,” merchants are treating November’s coverage window as a reside danger occasion. In these risk-off phases, liquidity vanishes and dip-buyers hesitate, making every down-move sharper and sooner.

Gold Takes the Protected-Haven Highlight

When concern hit, cash fled—however not into crypto. Gold ripped via $4,300 per ounce, setting new all-time highs as merchants wager on price cuts and geopolitical pressure. Silver tagged alongside, reinforcing the steel commerce as the popular shelter. That flight to old-school security undercut crypto’s “digital gold” pitch. At the same time as gold cooled briefly, its double-digit month-to-month achieve stored investor focus glued to metals, not tokens. For allocators, gold labored; Bitcoin didn’t. Till that dynamic flips, it’s powerful for crypto to reclaim its store-of-value glow.

ETFs Bled and Leverage Snapped

Then got here the structural flush. Spot Bitcoin ETFs within the U.S. noticed roughly $536 million in outflows on a single day—the largest since August. That regular demand pipeline dried up simply as futures markets bought hit with about $1 billion in long-side liquidations. Bitcoin briefly sliced under $106K earlier than rebounding weakly, whereas altcoins spiraled decrease on skinny books. It’s the traditional suggestions loop: ETFs bleed, perps unwind, liquidity collapses, and volatility feeds on itself. Till outflows reverse and liquidations settle, the market stays caught in chop mode, not restoration mode.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.