Veteran gold advocate Peter Schiff just lately stirred controversy on X by declaring that gold is extra prone to attain $1 million than Bitcoin, a remark that reignited the basic “gold vs. Bitcoin” debate.

The assertion drew swift criticism from crypto traders who proceed to see Bitcoin because the dominant long-term asset.

Regardless of short-term volatility and a current pullback to $106K, Bitcoin stays up 54% over the previous yr, solidifying its place as one of many strongest-performing belongings globally.

Whereas Schiff’s feedback renewed the acquainted “gold vs. Bitcoin” narrative, market members have shifted focus towards the rising infrastructure being constructed round Bitcoin, most notably Bitcoin Hyper, a Layer 2 undertaking that’s gaining traction through the ongoing correction.

Supply – 99Bitcoins YouTube Channel

Bitcoin Hyper Bridges Safety with Trendy Blockchain Utility

Bitcoin Hyper’s fast-growing presale has already reached a $24 million milestone, highlighting robust investor demand regardless of ongoing market uncertainty.

The undertaking’s purpose is obvious: introduce scalability, decentralized finance (DeFi) capabilities, and decrease transaction charges to the Bitcoin ecosystem.

Utilizing superior Layer 2 structure impressed by networks reminiscent of Solana, Bitcoin Hyper permits customers to deposit BTC and obtain Bitcoin Hyper tokens.

These tokens permit participation in staking, liquidity operations, and future decentralized exchanges, all whereas sustaining the underlying energy and safety of the Bitcoin community.

This design successfully bridges Bitcoin’s long-term stability with the performance of contemporary blockchains, giving customers a sensible technique to work together with decentralized functions on prime of the unique community.

The undertaking has drawn a number of five-figure whale purchases in current weeks and continues to pattern throughout presale platforms, signaling confidence amongst skilled members.

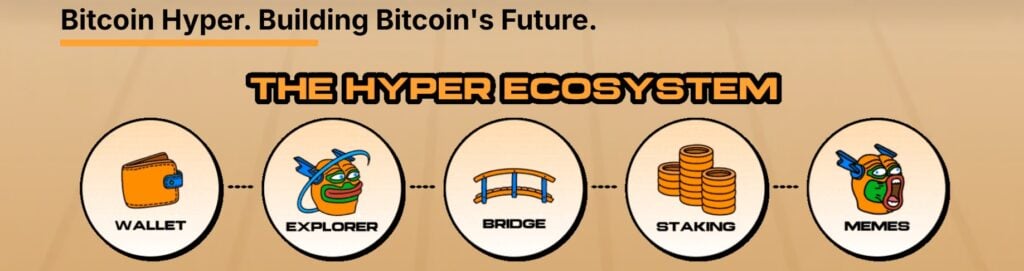

Constructing the Way forward for Bitcoin Utility: The Rise of the HYPER Ecosystem

Bitcoin Hyper is constructing greater than only a quick blockchain; it’s creating an entire HYPER Ecosystem designed to strengthen performance, accessibility, and consumer rewards.

On the middle of this imaginative and prescient are key parts such because the Hyper Pockets, a safe multi-chain resolution for managing BTC and tokens; the HYPER Explorer, which ensures transparency via on-chain monitoring; and the HYPER Bridge, which permits clean cross-chain transfers.

The ecosystem additionally features a staking portal for yield era and a meme zone, mixing neighborhood tradition with blockchain incentives. This complete construction is backed by robust credibility measures.

Impartial audits by Coinsult and SpyWolf have verified Bitcoin Hyper’s good contracts, making certain they’re safe and clear. Audits like these assist shield traders from potential vulnerabilities, which is particularly essential for newly launched tokens.

To help the ecosystem’s enlargement, Bitcoin Hyper’s presale technique dedicates 20% of raised funds to advertising campaigns throughout tier-one areas.

These efforts mix paid promotions, influencer partnerships, and natural publicity to maximise consciousness forward of the change launch.

In the meantime, the remaining funds are strategically allotted to liquidity, ecosystem growth, and staking incentives, making certain sustainable development, balanced token distribution, and sturdy treasury administration properly past the presale part.

Institutional Exercise Helps Bitcoin Narrative

Whereas Peter Schiff continues to dismiss Bitcoin’s development potential, institutional strikes paint a special image.

Supply – Bitcoin Archive through X

Funding agency Cardone Capital just lately added 200 BTC to its holdings, whereas Charles Schwab, managing $11.2 trillion in belongings, introduced plans to allow spot Bitcoin and crypto buying and selling by 2026, a put up from Bitcoin Journal on X.

Such developments spotlight the accelerating mainstream adoption that immediately strengthens initiatives like Bitcoin Hyper. Gold stays a precious commodity, however with a $30 trillion market cap already, its room for exponential development is restricted.

Bitcoin, presently valued at $2.1 trillion, gives far better upside, significantly as new infrastructure expands its utility past easy storage of worth, creating alternatives that initiatives like Bitcoin Hyper are designed to seize.

Conclusion

Peter Schiff’s argument reveals the hole between conventional wealth preservation and trendy innovation.

Gold could symbolize stability, however Bitcoin stands for progress. Buyers now search for belongings that generate worth via actual use relatively than merely holding it.

Bitcoin Hyper displays this shift by turning blockchain expertise right into a working ecosystem. Whereas Schiff stays targeted on the previous, the market is clearly shifting towards a future constructed on adaptability, velocity, and sensible utility.

Go to Bitcoin Hyper

This text has been offered by certainly one of our business companions and doesn’t replicate Cryptonomist’s opinion. Please bear in mind our business companions could use affiliate applications to generate revenues via the hyperlinks on this text.