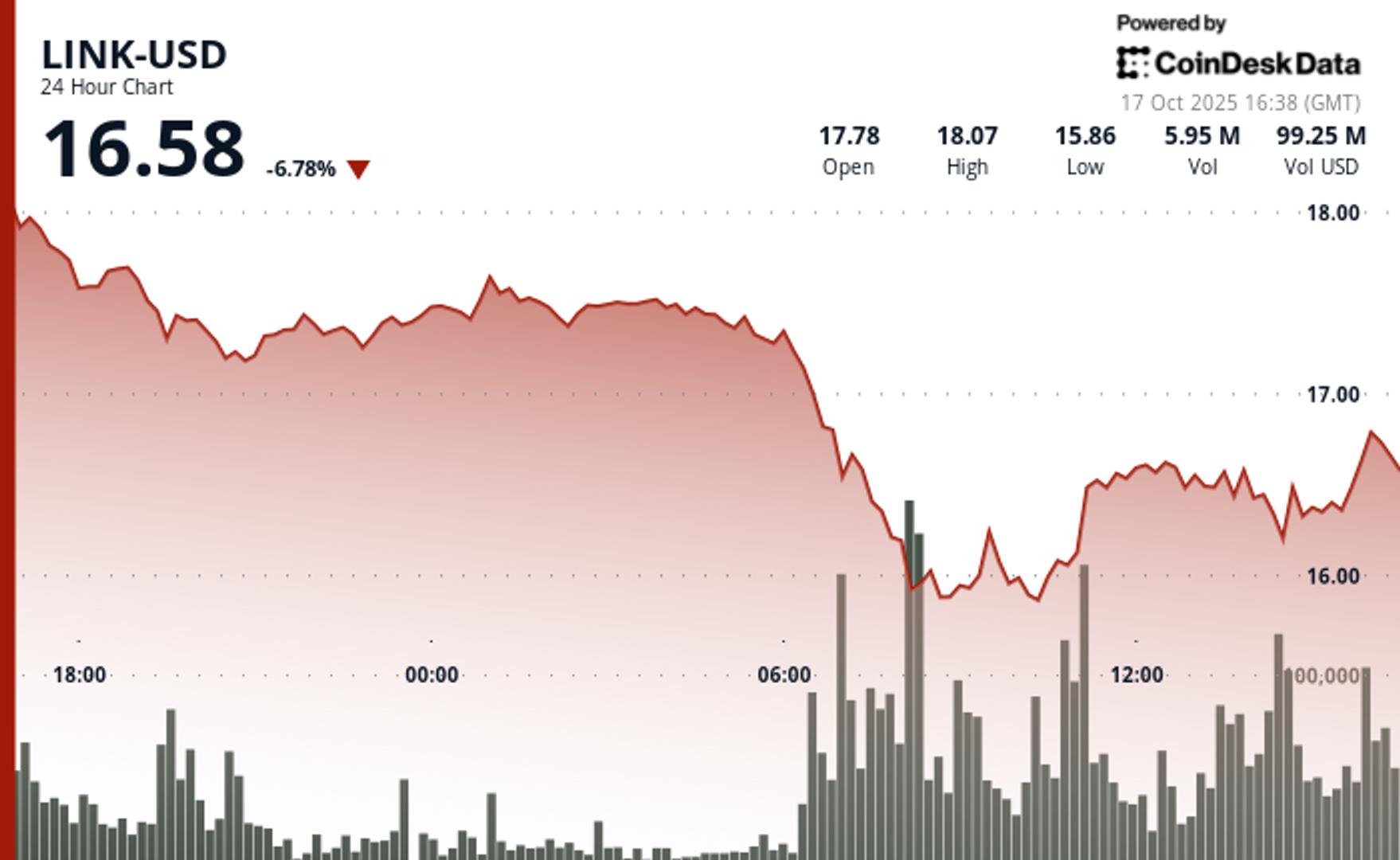

The native token of oracle community Chainlink fell sharply on Friday, dropping almost 9% to $16.46, its weakest worth since final Friday’s crypto crash.

The pullback occurred amid concentrated promoting stress, significantly between 6:00 and eight:00 AM ET on Friday, CoinDesk Analysis’s analytics mannequin famous. A quick restoration late within the session noticed LINK modestly up 0.4% within the remaining hour, however not sufficient to offset earlier losses.

Regardless of the steep decline, company curiosity in LINK gave the impression to be regular. Caliber Company (CWD), a Nasdaq-listed actual property funding agency, disclosed a $2 million LINK acquisition on Thursday. The acquisition introduced Caliber’s complete LINK tally to 562,535, value about $9.2 million at present costs.

In the meantime, the Chainlink Reserve added one other 59,969 LINK to its holdings, bringing its holdings to 523,159 tokens. Nevertheless, with a median value foundation of $21.98, the reserve stays deeply underwater, down over 34% from its entry level.

On the tech entrance, Chainlink superior its product roadmap with the launch of Information Streams on MegaETH, a high-speed blockchain optimized for real-time functions. The mixing permits sensible contracts to entry reside market information with sub-second latency, supporting DeFi use circumstances like perpetual swaps buying and selling and stablecoins with centralized exchange-level velocity.

Technical Evaluation Breakdown:

- Chainlink skilled a big sell-off, falling from $18.07 to $16.46, representing a considerable 9% selloff with an total buying and selling vary of $2.25.

- Crucial institutional assist emerged on the $15.72-$15.82 zone with robust quantity affirmation, whereas resistance fashioned at $17.43 with a number of rejections all through the buying and selling session.

- LINK established new assist stage round $16.30-$16.35 as potential re-entry methods.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial crew to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.