Be part of Our Telegram channel to remain updated on breaking information protection

Florida Home Republican Webster Barnaby has refiled a crypto reserve invoice after a earlier effort failed, increasing it from permitting investments in Bitcoin alone to crypto ETFs, NFTs, and different blockchain-based belongings.

The laws, Florida Home Invoice 183, would enable as much as 10% of sure public funds, together with pension belongings, to be allotted to digital belongings. It additionally introduces new custody, documentation, and fiduciary requirements for holding and lending these belongings.

By increasing the scope to a number of cryptocurrencies and ETFs, the revision provides the state extra funding flexibility whereas assembly regulatory and oversight necessities.

🇺🇸 NEW: Florida recordsdata first Strategic Bitcoin Reserve invoice of the 2026 legislative session.

Home Invoice 183 would enable the state to take a position 10% of public funds in digital belongings, and permits retirement fund funding. pic.twitter.com/sI4bUBiiB3

— Bitcoin Legal guidelines (@Bitcoin_Laws) October 16, 2025

The invoice would additionally enable Florida residents to pay sure taxes and costs in digital belongings whether it is accredited. These funds would then be transformed into {dollars} and transferred to the state’s basic fund.

The revised invoice seems to take impact on July 1 subsequent 12 months. It additionally goals to authorize the State Board of Administration to take a position pension and different funds into crypto.

Solely Three State Crypto Payments Enacted Into Legislation

Barnaby’s invoice is the newest in a sequence of crypto reserve payments that had been launched in state legislatures in the course of the 2025 legislative season.

However most of the proposed payments had been rejected. Solely three of them, particularly ones from Arizona, Texas, and New Hampshire, have been enacted into legislation.

Arizona’s HB 2749 solely permits for the creation of a crypto reserve utilizing unclaimed property, whereas the Texas Senate Invoice 21 particularly establishes a Bitcoin-only reserve.

In the meantime, New Hampshire’s HB 302 provides the treasurer the flexibility to take a position as much as 5% of public funds in digital belongings. Nevertheless, these belongings will need to have a market cap of greater than $500 billion to be included.

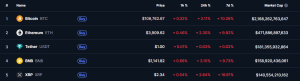

High 5 cryptos by market cap (Supply: CoinMarketCap)

Wanting on the high 5 largest cryptos by market cap, Bitcoin is the one digital asset that meets HB 302’s capitalization requirement. Altcoin chief Ethereum (ETH) may additionally meet the requirement quickly if there’s a sturdy sufficient value enhance, with its capitalization of over $471.98 billion, based on CoinMarketCap information.

Florida Seeks To Ease Regulation Round Stablecoin Issuers

Along with the revised crypto reserve invoice, Barnaby can also be seeking to ease the regulatory necessities for stablecoin issuers in Florida with the submitting of HB 175.

That invoice goals to make clear that acknowledged fee stablecoin issuers shouldn’t be required to acquire separate licenses or registrations. Below this invoice, stablecoin issuers should be absolutely collateralized with both US {dollars} or treasuries. These companies should conduct public audits of their reserves at the very least as soon as a month as properly.

Much like HB 183, the Florida lawmaker needs the stablecoin invoice to take impact on July 1 subsequent 12 months.

Stablecoin companies that wish to difficulty their tokens within the US already need to observe the Guiding and Establishing Nationwide Innovation for US Stablecoins (GENIUS) Act. It was signed into legislation by US President Donald Trump on July 18, 2025, after passing each the Senate and the Home with bipartisan help. This act can also be the primary US federal statute to control “fee stablecoins.”

One of many GENIUS Act’s major targets is to cut back regulatory ambiguity within the stablecoin market. Much like HB 175, the act requires that fee stablecoins by absolutely backed by liquid belongings. The composition of those backing reserves must be clear as properly.

Issuers additionally want to supply periodic disclosures, audit studies, and reserve composition in order that customers and regulators can monitor the belongings’ backing.

The regulatory readability has boosted the stablecoin market, which not too long ago noticed its capitalization soar to a brand new all-time excessive of $314 billion. A lot of the expansion was seen by Tether’s (USDT) and Circle’s USD Coin (USDC), that are at the moment the 2 greatest stablecoins out there with respective capitalizations of $181.37 billion and $75.96 billion.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection