XRP traded defensively however held key helps Friday, recovering from an early dip to $2.19 as institutional patrons absorbed promoting stress. The transfer got here amid renewed U.S.–China tariff fears and cautious positioning forward of subsequent week’s SEC deadlines for spot XRP ETFs.

What to Know

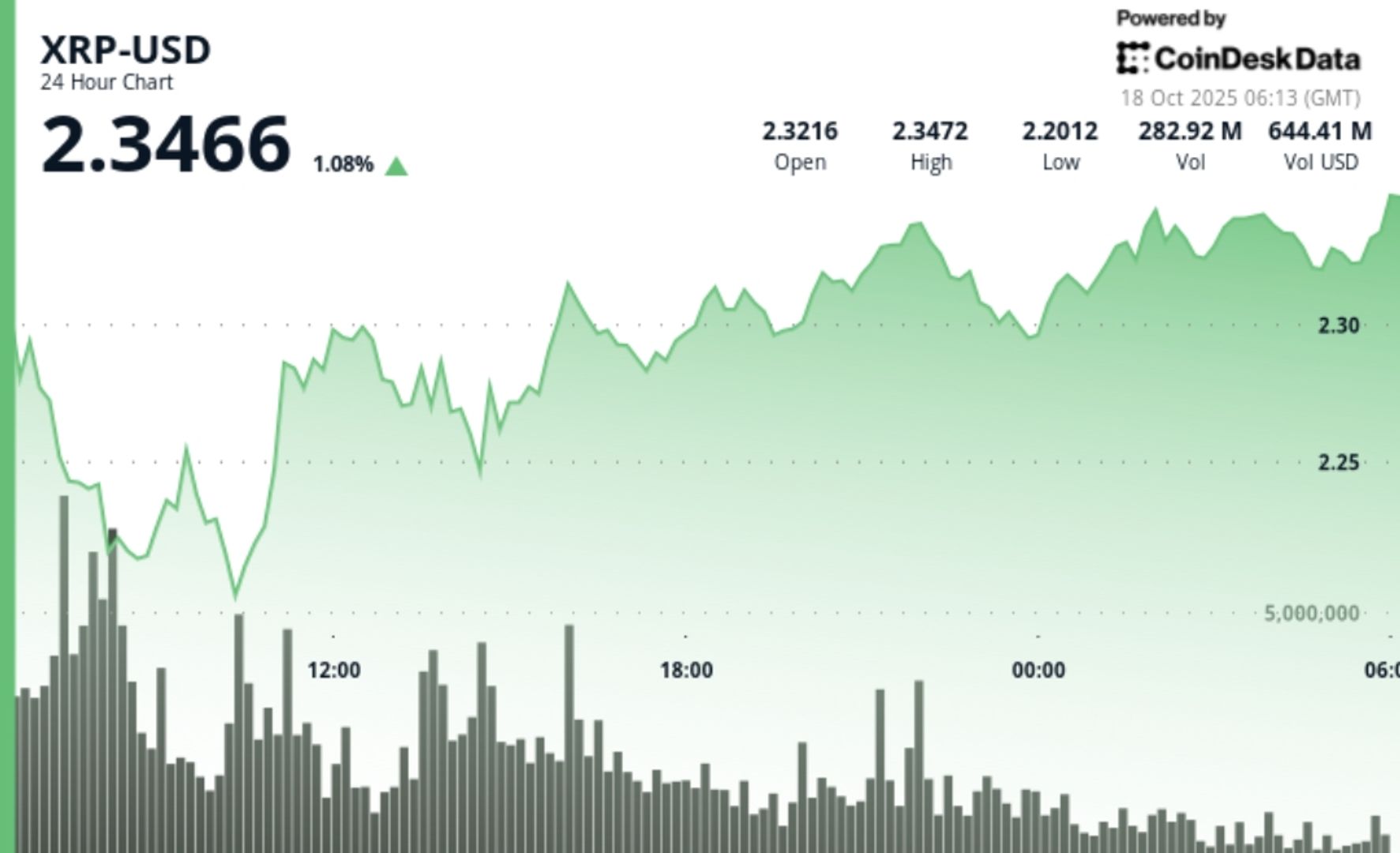

• XRP oscillated between $2.19 and $2.35 over the 24-hour session from Oct 17, 06:00 to Oct 18, 05:00 — a 7% vary.

• Buying and selling quantity hit 246.7M through the 07:00 hour, almost triple the 24-hour common, as sellers capitulated close to $2.23.

• Value recovered from a $2.19 low to settle at $2.33, logging a 1% acquire from the session open.

• Broader crypto market cap dropped 6% to $3.5T as macro tensions and U.S.–China commerce rhetoric spurred risk-off flows.

• SEC evaluation of six pending spot XRP ETF filings continues by means of Oct 25, alongside Ripple’s deliberate $1B treasury elevate.

Information Background

The early-session decline mirrored weak spot throughout the digital asset complicated as buyers lowered publicity forward of trade-related headlines and ETF deadlines. Regardless of a pointy morning drawdown from $2.33 to $2.19, XRP stabilized shortly as market depth recovered on robust purchase packages. Ripple’s $1B fundraising initiative for its treasury division bolstered confidence, whereas analysts framed the transfer as “managed rotation” fairly than structural weak spot.

Value Motion Abstract

• XRP dropped to $2.19 at 07:00 UTC on 246.7M quantity, setting key intraday help.

• Bulls regained management by means of mid-session, driving a gentle climb to $2.33–$2.35 resistance.

• The ultimate 60 minutes (04:22–05:21 UTC) noticed a minor flush to $2.32 adopted by a rebound to $2.33 (+1.8%), with 1.69M in peak tick quantity.

• Consolidation between $2.32–$2.34 fashioned the brand new short-term base, validating robust absorption close to prior lows.

Technical Evaluation

• Help – $2.23–$2.25 stays the important thing accumulation zone; sub-$2.20 publicity continues to draw lengthy curiosity.

• Resistance – $2.35–$2.38 intraday band caps upside; breakout affirmation wanted above $2.40.

• Quantity – Peak at 246.7M throughout selloff; late-hour surges (~1.7M) sign return of liquidity.

• Pattern – Gradual upward bias after morning flush; RSI impartial, MACD stabilizing.

• Construction – Brief-term consolidation inside $2.19–$2.35 suggests reaccumulation forward of potential ETF headline catalysts.

What Merchants Are Watching

• ETF approval window (Oct 18–25) and potential market repricing as soon as SEC determinations land.

• Whether or not $2.30 holds as base help by means of weekend buying and selling.

• Continuation of Ripple’s $1B treasury elevate and potential secondary-market implications.

• Broader danger sentiment as tariff escalation dampens altcoin liquidity.

• Technical breakout above $2.40 as sign for rotation again towards $2.70–$3.00 vary.