The cryptocurrency market has been hit with one other wave of promote strain as each the Bitcoin and Ethereum costs plunged sharply, triggering widespread panic and uncertainty. With over $536 million in Spot Bitcoin ETF outflows in a single day, the downturn has sparked renewed fears of an prolonged bearish section. Analysts are calling this correction a “Bloody Friday,” a much less however nonetheless extreme reflection of final week’s brutal selloff that wiped billions available in the market and noticed BTC and ETH spiraling downwards.

Associated Studying

ETF Outflows Set off Bitcoin And Ethereum Value Crash

The latest crash in Bitcoin and Ethereum costs is being attributed to latest large-scale outflows from US Spot Bitcoin ETFs. Crypto analyst Jana on X social media described the occasion as one of many bloodiest weekly downturns of the quarter, with Bitcoin tumbling 13.3% in seven days and Ethereum sliding 17.8% over the previous month. At press time, Bitcoin is buying and selling barely above $106,940 whereas Ethereum sits round $3,870, each struggling steep retracements from their latest highs.

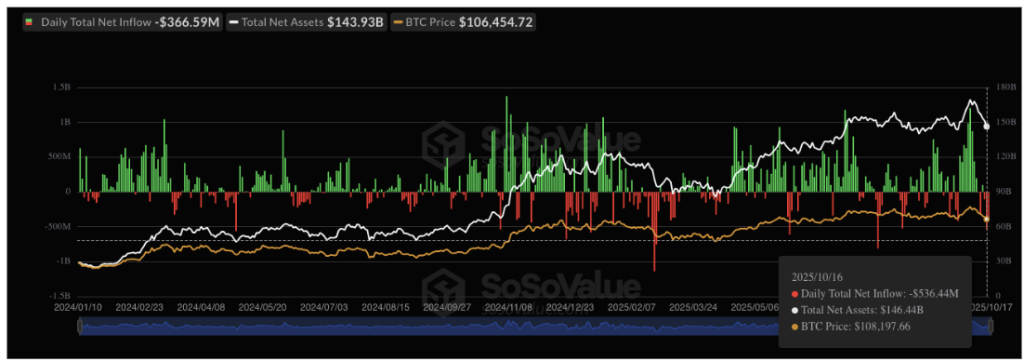

Knowledge from SoSoValue exhibits that Thursday, October 16, noticed a staggering $536.4 million in every day web outflows from Spot Bitcoin ETFs, marking the most important single-day unfavorable move since August 1, when $812 million exited the market. Out of twelve US Bitcoin ETFs, eight registered main outflows, led by $275.15 million leaving Ark & 21Shares’ ARKB, adopted by $132 million from Constancy’s FBTC. Notably, funds managed by different main firms like Grayscale, BlackRock, Bitwise, VanEck, and Valkyrie additionally reported vital withdrawals.

These persistent outflows have now stretched into their third consecutive day, with October 17, only a day in the past, recording an enormous outflow of $366.5 million. The sustained unfavorable ETF flows underscore waning investor confidence and recommend that the broader market downturn might proceed within the close to time period. Mixed with the $19 billion liquidation occasion final Friday, elevated outflows in ETFs might put extra promoting strain on the already fragile market.

Consultants Warn Of Deeper Market Ache Forward

Many specialists consider that the crypto market should still have extra room for a decline. Knowledge from Polymarket, one of many world’s largest prediction platforms, present that 52% of individuals count on Bitcoin to drop beneath $100,000 earlier than the top of October. Veteran economist and Bitcoin critic Peter Schiff has additionally warned that the approaching months might be catastrophic for the trade, predicting widespread bankruptcies, defaults, and layoffs as Bitcoin and Ethereum face one other main leg down.

In the meantime, technical analysts are pointing to indicators of deeper weak point in Ethereum’s construction. In response to Crypto Damus, Ethereum has damaged key weekly assist and is displaying a bearish setup on the charts. He says that MACD is about to “cross purple,” leaving a major quantity of room for a crash.

Different analysts like Marzell have echoed related issues, stating that Ethereum is now nearing a “crash zone.” Nonetheless, he additionally highlighted the $3,690 – $3,750 vary as a attainable short-term demand space the place patrons might step in once more and set off the following leg up.

Associated Studying

Featured picture from Unsplash, chart from TradingView