In line with reviews, Ripple is transferring into company treasury providers with an acquisition valued at $1 billion. The acquisition, tied to a treasury administration agency, has prompted some market educators to put out aggressive worth situations for XRP, together with a top-end projection of $1,000+.

Associated Studying

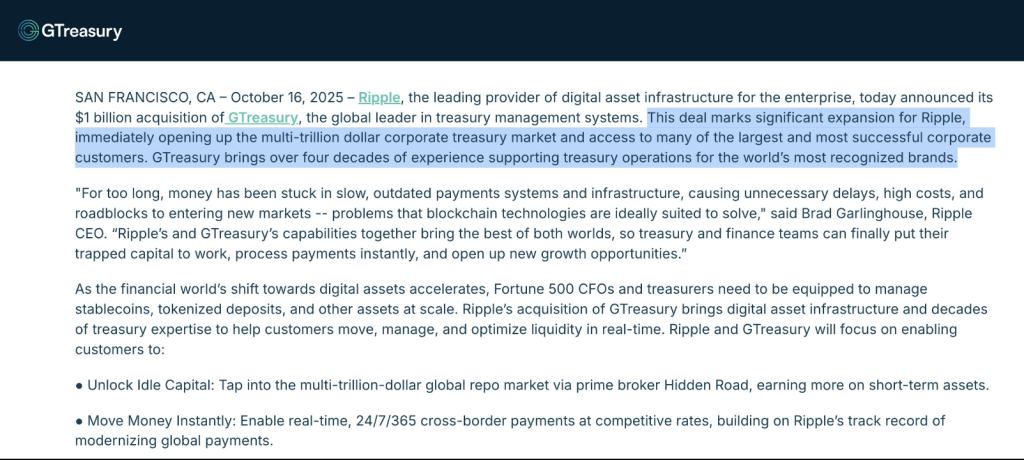

Ripple Hits Company Treasury

A crypto educator who posts below the title “X Finance Bull” has mapped out a sequence of worth milestones. Based mostly on his define, traders may see XRP commerce close to $2 to $3 within the instant part, climb to $5–$10 over an extended stretch, and attain $20–$100+ in a bullish enlargement.

The educator then presents a theoretical most of $1,000+ if XRP had been to seize a serious share of company treasury flows. These figures are being shared extensively, typically with out the caveats that may mood expectations.

🚨THIS IS WHERE IT BEGINS! 🚨 $XRP is about to go parabolic to $1,000 and past!

Ripple simply acquired GTreasury for $1B

It is a domino that units off the most important capital move occasion in crypto historical past

Ensure BUY each dips of $XRP!

Right here’s what most aren’t seeing 🧵👇 pic.twitter.com/6qs5KjKWgp— X Finance Bull (@Xfinancebull) October 16, 2025

Why The Transfer Issues

The logic behind the bullish situation is simple at a look. If Ripple ties its software program and token into treasury operations utilized by massive corporations, demand for on-ledger liquidity might rise.

Firms dealing with money, forex conversion, and liquidity have a tendency to maneuver very massive sums. Folks in markets level out that tapping into these flows can change adoption dynamics for a token. Nonetheless, adoption at scale, authorized readability, and actual utilization patterns would all must align for token costs to rise dramatically.

Bull Case And Numbers

Supporters spotlight the $1 billion price ticket of the deal as proof that Ripple sees enterprise alternative. They argue that treasury clients may wish quick settlement rails and that XRPL instruments may match into these processes.

The educator’s projections embrace concrete bands: $2 to $3 early, $5–10 mid, and $20–$100+ later. However these bands assume broad company adoption and token demand patterns that aren’t but confirmed.

Market caps implied by a $1,000+ XRP could be orders of magnitude bigger than at this time’s totals, until the circulating provide shrinks or new financial fashions are launched.

Associated Studying

Regulatory Alerts

Regulatory alerts are a key variable. Courts and regulators have begun to make clear how tokens are handled in numerous jurisdictions, and that therapy will form institutional urge for food.

Additionally vital are integration particulars: how the token is utilized in treasury software program, whether or not corporations maintain or just cross by way of XRP, and the way custody and threat fashions adapt to tokenized liquidity.

Every of these steps can both help worth appreciation or go away the token’s worth marginal to enterprise operations.

Featured picture from Unsplash, chart from TradingView