- Korea Premium Index above 8% hints at overheating retail exercise.

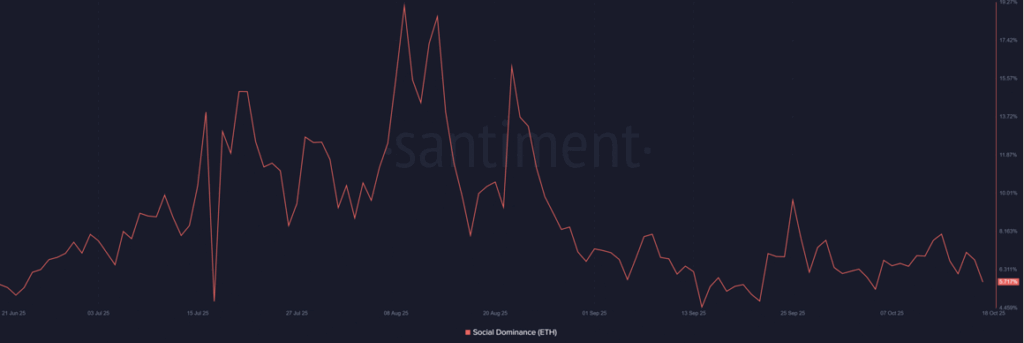

- Social Dominance for Ethereum is falling, displaying weaker engagement.

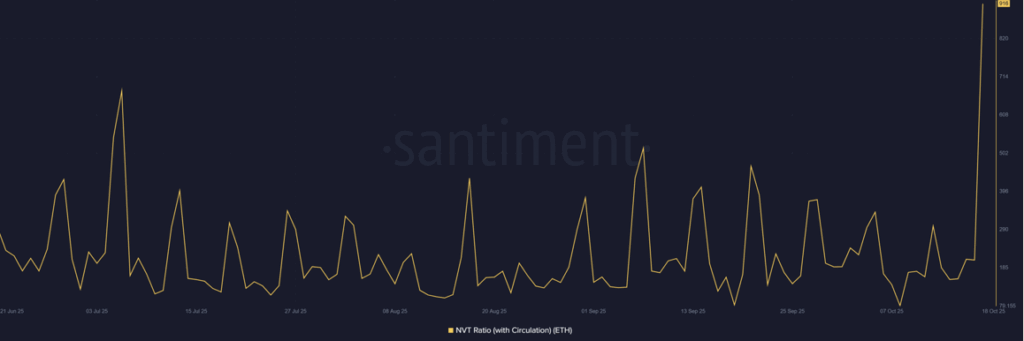

- Excessive NVT ratio and rising taker promote dominance recommend short-term correction dangers.

Ethereum’s newest rally is beginning to present cracks, not less than in line with a mixture of on-chain and social knowledge. The Korea Premium Index — which measures how a lot greater ETH trades on Korean exchanges in comparison with international markets — has jumped previous 8%, a degree that’s typically been related to euphoric retail exercise. When this index spikes, it normally means native merchants are piling in quick, typically with out robust fundamentals to again it up.

Traditionally, sharp climbs within the Korea Premium have preceded cooling phases. It occurred earlier than Ethereum’s 2022 downturn too. This time, the widening hole means that a lot of ETH’s present demand is perhaps speculative. Bigger gamers may begin taking earnings, particularly if retail enthusiasm begins fading.

Social Buzz Slipping — A Warning Signal

Whilst costs stayed elevated, Ethereum’s social dominance — its share of general crypto-related conversations — has dipped to about 5.17%. That drop hints at a fading highlight. Merchants and traders aren’t speaking about ETH as a lot as they have been only a few weeks in the past.

It’s not essentially bearish by itself, however historical past exhibits that Ethereum tends to lose steam when social engagement declines. Retail merchants drive quite a lot of short-term worth motion, and once they transfer on to the subsequent trending altcoin, momentum dries up quick. The present disconnect between robust worth motion and weak group chatter suggests conviction is scaling down.

Rising NVT Ratio Factors to Weak Community Exercise

Then there’s the NVT ratio, which compares Ethereum’s market cap to its on-chain transaction quantity. Proper now, it’s sitting at a staggering 916 — signaling that ETH’s worth is rising sooner than actual utilization on the community. Excessive NVT values normally imply hypothesis’s doing the heavy lifting, not precise adoption.

To place it merely, if ETH have been an organization, this could be like its inventory worth taking pictures up whereas income stays flat. It doesn’t imply a crash is assured, but it surely does recommend {that a} cooldown may very well be coming quickly. Except transaction exercise picks as much as match valuation, these worth ranges could also be arduous to maintain.

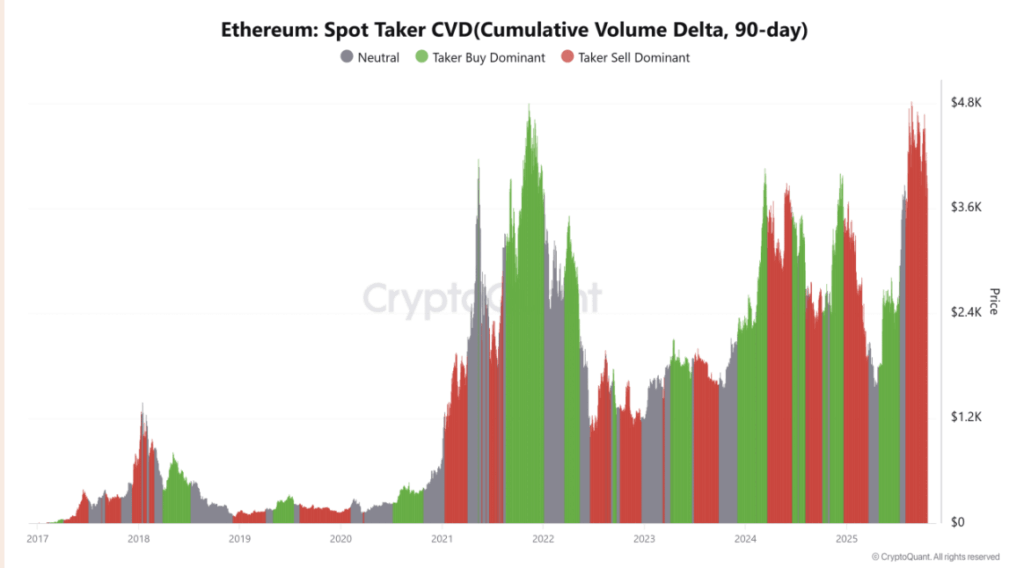

Taker Promote Dominance Indicators Rising Revenue-Taking

On-chain knowledge from CryptoQuant additionally exhibits taker promote dominance rising — that means extra merchants are hitting the promote button than shopping for on spot exchanges. It’s a delicate signal of profit-taking after the latest upswing. Tokens are steadily shifting from skilled merchants to latecomers coming into close to the highest, which frequently results in short-term corrections.

Put all this collectively — falling social dominance, excessive NVT ratio, and rising promote strain — and also you get an image of a market that’s working sizzling however shedding stability.

Can Ethereum Hold Its Momentum?

Proper now, Ethereum nonetheless appears robust on the floor. However the knowledge beneath hints at a rally fueled extra by hype than fundamentals. The Korea Premium suggests speculative retail exercise, whereas on-chain weak point and fading engagement level to smooth underpinnings.

Except community utilization and liquidity begin catching up, ETH may very well be due for a short-term correction. The excellent news? Corrections aren’t at all times unhealthy — they will reset sentiment and provides stronger fingers a greater entry level. For now, although, merchants would possibly need to tread fastidiously — as a result of when the gang begins cooling off, Ethereum normally follows.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.