High Tales of The Week

‘Bitcoin smells hassle’ as banks are burdened and ‘yields are puking’ – Strike CEO

A number of regional banks in the US are going through renewed stress regardless of strengthening their funds after the 2023 banking disaster, and Bitcoin may benefit from any liquidity disaster that follows.

Strike CEO Jack Mallers sees the banking stress as validation that Bitcoin is appropriately pricing in an impending liquidity disaster, opining that the Federal Reserve’s inevitable response will drive BTC costs increased.

“Bitcoin is precisely smelling hassle proper now,” he mentioned on the Primal social media platform on Friday. “The US goes to need to inject a few of that candy, candy liquidity quickly and print a ton of cash or else their fiat empire goes kaboom.”

‘Ethereum may flip Bitcoin’ like Wall Road flipped gold: Tom Lee

Ethereum may finally surpass Bitcoin’s market share in the same method to how US equities overtook gold 54 years in the past, when the US deserted the gold normal, in keeping with BitMine chair Tom Lee.

“Ethereum may flip Bitcoin much like how Wall Road and equities flipped gold post-71,” Lee mentioned in an interview with ARK Make investments CEO Cathie Wooden on Thursday.

Bitcoin’s market capitalization is about 4.6 occasions bigger than Ethereum’s, standing at roughly $2.17 trillion in comparison with $476.33 billion, in keeping with CoinMarketCap. Lee, who oversees BitMine’s Ethereum accumulation technique, prompt Ethereum may rise in the identical means the US greenback rose to dominance after 1971, when US President Richard Nixon made the US greenback “absolutely artificial” and now not backed by gold.

Ripple seeks to purchase $1 billion XRP tokens for brand new treasury: Report

Ripple Labs is reportedly on the cusp of launching a fundraising effort to buy $1 billion price of its XRP token to carry in a digital asset treasury, in keeping with Bloomberg.

The fundraiser is being organized by way of a particular objective acquisition firm or SPAC, Bloomberg reported on Friday, citing nameless folks with information of the matter.

The digital asset treasury will encompass the freshly purchased XRP and Ripple can even throw in a few of its personal stockpile, however the actual phrases of the transaction are nonetheless being hashed out and will change earlier than the deal is inked, in keeping with Bloomberg’s sources.

95% of company ETH buys occurred in Q3 — begin of Ether supercycle?

Almost all the Ethereum collected by public firms up to now occurred inside a three-month window between July and September, in keeping with latest knowledge.

This comes as a number of crypto executives predict the worth of Ether will rise by as a lot as 200% earlier than the tip of the yr.

“95% of all ETH held by public firms was bought prior to now quarter alone,” Bitwise Make investments mentioned on Wednesday, referring to the $19.13 billion held in public treasuries, equal to roughly 4% of Ether’s complete provide.

Ether set to go ‘nuclear’ with 3 energetic ‘provide vacuums’ — Analyst

The worth of Ether (ETH) has nowhere to go however up, in keeping with an analyst, with 40% of Ether now out of circulation amid report institutional demand.

“Ethereum has by no means skilled a market cycle with all three provide vacuums energetic without delay,” mentioned pseudonymous analyst Crypto Gucci on Tuesday.

Learn additionally

Options

UK hashish millionaire’s authorized ‘offers on wheels’ by way of crypto

Options

I spent per week working in VR. It was largely horrible, nevertheless…

Crypto Gucci famous that digital asset treasuries (DATs) didn’t exist within the final market cycle. Over the previous few months, DATs have amassed a whopping 5.9 million ETH, price round $24 billion and equal to 4.9% of the entire provide, in keeping with StrategicEthReserve.

These entities will maintain the asset for long-term yields.

Crypto Gucci acknowledged that Ether has entered this cycle with report institutional demand and the smallest liquid float in its historical past:

“When demand meets a shrinking provide like this, worth doesn’t simply go up, it goes nuclear.”

Most Memorable Quotations

“Ethereum may flip Bitcoin much like how Wall Road and equities flipped gold put up 71.”

Tom Lee, chair of BitMine

“I prefer to say that we’re the securities and innovation fee now.”

Paul Atkins, chair of the US Securities and Trade Fee

“I believe there’s a really excessive likelihood that is the beginning of the bull market.”

Alex Becker, crypto dealer

“That’s the reason Bitcoin is predicated on power: you may difficulty pretend fiat foreign money, and each authorities in historical past has performed so, however it’s not possible to pretend power.”

Elon Musk, billionaire entrepreneur

“One of many issues I’d ask everybody to do, each reporters and in any other case, is to carry conventional finance accountable for, sure — I agree that the crypto business needs to be held to the identical normal round AML [Anti-Money Laundering], KYC [Know Your Customer], OFAC [Office of Foreign Assets Control] compliance: Sure, sure, sure.”

Brad Garlinghouse, CEO of Ripple

“95% of all ETH held by public firms was bought prior to now quarter alone.”

Bitwise

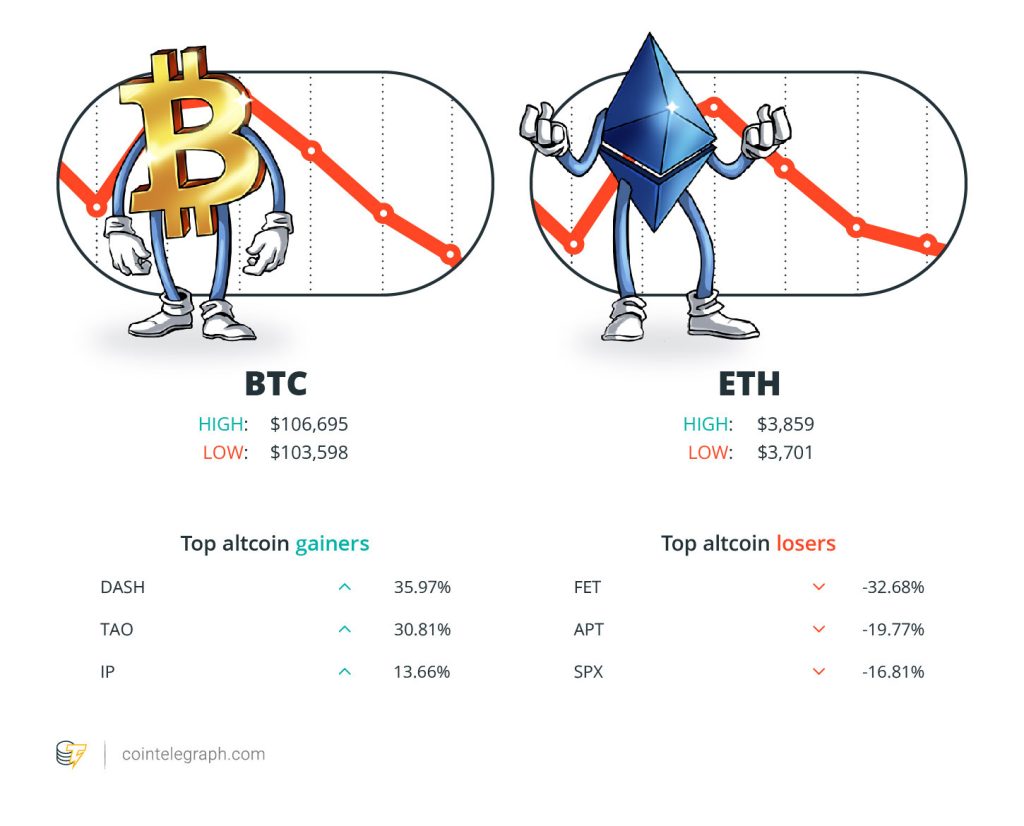

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $106,695 Ether (ETH) at $3,859 and XRP at $2.32. The overall market cap is at $3.61 trillion, in keeping with CoinMarketCap.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are Sprint (DASH) at 35.97%, Bittensor (TAO) at 30.81% and Story (IP) at 13.66%.

The highest three altcoin losers of the week are Synthetic Superintelligence Alliance (FET) at 32.68%, Aptos (APT) at 19.77% and SPX6900 (SPX) at 16.81%.

For more information on crypto costs, ensure to learn Cointelegraph’s market evaluation.

Prediction of The Week

Bitcoin ‘bull run is over,’ merchants say, with 50% BTC worth crash warning

Bitcoin fell to $103,500 on Friday, leading to over $916 million in liquidations of leveraged lengthy positions and dampening sentiment in BTC markets.

Traders look like dropping confidence after two straight weeks of failing to carry costs above $110,000. However does this imply the bull run is over?

Learn additionally

Options

Banking The Unbanked? How I Taught A Complete Stranger In Kenya About Bitcoin

Options

Is Bitcoin a faith? If not, it quickly might be

Bitcoin might solely have a couple of days of worth enlargement left within the cycle, particularly if it follows historic patterns from previous bull runs, in keeping with pseudonymous analyst CryptoBird.

The Bitcoin “bull run ends in 10 days,” the analyst mentioned in an X thread on Tuesday, basing the forecast on earlier cycles.

Cycle Peak Countdown exhibits that the Bitcoin bull run is 99.3% performed, as weak fingers are shaken out “in a basic pre-peak sample,” the analyst mentioned.

High FUD of The Week

Swiss regulator GESPA takes goal at FIFA’s NFT platform in formal grievance

Switzerland’s Playing Supervisory Authority (GESPA), the nation’s playing regulator, has filed a grievance towards FIFA’s non-fungible token platform FIFA Accumulate, alleging that it’s an unlicensed playing supplier.

On Friday, GESPA introduced the grievance, alleging the platform’s “competitions,” which function person rewards like airdrop campaigns and challenges, represent playing underneath present Swiss rules because of the aspect of likelihood in claiming rewards. GESPA wrote:

“Participation within the competitions is simply potential in trade for a financial stake, with financial advantages to be received. Whether or not members win a prize depends upon random attracts or related procedures.”

Ocean, Fetch.ai feud escalates to authorized threats as Binance restricts deposits

A feud between Fetch.ai CEO Humayun Sheikh and the Ocean Protocol Basis has escalated into authorized threats, onchain accusations and a response from Binance, all centering on about 286 million Fetch.ai (FET) tokens price about $84 million.

The battle stems from the Synthetic Superintelligence Alliance, a 2024 merger that mixed AI-focused crypto tasks Fetch.ai, Ocean Protocol and SingularityNET underneath a shared token framework.

On Wednesday, Sheikh alleged that Ocean Protocol minted and transferred thousands and thousands of OCEAN tokens earlier than the merger. He mentioned the undertaking later transformed them into FET and moved giant sums to centralized exchanges and market-making companies with out correct disclosure.

Bitcoin wants a recent catalyst to keep away from a ‘deeper correction’ — Analysts

Bitcoin might wrestle to maintain its upward development except one thing triggers extra pleasure amongst traders, in keeping with Glassnode.

“With out a renewed catalyst to elevate costs again above $117.1k, the market dangers deeper contraction towards the decrease boundary of this vary,” Glassnode mentioned in a report revealed on Wednesday.

“Traditionally, when worth fails to carry this zone, it has typically preceded extended mid- to long-term corrections,” Glassnode mentioned, mentioning the rise in profit-taking amongst long-term holders in latest occasions, which can sign “demand exhaustion.”

High Journal Tales of The Week

Again to Ethereum: How Synthetix, Ronin and Celo noticed the sunshine

Synthetix and Aave are making the Ethereum L1 nice for DeFi once more, whereas Ronin, Celo and Phala arrange store on L2s.

Binance shakes up Korea, Morgan Stanley’s safety tokens in Japan: Asia Specific

South Korea lastly greenlights Binance return, exchanges undertake a fail-proof formulation for rising markets, and extra.

Sharplink exec shocked by degree of BTC and ETH ETF hodling: Joseph Chalom

SharpLink Gaming co-CEO Joseph Chalom says BlackRock’s Bitcoin and Ether ETFs marked a “mission achieved” second.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.

Learn additionally

6 Questions for…

6 Questions for Ming Duan of Umee

Editorial Workers

6 min

Might 8, 2022

We ask the buidlers within the blockchain and cryptocurrency sector for his or her ideas on the business… and throw in a couple of random zingers to maintain them on their toes! This week, our 6 Questions go to Ming Duan, the co-founder and chief working officer of Umee, a cross-chain DeFi hub that enables decentralized interactions […]

Learn extra

Hodler’s Digest

SEC critiques Ripple ruling, US invoice seeks management over DeFi, and extra: Hodler’s Digest, July 16-22

Editorial Workers

7 min

July 22, 2023

The SEC examines the ruling within the Ripple case, a U.S. Senate invoice seeks to control DeFi, and the poor efficiency of altcoins within the second quarter of 2023.

Learn extra