- Stellar (XLM) rebounds above $0.31 after dropping under $0.19.

- Open curiosity plunges 50%, suggesting a full market reset.

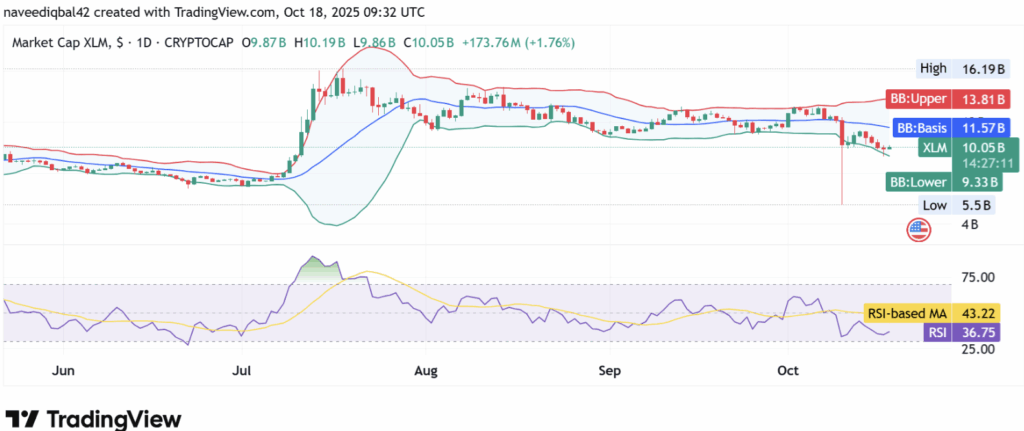

- RSI and Bollinger knowledge point out oversold circumstances — hinting at a attainable rebound.

Stellar (XLM) is lastly exhibiting early indicators of restoration after a wild journey that briefly pushed costs under $0.19 earlier than snapping again above $0.31. The sharp swings over the previous few periods seem to have flushed out extreme leverage — a reset that might assist the market settle right into a calmer rhythm.

The previous few weeks have been something however clean for XLM merchants. A burst of liquidations despatched costs tumbling earlier than patrons shortly stepped in to soak up provide, forsaking what seems to be like a cleaner setup for accumulation. Now, the query is whether or not Stellar can maintain its footing above $0.30 and construct a sustainable base.

Open Curiosity Drop Alerts Market Reset

On the time of writing, XLM/USD is hovering close to $0.312, consolidating after that rollercoaster dip-and-rebound transfer. When the worth briefly slipped underneath $0.19, it triggered a wave of compelled liquidations that cleared out speculative lengthy positions. However the restoration was quick — and that bounce off the lows suggests some severe patrons had been ready under.

Open curiosity — which tracks the whole variety of energetic futures contracts — has taken a significant hit, dropping from over $160 million to roughly $81 million. That’s a reasonably large deleveraging occasion, the sort that usually resets market circumstances after overheated phases.

Much less leverage means much less noise — and extra room for natural value motion. If this cleaner construction holds, Stellar might shift right into a steadier accumulation section as confidence begins to rebuild. The important thing now could be retaining assist above $0.31; shedding that stage might open one other spherical of turbulence, whereas holding it might lay the groundwork for a sluggish however wholesome restoration.

Market Exercise Rebounds With a 6.7% Each day Acquire

Regardless of the sooner chaos, Stellar is definitely up 6.69% over the previous 24 hours, buying and selling round $0.31 with a market cap of roughly $10 billion. Buying and selling quantity crossed $273 million, inserting XLM again among the many prime 20 cryptos by exercise. Liquidity throughout exchanges stays stable because of its 32 billion circulating tokens, and that stability helps calm short-term sentiment.

The short rebound in each value and quantity reveals merchants are slowly regaining confidence after final week’s liquidation wave. Open curiosity stays low, which aligns with lowered speculative stress — a great signal that the market is stabilizing naturally as a substitute of being pushed by leverage-heavy swings.

Technicals Present Oversold Alerts

Zooming in on the every day chart, XLM seems to be technically oversold. The coin is buying and selling close to the decrease Bollinger Band, an space that usually precedes short-term recoveries as soon as promoting momentum begins to chill off.

The Relative Energy Index (RSI) presently sits round 36, properly under the impartial 50 mark. That implies bearish momentum has stretched too far and might be nearing exhaustion. If patrons maintain defending the present ranges, Stellar might attempt to reclaim the Bollinger Band foundation — round $11.5 billion in market cap phrases — which frequently indicators the beginning of renewed upside stress.

If assist close to $9.3 billion (roughly $0.29 per coin) holds regular, XLM might step by step transition from stabilization into restoration, probably concentrating on resistance ranges nearer to $0.35–$0.38 within the coming weeks.

For now, it seems to be just like the market has flushed out the surplus — the speculative froth is gone, changed by slower, extra deliberate strikes. It’s not flashy, however it’s wholesome — the type of reset that usually builds the muse for the subsequent leg up.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.