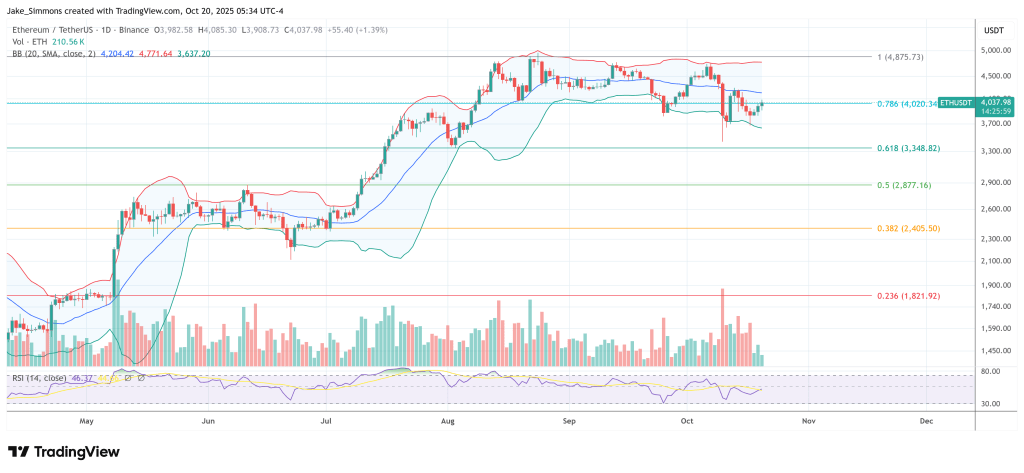

John Bollinger, the inventor of Bollinger Bands and a determine whose occasional crypto market calls carry outsized weight, says Ethereum and Solana are tracing potential “W” bottoms—whereas Bitcoin will not be. In a publish on X on October 18, Bollinger wrote: “Potential ‘W’ bottoms in Bollinger Band phrases in ETHUSD and SOLUSD, however not in BTCUSD. Gonna be time to concentrate quickly I feel.”

Potential ‘W’ bottoms in Bollinger Band phrases in $ETHUSD and $SOLUSD, however not in $BTCUSD. Gonna be time to concentrate quickly I feel.

— John Bollinger (@bbands) October 18, 2025

Ethereum And Solana Value: What To Watch Now

The emphasis on “Bollinger Band phrases” is doing heavy lifting right here. In traditional Bollinger taxonomy, a W backside is a two-trough reversal with the second low holding above the primary, typically accompanied by a volatility signature that features a prior band enlargement, subsequent contraction, and a failure to register a decrease low on the bands on the second leg.

Associated Studying

The extra sturdy variations see the second low forming contained in the bands or with a optimistic divergence in opposition to the decrease band, adopted by a band “pinch” and a transfer by means of the center band that transitions into an upper-band stroll. Bollinger’s phrasing—“potential” and “time to concentrate”—alerts that, in his framework, sample recognition precedes affirmation, and that the validation set off lies in subsequent worth interplay with the center and higher bands slightly than within the uncooked form of the worth lows alone.

The rarity of Bollinger’s crypto commentary layered urgency onto the sign. As crypto dealer Satoshi Flipper (@SatoshiFlipper) careworn, “John Bollinger, creator of Bollinger Bands, makes barely 1 crypto name per yr and hasn’t made one for ETH in 3 years till yesterday. And every name he makes goes on to mark generational bottoms. He simply informed us SOL + ETH have bottomed, now think about fading this legend.”

The identical account detailed that Bollinger’s final notable Ethereum name dates to September 9, 2022, noting that ETH “went on to pump from $1,290 to $4,000.” That historic reference captures the prevailing market psychology: Bollinger’s rare, technically disciplined alerts are perceived by many merchants as cycle-defining.

Context from earlier this yr additionally helps body the setup. On April 10, Bollinger publicly flagged the same construction in Bitcoin, saying: “Traditional Bollinger Band W backside establishing in BTCUSD. Nonetheless wants affirmation.” In the very same week, BTC carved out a backside at $74,508 and proceeded to log seven straight inexperienced weekly candles, advancing roughly 55%. From Bollinger’s name into the primary week of October, BTC rallied greater than 70%.

Associated Studying

The market nuance in Bollinger’s newest readout is the express exclusion of Bitcoin. If ETHUSD and SOLUSD are printing W-like constructions in Bollinger phrases whereas BTCUSD will not be, it implies a short lived decoupling in volatility construction and relative energy. In sensible phrases, a non-confirming Bitcoin can both lag right into a later affirmation, stay range-bound in a mid-band churn, or fail its personal setup if lower-band interactions persist with out recapture of the center band.

For Ethereum and Solana, affirmation would usually appear like sustained closes above the 20-period shifting common (the Bollinger center band), adopted by a disciplined advance that converts the higher band from resistance right into a information. A wholesome W backside sequence tends to not produce instant, vertical band overthrows; slightly, it builds a stair-step profile with periodic mid-band checks that maintain.

Failure would contain one other lower-band tour that undercuts the second trough or a volatility bloom that widens the bands with out directional follow-through—each signatures of an incomplete base.

At press time, ETH traded at $4,037.

Featured picture created with DALL.E, chart from TradingView.com