- Trade reserves fall to $60.8B, lowest in 2025 — signaling a possible provide squeeze.

- Whales accumulate closely, whereas Open Curiosity steadies round $19B.

- ETH consolidates between $3,800–$4,000, with cautious bullish sentiment constructing.

Ethereum (ETH) may be inching towards one other provide crunch — and this time, the indicators look eerily acquainted to the early phases of its 2020 bull run. Trade reserves are falling quick, whales are quietly stacking, and derivatives knowledge trace at a cautious however rising bullish bias. It’s a type of setups that creeps up in the marketplace earlier than the group catches on.

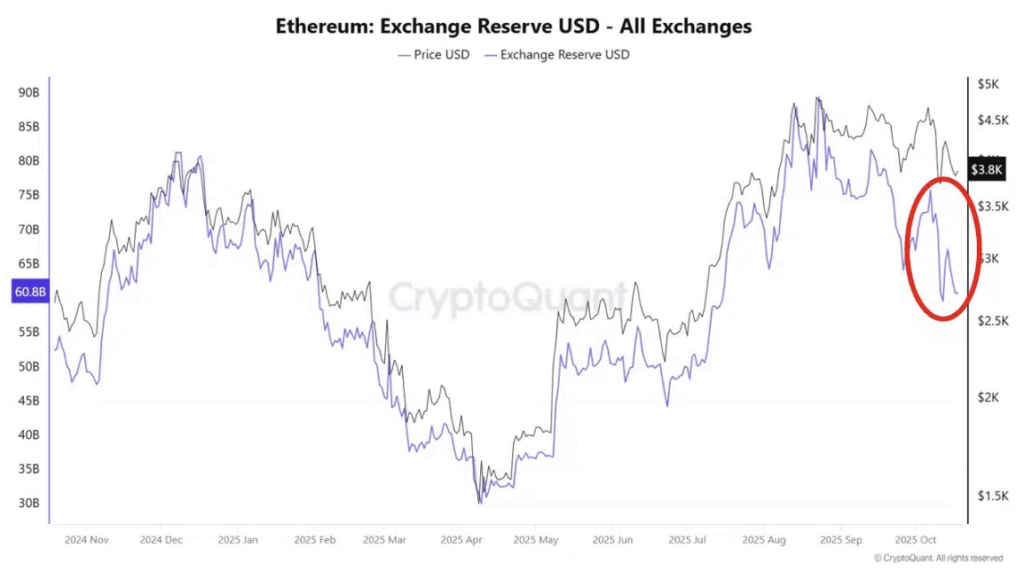

Trade Reserves Hit New 2025 Lows

In keeping with contemporary knowledge from CryptoQuant, Ethereum’s alternate reserves have slipped to their lowest degree this 12 months, now sitting close to $60.8 billion. Fewer cash on exchanges sometimes imply fewer tokens able to promote — and when liquidity thins whereas demand begins heating up, issues can transfer quick.

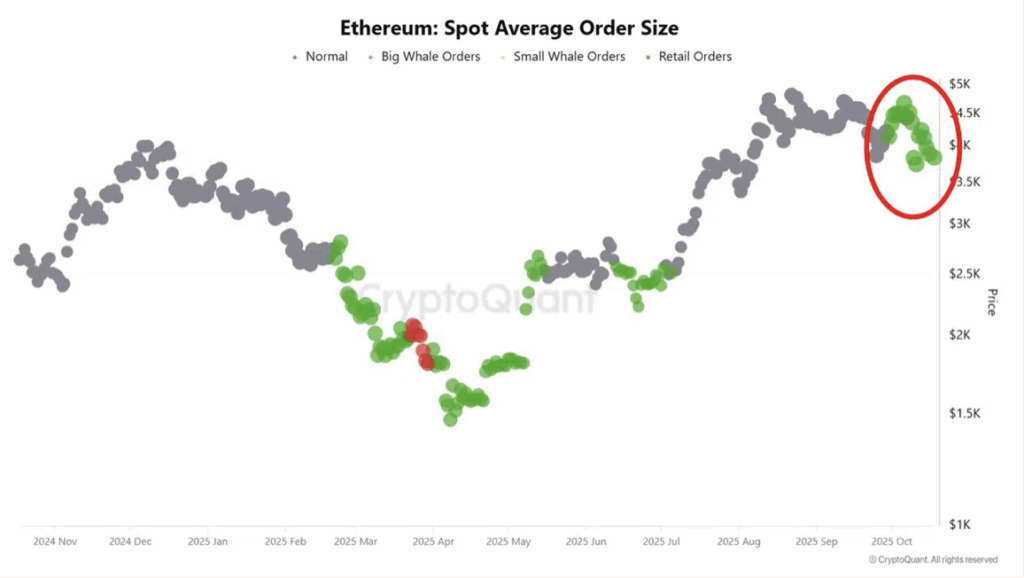

Whales have been scooping up ETH in giant chunks throughout spot markets, suggesting accumulation is effectively underway. This sort of quiet, regular shopping for usually flies underneath the radar till value begins to react. Traditionally, Ethereum has seen related accumulation patterns earlier than massive upside strikes — most notably throughout its 2020 to 2021 rally.

If you mix decrease provide with contemporary demand, even modest inflows could cause exaggerated value reactions. That’s what makes setups like this so fascinating — they construct slowly, then transfer all of sudden.

Derivatives Present Early Indicators of Confidence Returning

After a spherical of heavy liquidations earlier this week, Ethereum’s aggregated Open Curiosity has stabilized round $19 billion. That alerts merchants are steadily reopening positions after the shakeout.

Funding charges have additionally turned barely optimistic, hovering close to 0.008%, which often implies a mildly bullish bias. In plain phrases: merchants are paying small premiums to carry longs once more — a good signal of returning confidence, even when it’s nonetheless cautious.

This mix of regular OI and modest optimistic funding usually marks the start of speculative re-entry phases, the place conviction remains to be shaky however enhancing. The backdrop of whale accumulation makes it all of the extra compelling — it’s not hype driving this, it’s accumulation and endurance.

ETH Stabilizes, However Momentum Nonetheless Feels Smooth

On the time of writing, ETH trades round $3,900, displaying small however regular positive factors after final week’s correction. The RSI sits close to 42, suggesting that momentum stays neutral-to-weak for now. Buying and selling quantity has cooled off too, and On-Steadiness Quantity (OBV) reveals muted accumulation — gradual and quiet, slightly than a rush of inflows.

The short-term vary stays tight between $3,800 and $4,000. That’s the battle zone to observe. A break above $4,200may affirm a bullish continuation, whereas a slip beneath $3,800 dangers reopening the door towards $3,600 and even decrease helps.

Nonetheless, with shrinking alternate reserves and whales loading up, it looks like strain is quietly constructing. Momentum might look tender on the floor, however beneath — provide’s drying up, and demand’s creeping in. Generally, that’s all it takes.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.