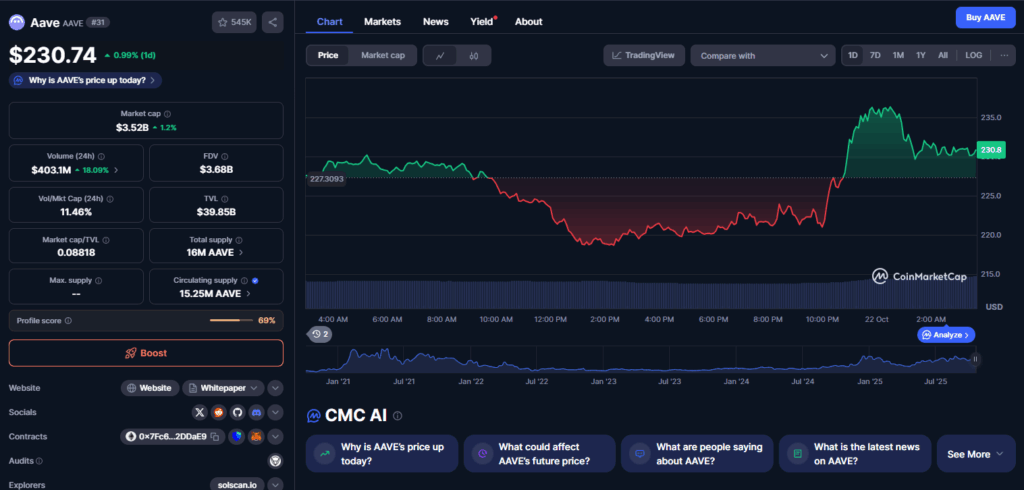

- Help: Sturdy double-bottom confirmed between $220–$221.13.

- Resistance: Breakout validated above $224.50; subsequent goal sits close to $238–$240.

- Quantity: Buying and selling exercise surged 87% above common, signaling conviction shopping for.

Aave (AAVE) staged a powerful rebound on Tuesday, climbing 2.5% to $232 and confirming a double-bottom reversal from the $220 zone. The transfer marked a pointy turnaround from the earlier night time’s selloff, with buying and selling quantity spiking almost 90% above its day by day common. In accordance with CoinDesk Analysis, the breakout above $224.50 signaled renewed shopping for curiosity and attainable institutional accumulation into the shut.

The broader crypto market additionally confirmed indicators of restoration, aided by a steep selloff in gold and silver that reignited danger urge for food. As capital rotated again into digital property, Aave stood out amongst DeFi leaders, confirming that sentiment could also be stabilizing after weeks of uneven flows.

Aave Companions with Maple Finance to Add Institutional Collateral

On the basic facet, Aave introduced a brand new partnership with Maple Finance (SYRUP) to combine institutional-grade yield tokens as collateral inside its lending markets. The rollout begins with syrupUSDT and syrupUSDC, that are backed by Maple’s managed yield methods. These tokens will quickly be obtainable as borrowing collateral on Aave’s Plasma and core markets.

The collaboration bridges institutional credit score with DeFi liquidity, connecting Maple’s community of capital allocators to Aave’s deep liquidity swimming pools. For customers, this implies higher-quality collateral and extra steady borrowing demand. For Aave, it’s a step towards constructing predictable, capital-efficient lending mechanics, even in a risky macro local weather.

Why It Issues for DeFi

This partnership may set a precedent for a way conventional capital interacts with decentralized markets. Maple manages billions in on-chain credit score, whereas Aave has facilitated over $3.2 trillion in lifetime deposits since its 2020 launch. Bringing these two collectively introduces a layer of professional-grade monetary infrastructure into the DeFi ecosystem, giving establishments a safer on-ramp into decentralized lending.

If profitable, it may make Aave a benchmark for regulated on-chain finance, the place risk-managed yield meets DeFi liquidity. It’s a small step technically, however strategically — a large one for belief and scalability in decentralized markets.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.