Peter Brandt, largely identified within the media as a legendary dealer or veteran dealer due to his 50 years of experience on the monetary market, has simply revealed an funding alternative that could be much like “shopping for Bitcoin at $1.” Surprisingly, it’s not about crypto however about silver.

In his latest X put up, Brandt urged the thought of shopping for as a lot steel as attainable and, if obligatory, even utilizing ultra-leveraged name choices, suggesting that taking out loans to seize the commerce is likely to be the generational play for Gen Z and Millennials.

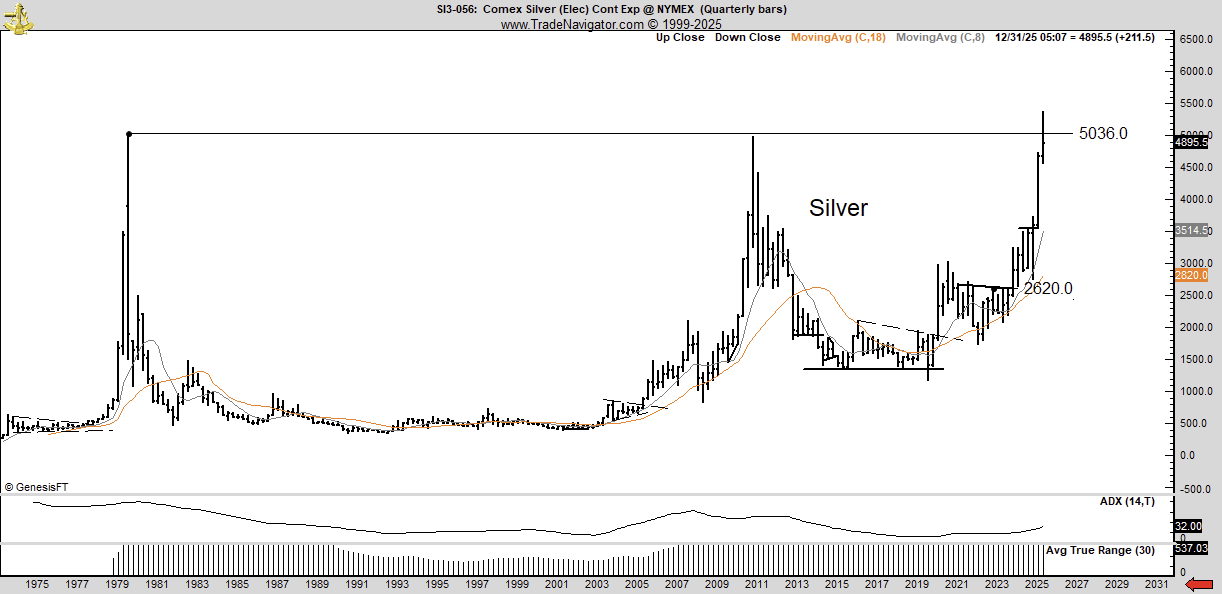

To show his opinion, Brandt factors to the silver chart that stretches again to the Nineteen Seventies. After years of nothing, the market is now urgent towards the $5,036 per contract degree, having already cleared the $2,620 pivot that capped costs for a lot of the final 10 years.

Brandt’s annotated goal means that this isn’t simply one other bounce; it’s the sort of transfer the place long-dated resistance provides method and the underlying volatility expands quickly — one thing the market noticed with gold within the final two years.

“Bitcoin at $1”

Silver’s final explosive runs in 1980 and 2011 each resulted in parabolic spikes earlier than crashing again, however the background of 2025 is what makes the present setup completely different. Financial tightening has run its course, fiscal imbalances are worsening and ETF flows into treasured metals are beginning to mirror Bitcoin’s 2024 run.

Gold has prospered when a safe-haven hedge was wanted, however silver’s thinner liquidity and industrial utilization give it extra upside potential proper now.

When a dealer with half a century of expertise frames silver as “Bitcoin at $1,” it doesn’t imply the chart is future, nevertheless it does imply the asymmetry is profitable sufficient to have a look.