- Chainlink value drops 5% to $17.70 as promoting stress and weak momentum persist.

- Trade outflows and failed EMA retests level to short-term bearish bias.

- Lengthy-term confidence stays robust due to Fed visibility and infrastructure reliability.

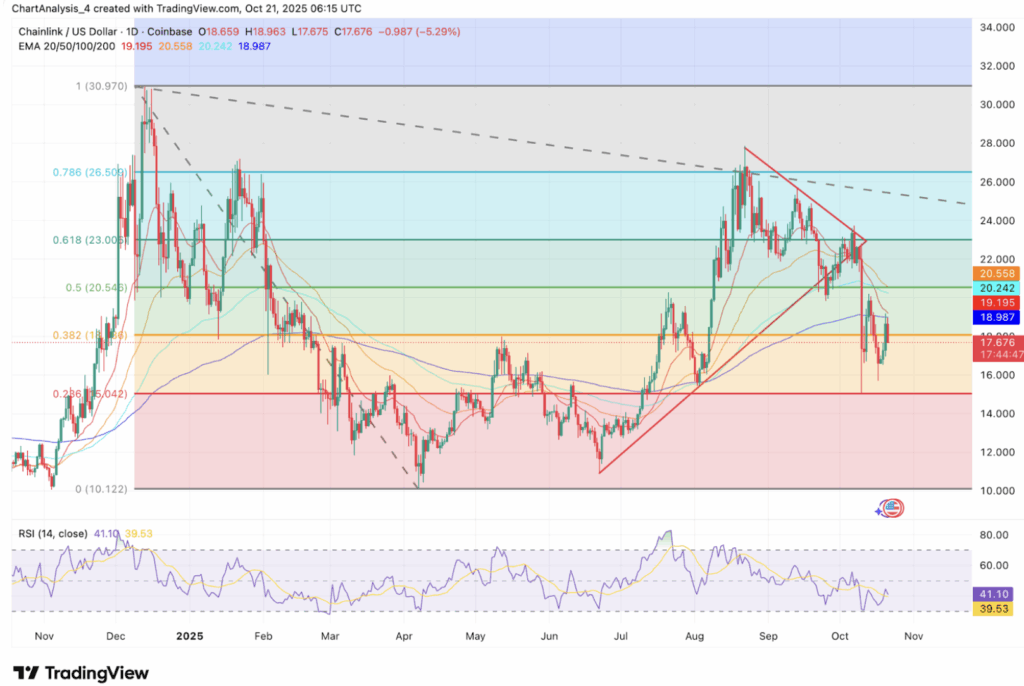

Chainlink (LINK) has been on shaky floor these days, falling over 5% previously 24 hours to commerce round $17.70. The pullback has merchants eyeing the $17–$16.50 zone — a key help space that strains up neatly with the Fibonacci retracement and prior demand zones. For now, the bulls are hanging on, however barely.

Momentum Fades Under Key Resistance Ranges

LINK’s value motion paints a transparent image of exhaustion. The token bought rejected laborious from the 50-day EMA close to $20.20, and after failing to remain above the 0.382 Fibonacci stage at $18.62, sellers shortly took cost once more. It’s now drifting nearer to the $17 area the place patrons try to catch their breath.

The 20-, 50-, and 200-day EMAs—clustering between $18.90 and $19.20—have all flipped into resistance. That’s a nasty signal within the brief time period since value sitting under each main transferring common normally means sellers are nonetheless in management. The RSI sits at about 41, which reveals weak momentum however not but oversold territory. Translation: there’s nonetheless room for another dip earlier than the subsequent bounce.

Trade Outflows Replicate Bearish Sentiment

On-chain knowledge backs up the story. Chainlink noticed greater than $14 million in internet outflows on October 21, extending a constant streak of pink since mid-September. Usually, outflows can trace at accumulation—however not this time. The value retains dropping, which suggests the market hasn’t totally absorbed the promoting stress but.

The imbalance between flows and value factors to fading demand. Volatility’s additionally rising, making it powerful for LINK to search out stability above $18. Except these metrics settle quickly, LINK’s short-term bias stays tilted to the draw back.

Chainlink’s Fed Look Attracts Eyes, However No Worth Affect

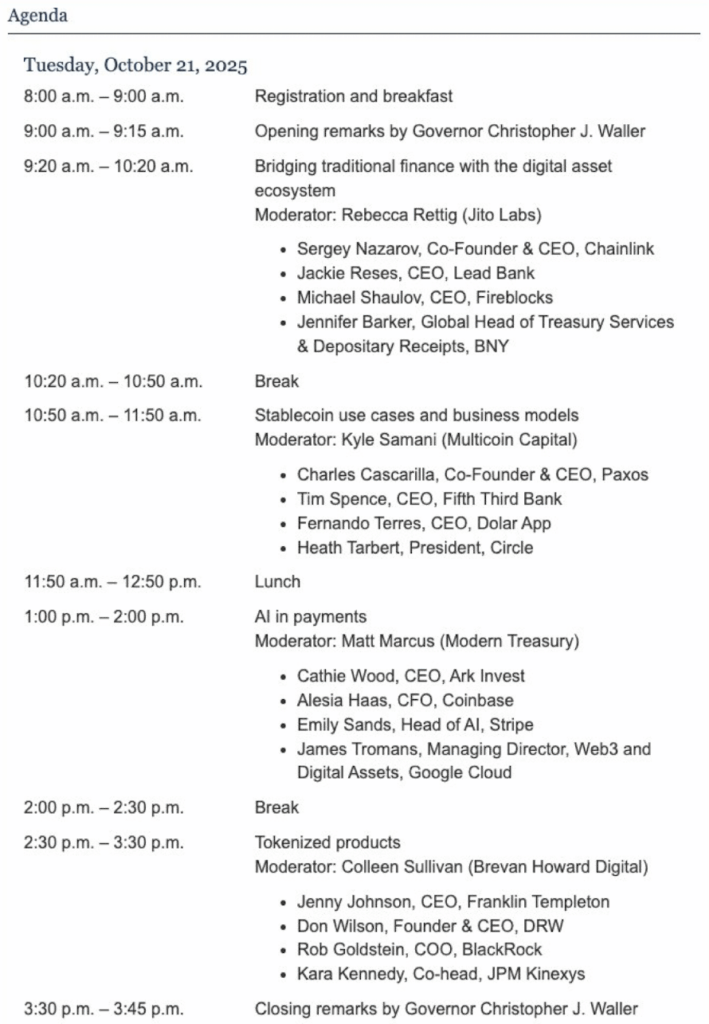

Curiously, Chainlink managed to seize some highlight through the Federal Reserve’s Funds Innovation Convention on October 21. Co-founder Sergey Nazarov joined a panel alongside execs from Coinbase, Circle, Paxos, and main banks. The dialogue targeted on bridging conventional finance with blockchain infrastructure—precisely the place Chainlink thrives.

Nonetheless, the market didn’t flinch. Regardless of the constructive publicity, LINK’s value motion stayed sluggish. It’s one other reminder that recognition and fundamentals don’t all the time translate into rapid value motion—particularly in bearish situations.

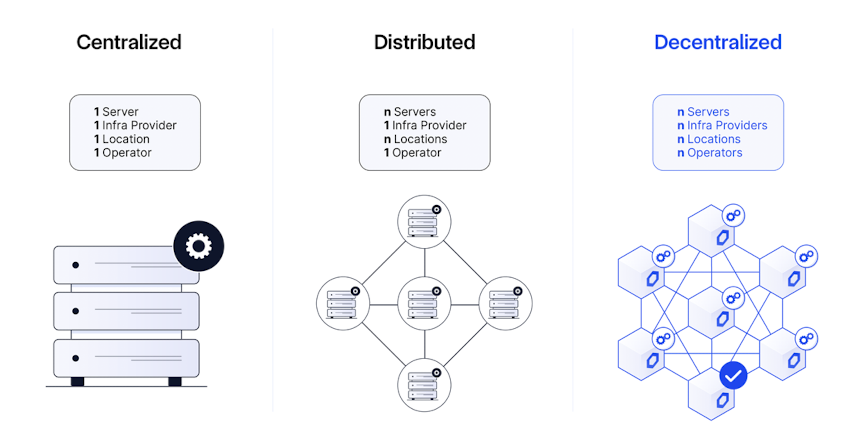

Chainlink Survives Cloud Outage And not using a Scratch

Whereas elements of the web struggled via a serious cloud outage, Chainlink reported zero downtime. Its oracle companies remained totally purposeful, securing billions in DeFi and holding knowledge feeds stay when centralized suppliers faltered.

That reliability reinforces Chainlink’s place because the spine of decentralized oracle networks. However even robust fundamentals can’t all the time struggle technical weak spot—a minimum of not within the brief run.

Technical Outlook: Can Bulls Defend $17?

Proper now, $17.00 is the road within the sand. Shedding it might drag LINK towards $15.00, the place the 0.236 Fibonacci stage and summer time consolidation zone align. If bears push tougher, the subsequent ground is likely to be $13.50.

Alternatively, reclaiming $18.62 might flip momentum again to impartial. A clear breakout above $20.50 may even set the stage for a retest of $23.00—the September highs. However that’s an enormous “if” for now.

The Backside Line

Chainlink’s short-term setup stays bearish. Failed EMA retests, weak quantity, and protracted outflows maintain sellers in cost. Nonetheless, long-term fundamentals—like its Fed recognition and flawless uptime—proceed to present traders a purpose to remain affected person.

If patrons handle to carry the $17 help and push above $19, LINK might regular itself quickly. If not, a deeper dip towards $15 is likely to be subsequent earlier than any actual restoration kicks in.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.