Key Takeaways

- Ripple Labs is reportedly organizing a serious fundraising effort via a Particular Goal Acquisition Firm (SPAC) to buy $1 billion value of its native XRP token for a brand new digital asset treasury.

- Ripple is already a serious XRP holder, with 4.5 billion tokens in its stash and an extra 37 billion XRP locked in an on-ledger escrow, launched month-to-month.

- The plan follows Ripple’s latest $1 billion acquisition of company treasury administration firm GTreasury, geared toward offering infrastructure to handle digital property for company shoppers.

Ripple Labs is poised to solidify its dominance over the XRP ecosystem with a reported plan to buy a considerable $1 billion value of its native token for a brand new digital asset treasury. This bold funding initiative is reportedly being organized via a Particular Goal Acquisition Firm (SPAC), an more and more standard methodology for elevating capital for public market ventures.

The brand new Digital Asset Treasury (DAT) can be comprised of the newly acquired XRP, supplemented by a portion of Ripple’s current stockpile. The precise phrases and closing particulars of the transaction are nonetheless being negotiated, however the transfer alerts a serious strategic emphasis on holding XRP as a core treasury asset for the corporate’s future operations.

Ripple Already a Important XRP Holder

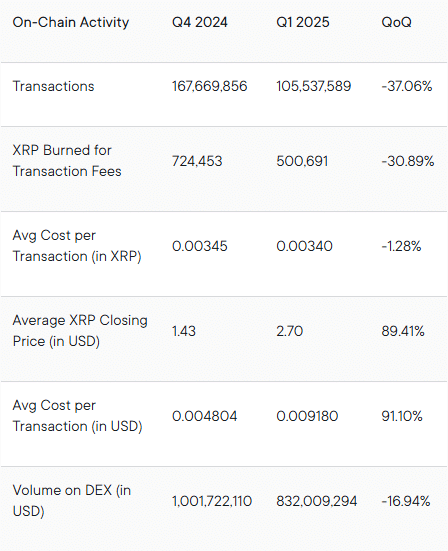

Ripple Labs is way from a brand new participant in holding XRP. In line with its Could market report, the corporate already holds over 4.5 billion XRP in circulation. This represents a considerable portion of the whole circulating provide, which at the moment exceeds 59 billion tokens.

The reported $1 billion buy would permit the corporate to accumulate roughly 427 million extra tokens, additional concentrating its management. Furthermore, Ripple holds an enormous 37 billion tokens locked in an on-ledger escrow, which is launched month-to-month, some is offered, and the rest is returned to escrow.

The brand new treasury plan carefully follows a serious strategic enterprise transfer: the $1 billion acquisition of GTreasury, a company treasury administration firm. This deal offers Ripple with the mandatory infrastructure to assist company shoppers handle varied digital property, together with stablecoins and tokenized deposits, which may also be used to generate yield.

Deal Would Make Ripple the Main XRP Treasury

Whereas Bitcoin and Ether lead the institutional crypto treasury race with firms holding over $152 billion in BTC and $23 billion in ETH, XRP has seen slower company adoption. Ripple’s deliberate $1 billion buy is a pivotal transfer meant to speed up its asset’s uptake.

https://twitter.com/SamAltcoin_eth/standing/1979005024383463533

If the deal goes via, it will cement Ripple’s place because the main entity within the XRP treasury house. The information comes as different firms additionally announce their intent to construct XRP-centric reserves, although on a smaller scale.

These embody Singapore-based Web3 firm Trident Digital Tech Holdings, which plans an XRP treasury of as much as $500 million, Chinese language AI agency Webus allocating $300 million, and VivoPower focusing on a $100 million XRP reserve. Ripple’s transfer is a transparent sign that the corporate intends to guide the institutional adoption of its native token.

Remaining Ideas

Ripple’s reported plan to purchase $1 billion in XRP for a brand new treasury, organized through a SPAC, is a high-stakes transfer to spice up the token’s institutional standing. Coupled with the GTreasury acquisition, this technique is designed to place Ripple because the central facilitator for company administration and possession of XRP and different digital property.

Steadily Requested Questions

What’s a SPAC on this context?

A Particular Goal Acquisition Firm (SPAC) is a shell firm used as a automobile to lift capital via a public providing for the aim of a merger or acquisition, on this case, to purchase a considerable amount of XRP.

How a lot XRP does Ripple at the moment have locked in escrow?

Ripple Labs has a complete of 37 billion XRP tokens locked in an on-ledger escrow, which is launched regularly every month.

What was the aim of the GTreasury acquisition?

The $1 billion acquisition of GTreasury offers Ripple with the platform and infrastructure to supply company treasury administration companies for digital property, together with stablecoins and tokenized deposits.