Be a part of Our Telegram channel to remain updated on breaking information protection

The XRP worth dropped 2.6% within the final 24 hours to commerce at $2.40 as of 4 a.m. EST on a 14% enhance in buying and selling quantity to $4.66 billion.

The autumn within the Ripple token’s worth got here after Ripple Labs co-founder Chris Larsen offered 50 million XRP tokens value near $120 million.

CHRIS LARSEN MAKING BIG MOVES 🚨

Ripple co founder simply shifted 50,000,000 $XRP that’s over $123M to an unknown pockets!

Strategic play? Institutional setup? One thing large is coming… 🌊💥 pic.twitter.com/GaNmoeUGct

— XRP Replace (@XrpUdate) October 20, 2025

Larsen’s sale, confirmed by on-chain trackers, is his first main transaction since July, fueling debate about whether or not he expects the coin to fall additional within the quick time period. Whereas some see it as easy portfolio rebalancing, others say the transfer alerts warning from XRP management.

There was higher information, too, when Evernorth, led by former Ripple government Asheesh Birla, revealed plans for a SPAC merger that may elevate $1 billion to construct the biggest public XRP treasury.

Evernorth has secured $200 million from large names like SBI Holdings, Pantera Capital, Kraken, and GSR, promising to purchase XRP on the open market as soon as the deal closes.

JUST IN: Evernorth, backed by Ripple, plans Nasdaq itemizing to lift over $1 billion for constructing the biggest publicly traded $XRP treasury – Reuters. pic.twitter.com/KP0IIx3nnN

— Whale Insider (@WhaleInsider) October 20, 2025

XRP On-Chain Response: Trade Inflows and Institutional Strikes

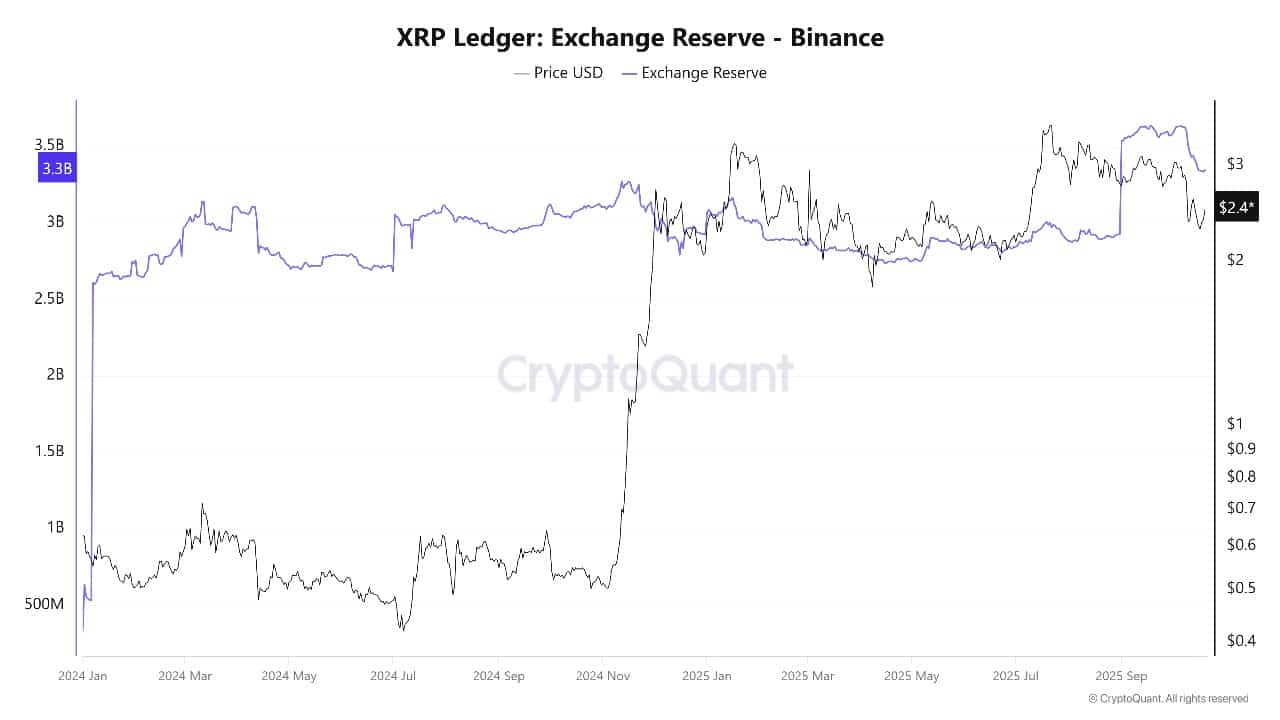

On-chain knowledge from CryptoQuant exhibits Larsen’s pockets despatched about $140 million value of XRP on to exchanges, with one other $35 million shifting into recent wallets. This type of massive outflow normally means doable sell-offs or liquidations, which might trigger sudden worth drops as merchants react.

XRP Trade Reserve Supply: CryptoQuant

Analysts say these trade inflows are vital to observe. Large transfers like Larsen’s are sometimes performed for strategic causes and sign {that a} main participant is both cashing out, reshuffling belongings, or making ready for brand new strikes involving XRP.

Alternatively, Evernorth’s SPAC mannequin is designed for institutional accumulation, utilizing lending, yield methods, and direct market purchases of XRP for its Treasury. These efforts might create regular shopping for strain over time, balancing out near-term promoting if retail sentiment stays constructive.

Evernorth’s public itemizing plans additionally energy up the XRP ecosystem. If permitted, it should commerce brazenly and provides establishments new methods to personal and handle XRP on a big scale.

XRP Worth Evaluation: Key Help And Resistance

The XRP worth chart for October exhibits the coin struggling to recuperate from a fast drop beneath key assist zones. It’s buying and selling simply above $2.40, with the 50-day Easy Shifting Common (SMA) at $2.81 appearing as an overhead resistance, and the 200-day SMA at $2.59 now probably a ceiling if the value tries to bounce up.

XRPUSDT Evaluation Supply: Tradingview

Quick-term assist is discovered close to $2.40, however a stronger space sits round $2.00, the place patrons final stepped in. The chart exhibits a significant resistance band between $2.80 and $2.59. If the value manages to climb above the shifting averages, there’s a probability for a transfer again in the direction of $2.80 and even the $3.00 area, which is a key psychological degree for merchants.

Proper now, technical indicators are combined. The Relative Energy Index (RSI) reads 39, which is low and suggests the market is oversold. This implies a short-term rebound might occur if patrons return. Nonetheless, sellers are nonetheless in management, and the MACD indicator is flat and destructive, exhibiting little momentum for an rise.

If XRP drops beneath $2.40, a take a look at of the $2.00-$2.05 area is probably going. Under $2.00, the subsequent helps are a lot decrease, close to $1.25. On the upside, clearing resistance at $2.60 and $2.80 might let the coin worth react positively, particularly if Evernorth’s open-market purchases start and extra establishments be a part of the transfer.

For now, the XRP worth faces short-term headwinds from Larsen’s sale and nervous sentiment, however rising institutional strikes like Evernorth’s $1 billion SPAC might assist regular the market and produce new patrons.

If assist ranges maintain, a rebound in the direction of $2.60–$2.80 stays doable within the subsequent few weeks. A decisive break decrease, nonetheless, might spur a retest of the summer time lows.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection