- Vincent Van Code says holding XRP long-term takes both excessive conviction or “a little bit of insanity.”

- He compares it to early Bitcoin holders who offered too quickly, exhibiting how emotional stress drives choices.

- Staying invested via crashes isn’t about timing—it’s about emotional endurance few buyers really possess.

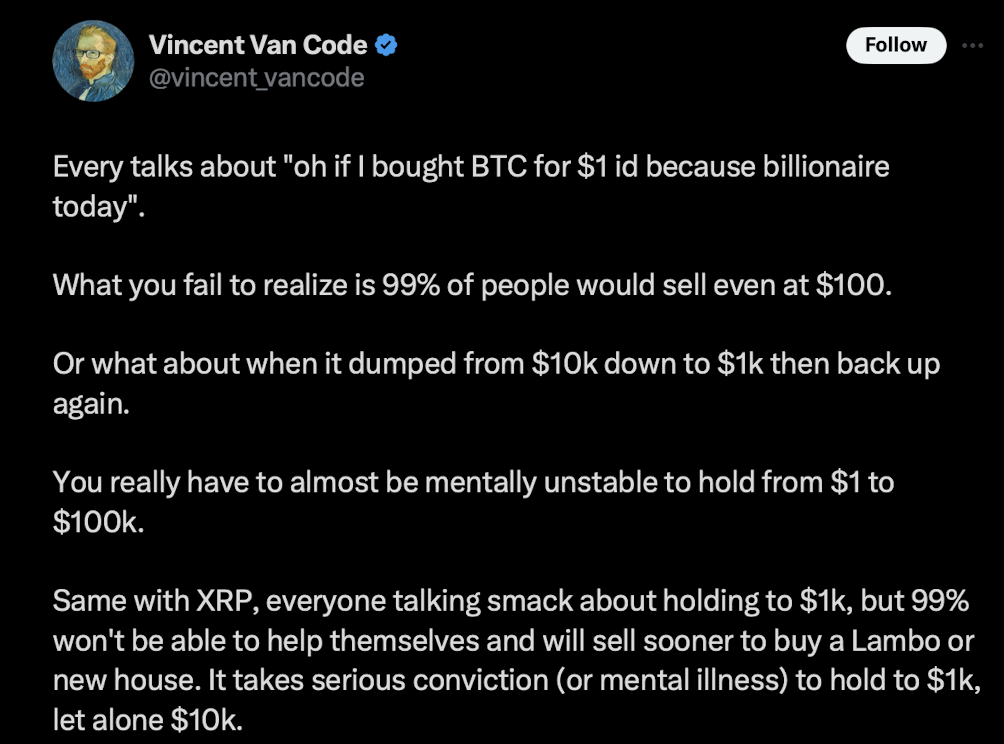

Software program engineer and XRP supporter Vincent Van Code has stirred up some sturdy reactions once more, this time with a brutally sincere tackle what it actually takes to carry risky property like XRP via thick and skinny. In a submit that shortly went viral amongst crypto circles, he joked that staying invested in XRP for years—regardless of fixed market swings—requires both “unshakable conviction or only a little bit of psychological instability.” Behind the humor although, lies a critical fact in regards to the psychological value of long-term investing in unpredictable markets.

The Psychological Marathon of Lengthy-Time period Holding

Van Code argued that the majority buyers suppose they’ll deal with the stress of long-term holding… till volatility truly hits. He stated that folks like to consider they’d keep affected person via each dip, however when costs soar or crash onerous, emotion at all times wins. Many find yourself promoting the second they see a life-changing revenue, even when an even bigger transfer remains to be forward.

He used Bitcoin as an ideal instance—how few individuals might’ve imagined its journey from lower than $1 to over $110,000. “A lot of the ones claiming they’d have held from the beginning would’ve most likely offered at $100,” he wrote. And he’s not mistaken. Through the years, numerous early BTC holders have offered after lengthy dormancy, taking big income however lacking out on far bigger potential returns. And naturally, who can overlook the man who spent 10,000 BTC on two pizzas?

In accordance with Van Code, surviving brutal corrections—like Bitcoin’s previous 80% crashes—requires extra than simply perception.It takes critical emotional resilience, a type of psychological toughness that only a few buyers even have.

Might Anybody Actually Maintain XRP Till $1,000?

The engineer then turned his ideas to XRP, asking if anybody might really maintain till the token hit $1,000 or extra. “Folks like to say they’ll by no means promote,” he famous, “however when their wallets present numbers that would change their complete lives, most would hit the promote button with out a second thought.”

Whereas predictions of XRP reaching $1,000 have been floating round for years—some even saying by 2040 underneath excellent situations—it’s simpler stated than finished. With XRP nonetheless underneath $3 right now, holding for over a decade would take a look at anybody’s sanity, particularly given how wild crypto cycles can get. Van Code pointed again to 2018, when XRP crashed over 95% after peaking close to $3, saying that type of drawdown “makes even essentially the most assured buyers query all the pieces.”

The Actuality of Emotional Self-discipline

One other longtime XRP holder, identified on-line as TheXFactor33, backed Van Code’s view. He admitted that staying invested via countless downturns calls for what he known as “an unhealthy quantity of stubbornness.” Having held XRP for greater than eight years, he stated emotional self-discipline—not market information—is what separates survivors from sellers.

Van Code later shared that he’s already mentally indifferent from his holdings. “The cash doesn’t exist to me anymore,” he stated, explaining that even when XRP hits $10,000 sometime, he has no plans to promote. For him, it’s about long-term objective—one thing greater than short-term income. “Possibly it buys property for my children someday,” he added.

His outlook sums it up completely: in crypto, the toughest half isn’t selecting the correct asset—it’s surviving the psychological pressure of watching it swing wildly for years. Holding via concern, greed, and doubt isn’t a ability most buyers grasp. It’s a take a look at of psychology greater than anything.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.