Bitcoin’s explosive rise in 2025 has reignited one of the crucial debated questions in finance – can the digital forex really rival gold because the world’s most beneficial asset? As market momentum pushes each belongings to historic highs, Binance founder has weighed in with a daring forecast that has caught the eye of buyers and analysts alike.

Changpeng Zhao (CZ) has as soon as once more sparked debate throughout the monetary world along with his daring prediction that Bitcoin will surpass gold in market capitalization. In a put up on X, CZ wrote:

Zhao additionally identified that whereas Bitcoin could sooner or later surpass gold in market worth, the valuable steel itself won’t ever lose relevance – “Gold gained’t go to zero,” he famous, emphasizing its enduring function as a retailer of worth.

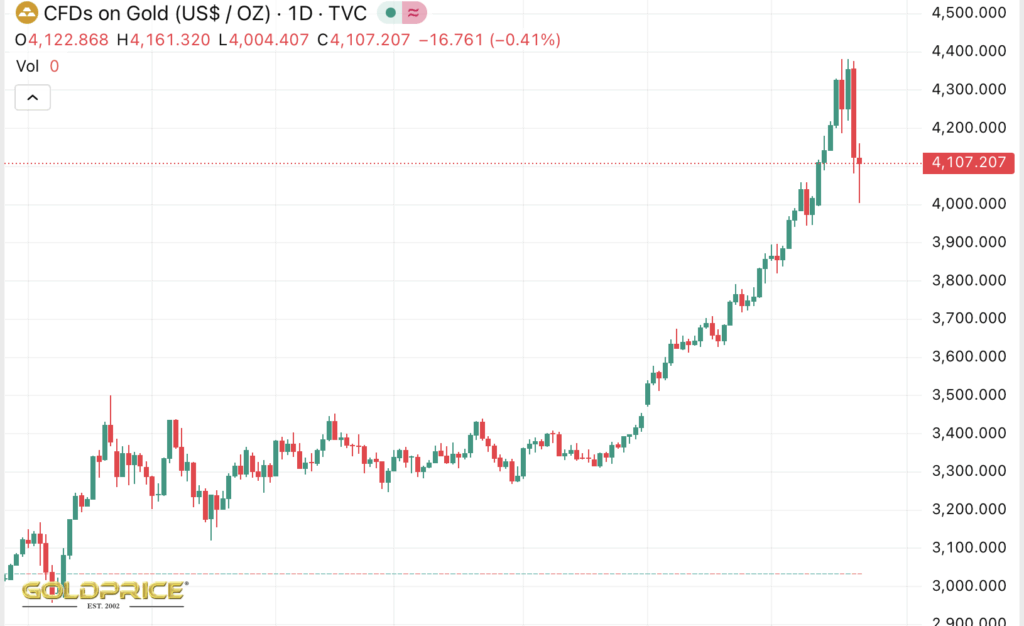

At current, gold stays the world’s largest asset by market worth, boasting a capitalization of roughly $29.6 trillion, pushed by renewed investor demand and international financial uncertainty. Gold costs have climbed sharply in 2025, buying and selling round $4,107 per ounce, as geopolitical tensions, inflationary pressures, and continued central financial institution purchases pushed the steel to document highs. The valuable steel’s efficiency this yr has reaffirmed its function as a conventional protected haven in instances of volatility.

Bitcoin Closes the Hole as Digital Gold

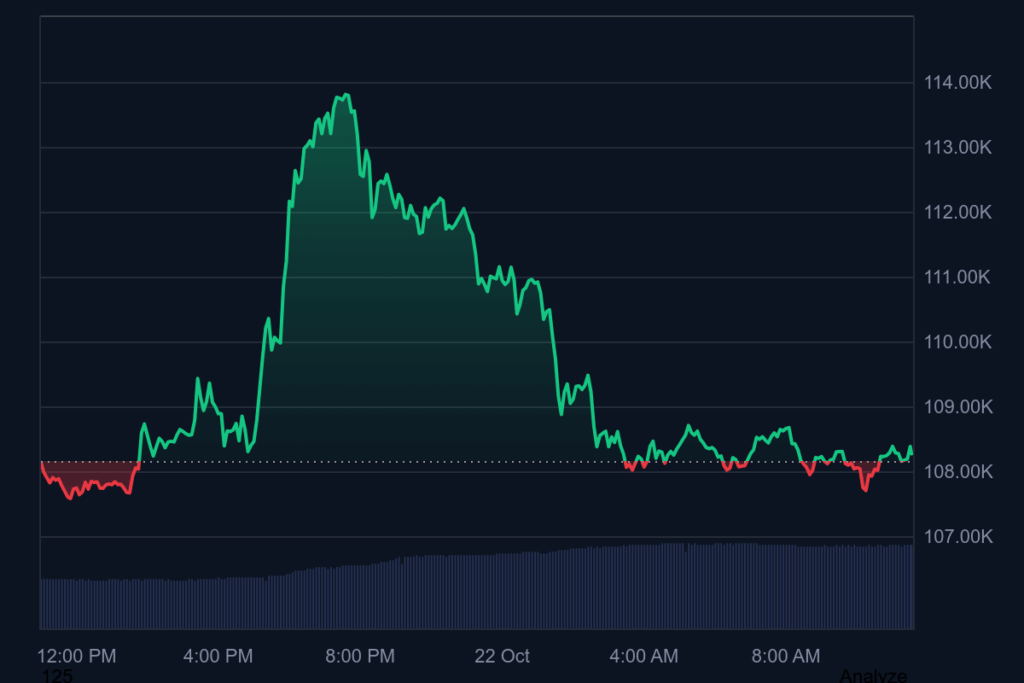

Bitcoin, nonetheless, has been closing the hole. With a market capitalization of about $2.2 trillion and a worth close to $108,000, the world’s main cryptocurrency now ranks eighth amongst international belongings, surpassing main firms like Meta Platforms.

Its rally has been fueled by institutional adoption, the rising affect of spot Bitcoin ETFs, and increasing recognition of Bitcoin as a digital various to gold.

Whereas gold derives its power from centuries of belief and bodily shortage, Bitcoin’s supporters spotlight its finite provide of 21 million cash and borderless nature as key benefits within the digital period. Each belongings share the attraction of being inflation hedges, however Bitcoin’s programmable shortage and decentralized construction give it a singular edge in fashionable finance.

CZ’s prediction could appear bold, however the market traits counsel the race between gold and Bitcoin is tightening. Because the digital asset house matures and international buyers proceed to diversify past conventional commodities, the potential of Bitcoin overtaking gold – as soon as thought of unthinkable – is now a part of mainstream dialog.