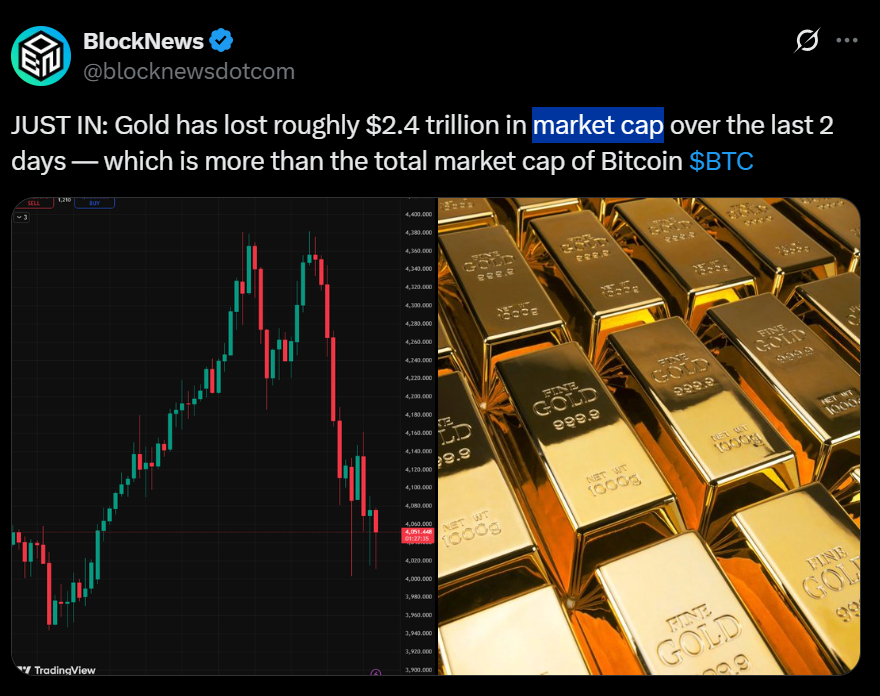

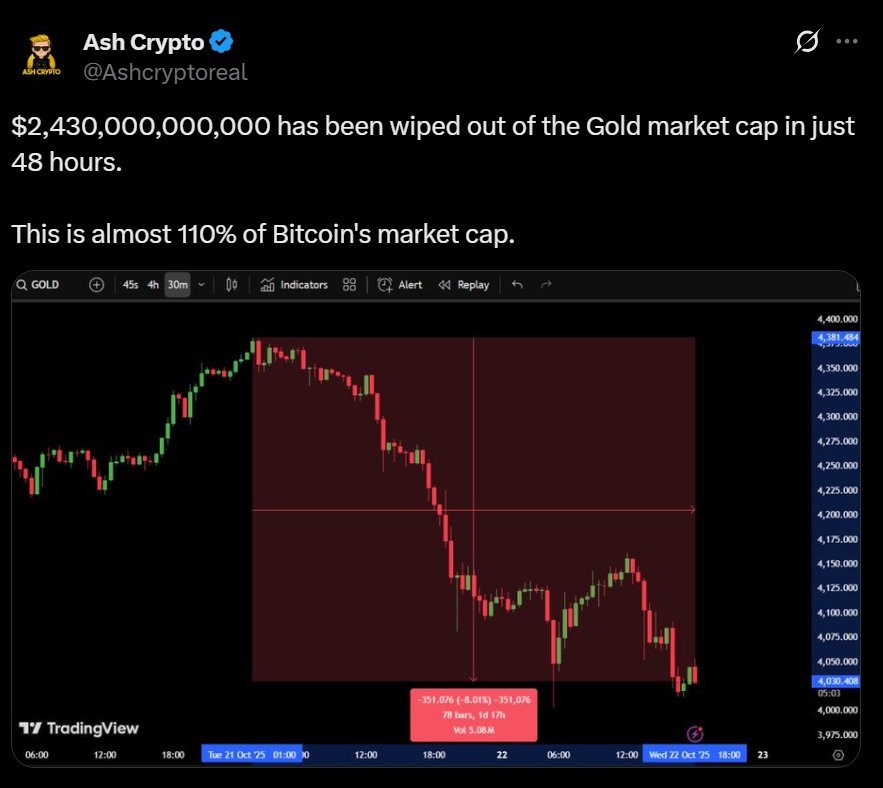

- Gold crashes 8%, erasing $2.43 trillion — over 110% of Bitcoin’s market cap.

- The drop follows a stronger U.S. greenback, investor rotation, and profit-taking.

- Analysts count on gold to rebound towards $5,000 by 2026, however Bitcoin’s resilience is shifting sentiment.

Gold simply noticed certainly one of its steepest sell-offs in current reminiscence. In simply 48 hours, the metallic’s market capitalization collapsed by $2.43 trillion, erasing greater than 110% of Bitcoin’s total market cap. Costs plunged roughly 8%, dropping gold to round $4,129 per ounce — a staggering reversal that’s despatched shockwaves by international markets.

Analysts say the carnage stemmed from a surging U.S. greenback, profit-taking after months of rallying, and a rotation of capital into equities and digital property. The mix hit what was imagined to be the world’s most secure hedge asset — and compelled traders to query whether or not the “golden rally” is lastly cracking.

Why Gold’s Drop Issues for Bitcoin

The irony? Whereas gold sank, Bitcoin (BTC) held comparatively agency close to $108,000, fueling debate over which asset really deserves the “retailer of worth” crown in 2025. Gold’s two-day wipeout equals practically 1.1x Bitcoin’s market cap, underscoring simply how huge the loss was.

Crypto merchants say a few of that fleeing capital is already discovering its manner into BTC, which is up about 20% year-to-date, in comparison with gold’s still-impressive 45% rally. “We’re watching a rotation second,” stated one analyst. “When conventional safe-havens wobble, digital ones all of a sudden look extra engaging.”

Analysts Nonetheless Count on Lengthy-Time period Gold Restoration

Regardless of the chaos, high banks like Goldman Sachs, Financial institution of America, and HSBC stay bullish long run, projecting gold might climb towards $4,900–$5,000 per ounce by late 2026. Central financial institution accumulation and geopolitical pressure are anticipated to maintain demand sturdy — even when volatility stays wild within the quick run.

Nonetheless, this week’s $2.43 trillion loss is a sobering reminder that no hedge is really proof against fast-moving markets. As one strategist put it: “Even gold bleeds when liquidity dries up.”

Bitcoin vs. Gold in 2025: The Nice Retailer-of-Worth Debate

The sell-off reignited certainly one of finance’s oldest arguments — Bitcoin vs. Gold. Gold stays the heavyweight, with a $27.6 trillion market cap even after the crash, dwarfing Bitcoin’s $2.16 trillion. But Bitcoin’s digital design, portability, and rising institutional backing give it a special form of edge — one tied to innovation, not custom.

Analysts notice that Bitcoin stays 3.6 instances extra unstable than gold, but additionally way more scalable. “Gold is dependable,” stated Coin Bureau’s Nic Puckrin, “however Bitcoin is evolving. One’s a vault, the opposite’s an engine.”

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.