The primary wave of crypto ETFs allowed buyers to onboard crypto property into conventional brokerage accounts – and tax-advantaged retirement accounts. Given the long-term return potential of cryptocurrencies, that’s a win-win.

However cryptos are nonetheless risky. Final week’s $19 billion leveraged wipeout in bitcoin surpassed the wipeout on the Covid backside in March 2020. And the FTX collapse in late 2022.

Crypto ETFs May Not Maintain Good Earnings Potential

Traders in conventional property just like the upside potential of crypto. However the draw back volatility is a bit a lot to abdomen.

They need merchandise that take a few of the excessive swings out of it, even when it means a decrease upside.

Sponsored

Sponsored

As we speak, a brand new wave of ETFs are coming on-line. They boast increased charges, however extra energetic administration.

Not content material to easily purchase and HODL, they’re using totally different methods to benefit from the upper volatility in cryptocurrencies.

For extra cautious buyers, crypto revenue ETFs could also be engaging funding alternatives. However as with something, purchaser beware.

A peek underneath the hood of a few of the revenue ETFs present that – whether or not in a crypto-specific ETF or a basket of crypto shares – there aren’t nice whole returns.

The Professionals and Cons of Crypto Earnings ETFs

On paper, crypto revenue ETFs supply buyers a lot of the upside from cryptocurrencies, however with revenue alongside the best way.

However there’s a catch. Really, fairly a couple of. A very powerful is that these ETFs use crypto futures, slightly than maintain crypto itself.

With the ability to handle crypto futures permits for the flexibility to create revenue. By shopping for long-dated futures after which promoting short-dated futures, revenue might be generated from value swings.

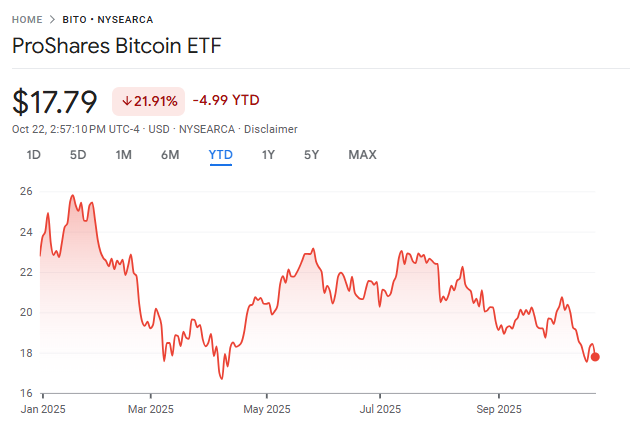

A few of the revenue returns look good, at the very least throughout a bull market. As an example, the ProShares Bitcoin ETF (BITO) boasts a dividend yield of over 50% annualized.

Nevertheless, buyers want to have a look at the entire return. BITO shares are down practically 20% year-to-date.

Sponsored

Sponsored

With the underlying asset of Bitcoin up over 20%, BITO has generated solely a modest acquire on high of that. Anybody who has to promote shares of BITO will expertise capital loss regardless of having to pay taxes on dividends obtained.

And on high of that, buyers are paying a 0.95% administration payment.

Why The Disconnect?

Utilizing futures, ETFs successfully purchase an asset with a time premium that decays. Throughout a bull market, the influence is muted. However in sideways markets or a crypto winter, the losses might be brutal.

Mix that with leverage, and the outcomes can get fairly dangerous, fairly shortly.

The Defiance Leveraged Lengthy Earnings Ethereum ETF (ETHI) launched at the beginning of October.

Designed to return 150-200% of the day by day efficiency in Ethereum and utilizing credit score spreads to generate revenue, shares dropped 30% inside their first few weeks of buying and selling.

October 10’s liquidation bloodbath is the speedy perpetrator. However the best way this ETF is structured, it could possible bleed out over time.

Sponsored

Sponsored

Presently, crypto revenue ETFs are set as much as make buyers solely throughout a scorching bull market – not a crypto winter, or perhaps a sideway market.

However the crypto house is now extra than simply cryptocurrencies themselves. There’s an ETF for every part in any case, and it’s no shock that crypto inventory ETFs are making a debut.

Beware the Returns In Crypto Inventory ETFs, Too

ETFs monitoring crypto-related shares have began to launch this yr.

In principle, these could also be extra engaging for buyers in comparison with a single-crypto revenue ETF, since they provide some diversification. Let’s check out two of them:

At first of the yr, the REX Crypto Fairness Premium Earnings ETF (CEPI) launched.

Boasting a month-to-month dividend fee, the ETF owns shares of a number of crypto-related firms, from mining firms, Bitcoin treasury firm MicroStrategy, and even bank card large Visa.

Shares have been risky since their launch, in a rising marketplace for shares – not good. However the dividends paid out have exceeded 20% yr so far, for a optimistic whole return.

A second ETF that launched this yr, the long-winded YieldMax Crypto Trade Portfolio Choice Earnings ETF (LFGY), has a reported distribution of 19.9% annualized.

Sponsored

Sponsored

But the ETF, which holds property akin to Coinbase, IBIT, MARA Holdings, and different runaway inventory winners this yr, is down practically 25% since inception.

With lower than $200 million underneath administration, it’s clear that this ETF is failing to draw buyers. And with these returns within the first yr of operation, it’s straightforward to see why.

Managing Volatility Well

Regardless of the more and more mainstream integration of cryptocurrencies, the October tenth bloodbath in altcoins serves as a painful reminder.

Cryptocurrency is risky. And whereas that volatility ought to decline as crypto property acquire traction and turn out to be built-in with conventional finance, it’s nonetheless topic to massive swings.

Traders trying to get into the cryptocurrency house don’t wish to sit by means of a 30-50% decline – or extra. They need the upside volatility, however could also be keen to surrender some positive aspects if it means decreasing the danger of getting to take a seat by means of huge declines.

However for now, crypto revenue ETFs live as much as their identify by offering revenue – however they’re failing to carry their worth. That’s an issue over time.

Given the variety of new crypto ETFs coming on-line, extra competitors within the house ought to drive methods to enhance returns.

For crypto fans, the ETFs are not any cause to modify out of proudly owning the true asset.

For buyers in search of crypto publicity, the spot ETFs that maintain the underlying crypto nonetheless look like one of the best recreation on the town.