- Binance’s stablecoin-to-Bitcoin ratio hit its lowest stage in two years, hinting at sturdy shopping for potential.

- Tether and Circle minted $7B in new stablecoins, with Tether reaching 500M actual customers worldwide.

- Citi initiatives the stablecoin market might develop to $1.9T by 2030, reshaping international liquidity.

The stablecoin-to-Bitcoin ratio on Binance has dropped to its lowest stage in two years, whilst Tether and Circle collectively minted $7 billion price of latest tokens. It’s a wierd combine — much less stablecoin exercise on exchanges, however far more being created — and it’s hinting at one thing constructing beneath the floor. In response to information from Lookonchain, Bitcoin climbed previous $108,000 proper as this new liquidity entered the market, suggesting traders are gearing up for one thing larger.

CryptoQuant’s information exhibits Binance’s stablecoin ratio now sits at simply 0.8149, a stage not seen since 2023. Meaning merchants are holding extra stablecoins relative to Bitcoin — principally ready, watching, and able to pounce when costs look proper. Traditionally, when this ratio dips this low, it usually precedes a wave of accumulation. We noticed the identical factor again in 2023 and 2024 earlier than main rallies. If Bitcoin holds above the $108K–$110K vary, this could possibly be a kind of quiet moments at the start strikes quick.

Billions minted as Tether hits adoption milestone

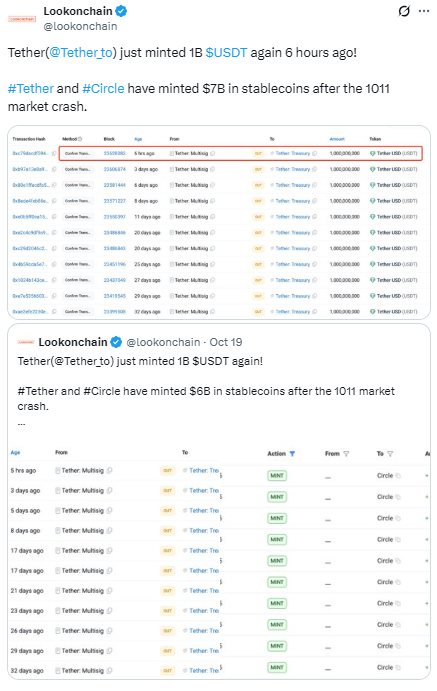

Tether simply printed one other $1 billion USDT, pushing the mixed complete of latest issuance from Tether and Circle to $7 billion because the final market pullback. It’s an indication that demand for dollar-pegged property stays sturdy, particularly as international markets wobble. Tether additionally hit an eye-popping milestone of 500 million customers — and in keeping with them, these aren’t simply pockets addresses however actual folks. That’s roughly 6% of the worldwide inhabitants that has used or held USDT sooner or later.

The expansion is most seen in rising economies like Kenya and components of Latin America, the place persons are utilizing stablecoins as shields in opposition to inflation and shaky nationwide currencies. With Tether now commanding a market cap of $182 billion (round 58% of all stablecoins) and Circle trailing with $76 billion, it’s clear who’s dominating the digital greenback sport.

Citi sees a $1.9 trillion stablecoin future

Even conventional banks are paying consideration. Citi analysts just lately projected that the stablecoin market might attain $1.9 trillion by 2030, representing as a lot as 10% of complete crypto worth. They in contrast this part of stablecoin adoption to the rise of cash market funds within the Eighties — one thing that reshaped liquidity with out destabilizing conventional finance.

Whereas the ratio drop seems to be bearish on paper, the large minting spree and international consumer development counsel the other: a ton of dry powder ready for the precise second to enter the market. Whether or not it’s subsequent week or subsequent quarter, the setup feels eerily just like these pre-rally moments that crypto veterans know all too we

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.