Bitcoin is struggling to reclaim larger ranges as promoting stress intensifies and worry continues to dominate market sentiment. After weeks of unstable worth motion, the market’s restoration makes an attempt are being met with heavy resistance, with BTC nonetheless buying and selling beneath key psychological ranges.

In accordance with knowledge from Lookonchain, the well-known dealer referred to as the BitcoinOG (1011short) — well-known for shorting the market throughout the October 10 crash — is as soon as once more making headlines. On-chain knowledge exhibits that the whale has began dumping BTC, triggering renewed nervousness amongst merchants and buyers.

This transfer has reignited debate throughout the group, as many analysts take into account this dealer a part of the so-called “sensible cash” cohort — entities recognized for anticipating market shifts with excessive precision. Whereas some interpret the whale’s exercise as an indication of additional draw back forward, others argue that such occasions typically mark capitulation factors the place the market absorbs remaining waves of promoting earlier than rebounding.

With uncertainty rising and liquidity skinny, Bitcoin’s subsequent strikes will likely be essential in figuring out short-term sentiment. The approaching days may resolve whether or not this whale’s actions verify one other leg down — or sign the final shakeout earlier than a broader restoration section.

Whale Exercise Intensifies: The BitcoinOG Strikes Hundreds of thousands Throughout Exchanges

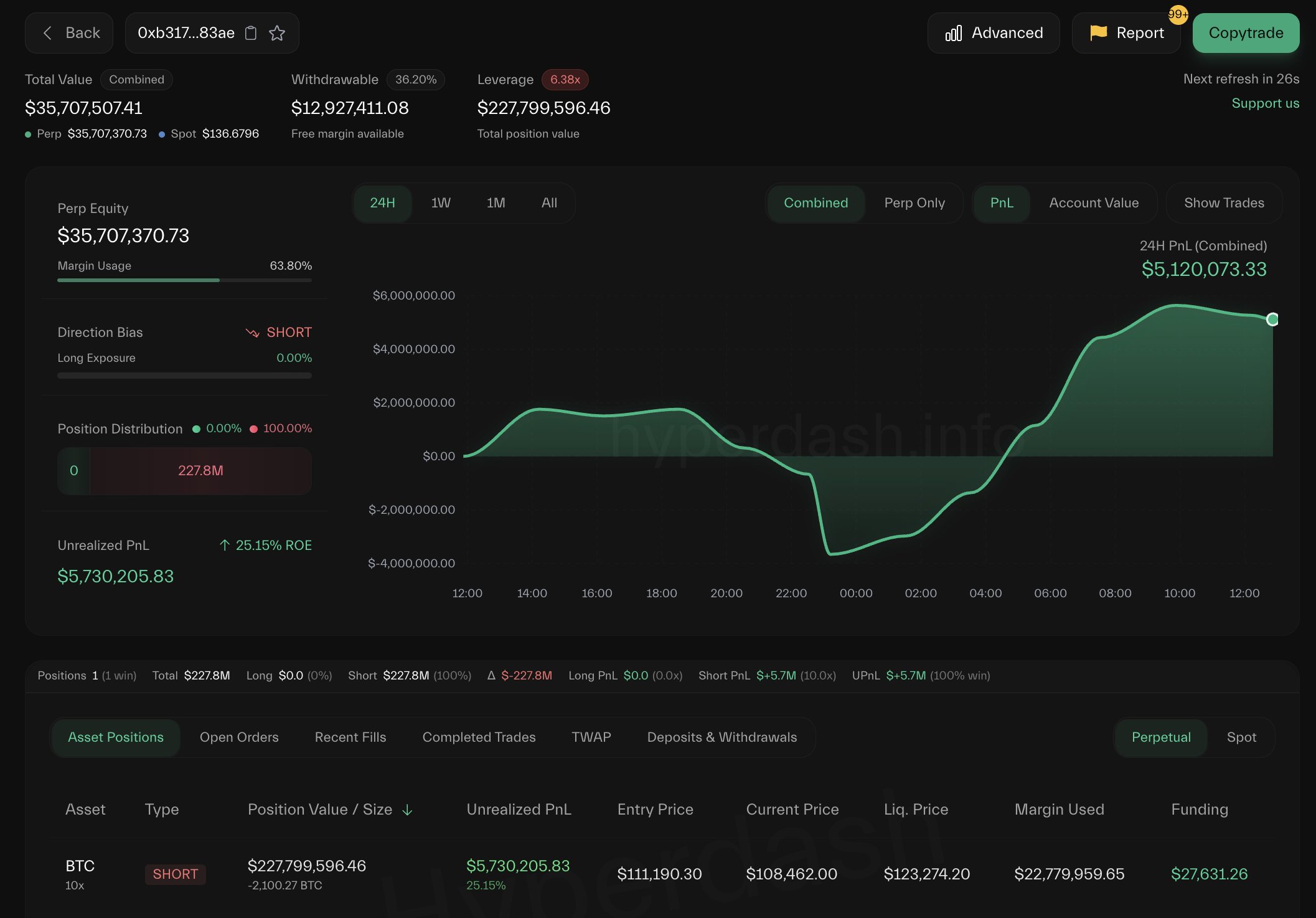

In accordance with Lookonchain insights, the BitcoinOG (1011short) — the dealer who famously shorted the market throughout the October 10 crash — is as soon as once more making main strikes. For the reason that market downturn, this whale has deposited 5,252 BTC, price roughly $587.88 million, into main exchanges together with Binance, Coinbase, and Hyperliquid. On the identical time, knowledge exhibits his brief place on Hyperliquid has grown to 2,100 BTC, valued at round $227.8 million.

This scale of exercise has drawn intense consideration from analysts, given the dealer’s historic accuracy in predicting market tops. Depositing Bitcoin to exchanges typically alerts potential promoting or hedging habits, including to the bearish tone at the moment dominating sentiment. Mixed with the enlargement of his brief publicity, it suggests the whale may very well be positioning for additional draw back or defending features from earlier market strikes.

Nevertheless, a number of specialists have urged warning in overinterpreting these transactions. On-chain visibility solely offers a partial view — these could also be only a fraction of the whale’s whole holdings or broader technique. It’s potential that some positions stay hidden throughout different derivatives platforms, wallets, or over-the-counter offers.

This uncertainty makes the whale’s habits each intriguing and regarding. Whereas retail merchants typically react strongly to such seen actions, seasoned analysts emphasize the necessity for broader context — together with derivatives knowledge, funding charges, and liquidity shifts.

Weekly Chart: Assist Retest as Market Faces Key Inflection Level

The weekly Bitcoin chart exhibits the market struggling to carry above the $108,000 area, a essential short-term help degree that aligns carefully with the 50-week transferring common (blue line). After the sharp drop following the October 10 crash, BTC tried a rebound however didn’t maintain momentum above $114,000, signaling persistent promoting stress close to the $117,500 resistance — a degree that has acted as each help and resistance a number of occasions over the previous 12 months.

The construction now suggests Bitcoin is in a consolidation section inside a broader bullish development, however draw back dangers stay elevated. If the 50-week transferring common fails to carry, the subsequent potential help lies close to $100,000, which aligns with the decrease vary of historic demand and the March 2025 breakout zone. A break beneath this area may speed up promoting momentum and ensure a deeper retracement.

Conversely, reclaiming $117,500 would sign renewed power, opening the door for a possible retest of the $125,000–$130,000 vary. General, Bitcoin’s weekly construction stays cautiously bullish, however sustained weak spot round present ranges would put the broader uptrend in danger — making the approaching weeks decisive for long-term route.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.