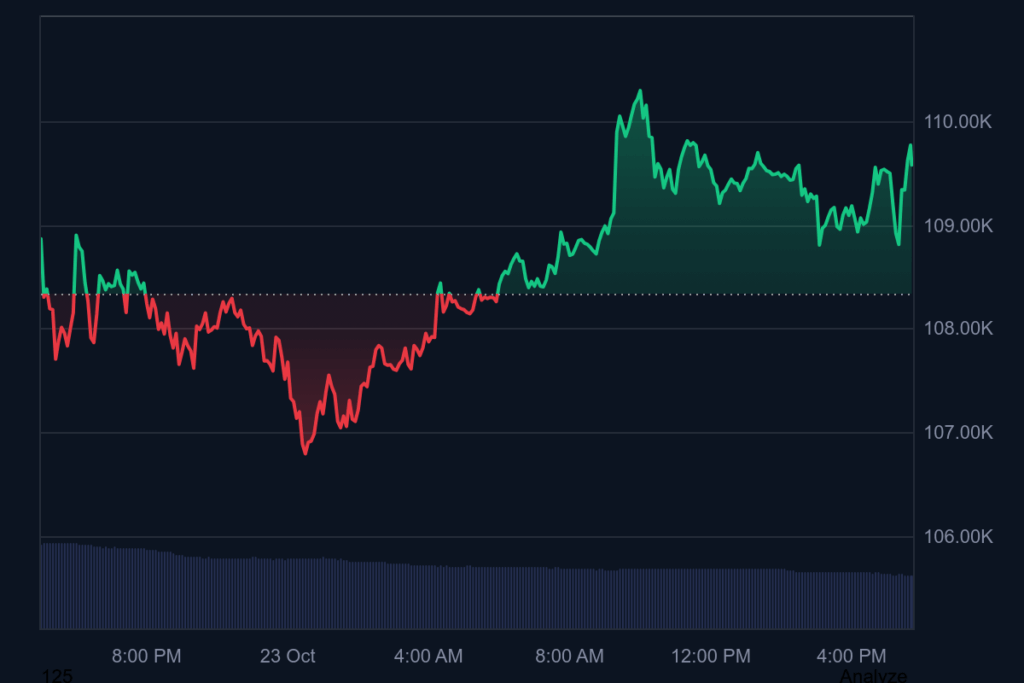

Bitcoin hovered round $109,000 on Oct. 23, with merchants watching a narrowing value hall and rising market rigidity.

Analysts from BRN and QCP Capital say the asset is now shifting inside a fragile vary, the place even small shifts might spark sharp reactions.

In accordance with market knowledge, BTC has shed greater than 3% over the previous month, with intraday strikes largely capped between $107,200 and $109,500. Persistent rejections close to the $113,000 mark have inspired profit-taking, leaving the $108,000 assist stage as a key line within the sand. If that breaks, analysts warn of potential slides towards $104,500 – and even under $100,000, as Normal Chartered just lately predicted.

Choices merchants have additionally entered a extra unstable part. Open curiosity in BTC contracts has hit contemporary highs, however the build-up in put publicity means sellers are sitting on vital brief gamma positions. This setup, analysts say, can shortly amplify volatility when the value shifts, triggering sudden surges or steep drops round vital strike costs.

Institutional sentiment stays combined. Spot Bitcoin ETFs noticed outflows of roughly $101 million on Tuesday, with Ethereum merchandise dropping one other $19 million. The information trace at a pause in institutional urge for food after a number of weeks of uneven inflows.

Macroeconomic uncertainty is including to the strain. With most U.S. authorities knowledge releases delayed by the continuing shutdown, traders at the moment are laser-focused on Friday’s CPI print. A softer-than-expected quantity might revive bullish sentiment, whereas a better studying may speed up risk-off strikes throughout the board.

For now, Bitcoin seems trapped in what analysts describe as a “proof-of-conviction part,” the place long-term holders are trimming positions whereas establishments proceed cautious accumulation by ETFs and treasury automobiles. The outcome, they are saying, is a rangebound market—one that might keep uneven till a transparent macro or liquidity catalyst emerges.