Key Takeaways

How excessive can ETH and SOL go by 2030?

ETH might attain $10K if resistance breaks; SOL might prolong towards $500–$1K post-ETF traction.

What indicators help their progress?

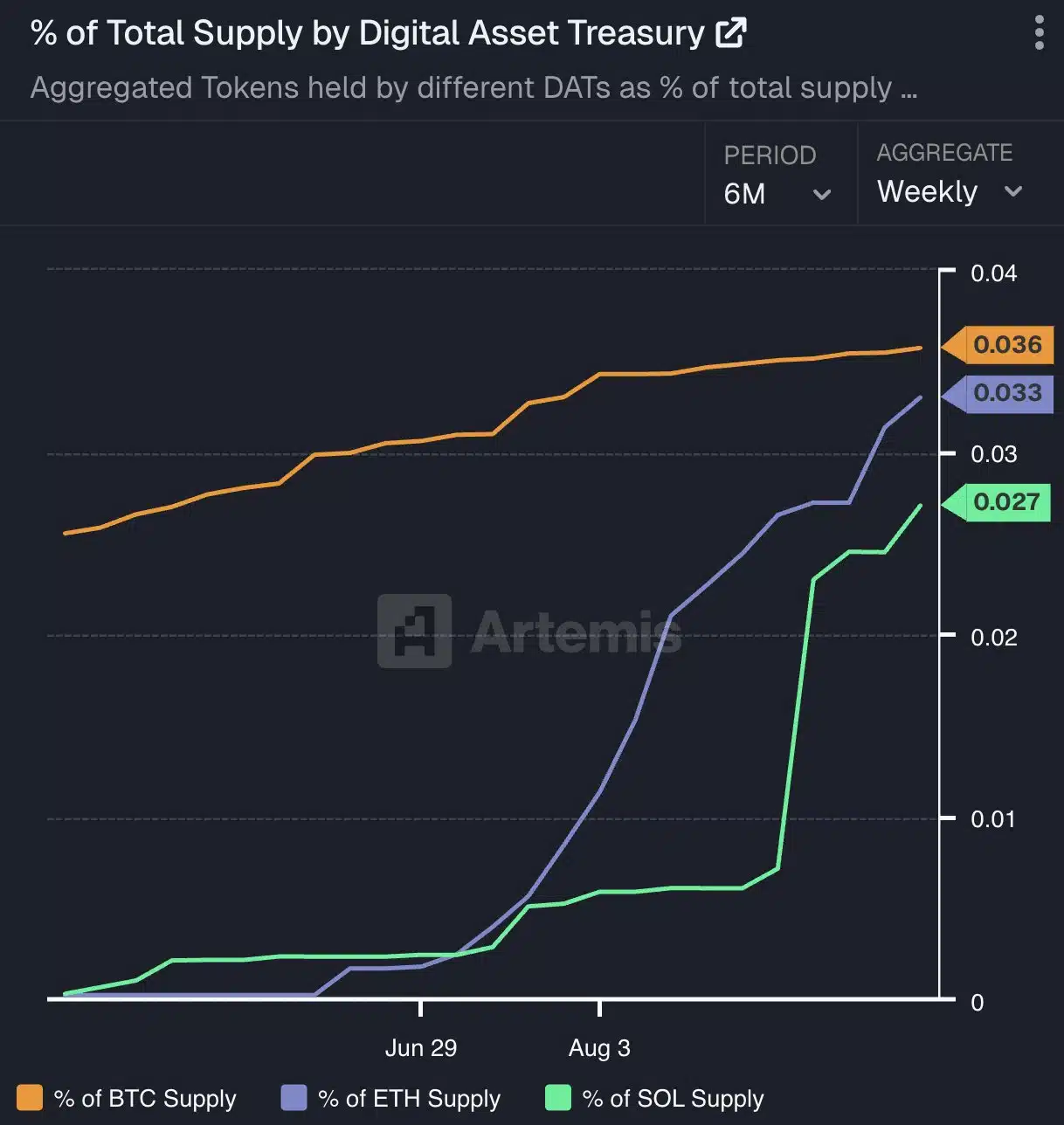

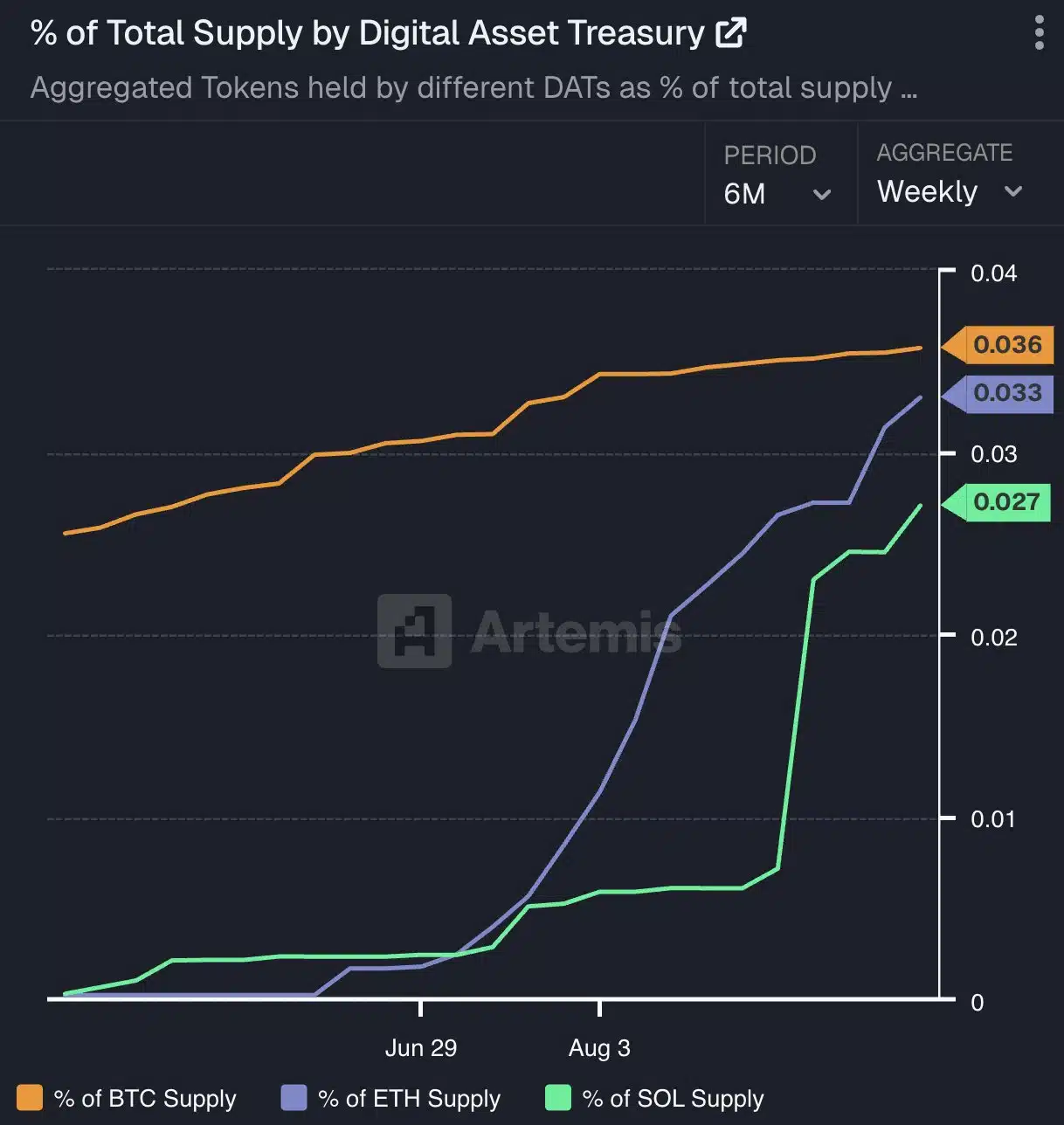

RSI readings stayed impartial, whereas Digital Asset Treasuries held 0.033% ETH and 0.027% SOL, reflecting regular institutional inflows.

Ethereum [ETH] and Solana [SOL] stay two of essentially the most actively used altcoins in decentralized functions, regardless of Binance Coin’s [BNB] having a go in the previous couple of months.

Their transaction speeds and scalability proceed to drive institutional and retail demand. Projections for 2030 instructed each might greater than double their valuations.

Is $10K too low for Ethereum by 2030?

Ethereum’s month-to-month chart confirmed a multi-year consolidation zone between $1,228 and $4,878 since late 2021. At press time, ETH traded at $3,837.

The RSI was at 52.86 at press time, indicating a near-neutral momentum, whereas the Cash Circulation Index (MFI) at 47 confirmed balanced and never excessive capital move.

If the consolidation bears up and overcomes the higher resistance, ETH would enter a brand new discovery stage.

Supply: TradingView

Essential to notice is that the market construction resembled the expansion patterns noticed in earlier cycles. Actually, breaking this vary meant ETH would attain $10,000 or increased by the 12 months 2030.

Nonetheless, the goal appeared too conservative, taking into account how ETH can carry out throughout bull runs.

An extended-term continuation towards $1,228, alternatively, would nullify the long-term bullish construction.

Will Solana hit $1,000?

Solana’s weekly chart confirmed a large buying and selling vary between $12 and $260, lively since mid-2021. SOL traded at $183.92, positioned within the higher half of this vary.

The RSI at 48.92 indicated impartial sentiment, and the MFI at 68.16 mirrored reasonable inflows. A sustained breakout above $260 might affirm a structural shift.

Supply: TradingView

In case such a breakout occurred, an estimated projection implied a bullish forecast of a $300-$500 vary by the 12 months 2030.

Contemplating its surge in 2021, this forecast was additionally conservative. This indicated that ranges above $1,000 could be a chance.

Establishments accumulate Ethereum and Solana

On-chain knowledge confirmed rising institutional publicity to each ETH and SOL.

Based on analyst Kate The Alt, establishments have amassed greater than 1.5 million ETH since January. Alternatively, Solana was following an analogous pattern, as demonstrated by Hong Kong’s approval of its first spot ETF.

Nonetheless, SOL had extra ETF filings, about 23, than every other cryptocurrency since 2024, as per analyst Crypto Curb.

Information from Artemis confirmed regular will increase in Digital Asset Treasuries (DATs). As of August, ETH’s share stood at 0.033% of complete provide, whereas SOL reached 0.027%.

Supply: Artemis

These figures mirrored constant institutional purchases, with Ethereum holding a slight lead.

Last tackle worth by 2030

Altogether, the 2 altcoins had been destined for larger heights.

The conservative worth targets had been at $10K and $500 for Ethereum and Solana, respectively, as they had been inside attain.

Nevertheless, Ethereum appeared to outperform Solana by this time, bearing its wider utility than that of its counterpart.