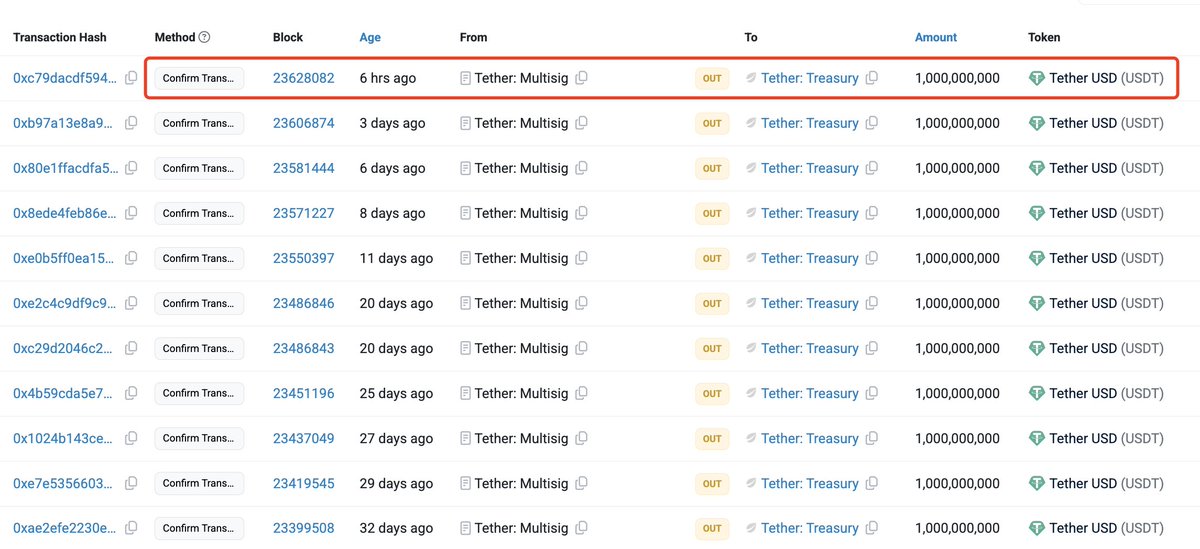

Tether has simply minted one other 1 billion USDT, solely hours in the past, reigniting debate over stablecoin-driven liquidity flows throughout the crypto market. The mint comes at an important time — Bitcoin is struggling to reclaim greater ranges after weeks of volatility, whereas altcoins proceed to bleed as if a full-blown bear market have been underway.

These mints are likely to inject liquidity into exchanges, offering the capital wanted for merchants and market makers to re-enter positions or stabilize unstable value swings. Whereas not all the time a right away bullish catalyst, they incessantly precede recoveries in market sentiment and quantity.

The most recent mint follows a wave of renewed uncertainty throughout the crypto panorama, with traders intently watching Bitcoin’s $110K stage as a make-or-break assist zone. Altcoins, in the meantime, are experiencing double-digit declines, elevating issues that danger urge for food stays weak.

If historical past is any indication, this new inflow of stablecoin liquidity might be setting the stage for a short-term rebound — or a minimum of a brief reduction rally — as liquidity begins to flow into throughout main exchanges and spinoff markets within the days forward.

A Liquidity Wave That Might Shake the Market

In accordance with information from Lookonchain, Tether and Circle have collectively minted over $7 billion in stablecoins because the October 10 market crash. This surge in new provide marks one of the vital liquidity injections since midyear, sparking hypothesis about its potential influence on Bitcoin and the broader crypto market.

Stablecoin mints on this scale typically act as precursors to main value swings. Whereas not a direct type of shopping for, they point out that recent capital is being positioned to enter the market — sometimes by way of market makers, institutional desks, or exchanges getting ready for renewed buying and selling exercise. On this context, the $7 billion inflow means that liquidity situations are bettering after the sharp drawdown that liquidated billions in lengthy positions earlier this month.

Associated Studying: 2,496 Bitcoin Moved After Years Of Inactivity – Lengthy-Time period Holders Take Motion

Nevertheless, such fast capital motion also can heighten volatility. As this liquidity begins to flow into, it may well amplify each side of the market — first triggering reduction rallies as consumers re-enter, after which sharp corrections as leveraged positions unwind.

For Bitcoin, the timing is particularly crucial. With BTC nonetheless struggling to carry above $108K–$110K, this new liquidity may decide whether or not the subsequent transfer is a bullish breakout or one other leg decrease. Traditionally, massive stablecoin issuances have preceded upward shifts in Bitcoin’s value, however in a fragile market, they will additionally gas speculative whipsaws.

Tether’s USDT Dominance Rebounds As Merchants Search Stability

Tether’s market dominance has risen sharply to round 5.06%, signaling a notable shift in sentiment as traders transfer capital into stablecoins amid heightened market volatility. The weekly chart reveals a powerful rebound from the 4.6% stage, with USDT dominance now testing resistance close to the 100-week transferring common. This uptick coincides with the broader crypto market downturn following Bitcoin’s failure to carry key assist at $110K and widespread promoting throughout altcoins.

Traditionally, rising USDT dominance displays elevated demand for security — merchants exiting unstable property and parking capital in stablecoins to attend for clearer market path. This sample typically precedes durations of accumulation, as sidelined liquidity builds up, able to re-enter as soon as confidence returns.

From a technical standpoint, the construction suggests {that a} sustained breakout above 5.2% may prolong the dominance rally towards 6%, a stage final seen throughout earlier market corrections. Nevertheless, rejection right here would suggest stabilization and potential capital rotation again into danger property.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.