ChainOpera AI’s native token, COAI, has surged over 70% up to now 24 hours, rising because the market’s prime gainer.

Because the coin continues to achieve momentum, the market seems divided — whereas some stay bullish on the altcoin, others are elevating issues concerning the venture.

Sponsored

Sponsored

COAI Value Skyrockets as Merchants Flip Bullish on the Altcoin

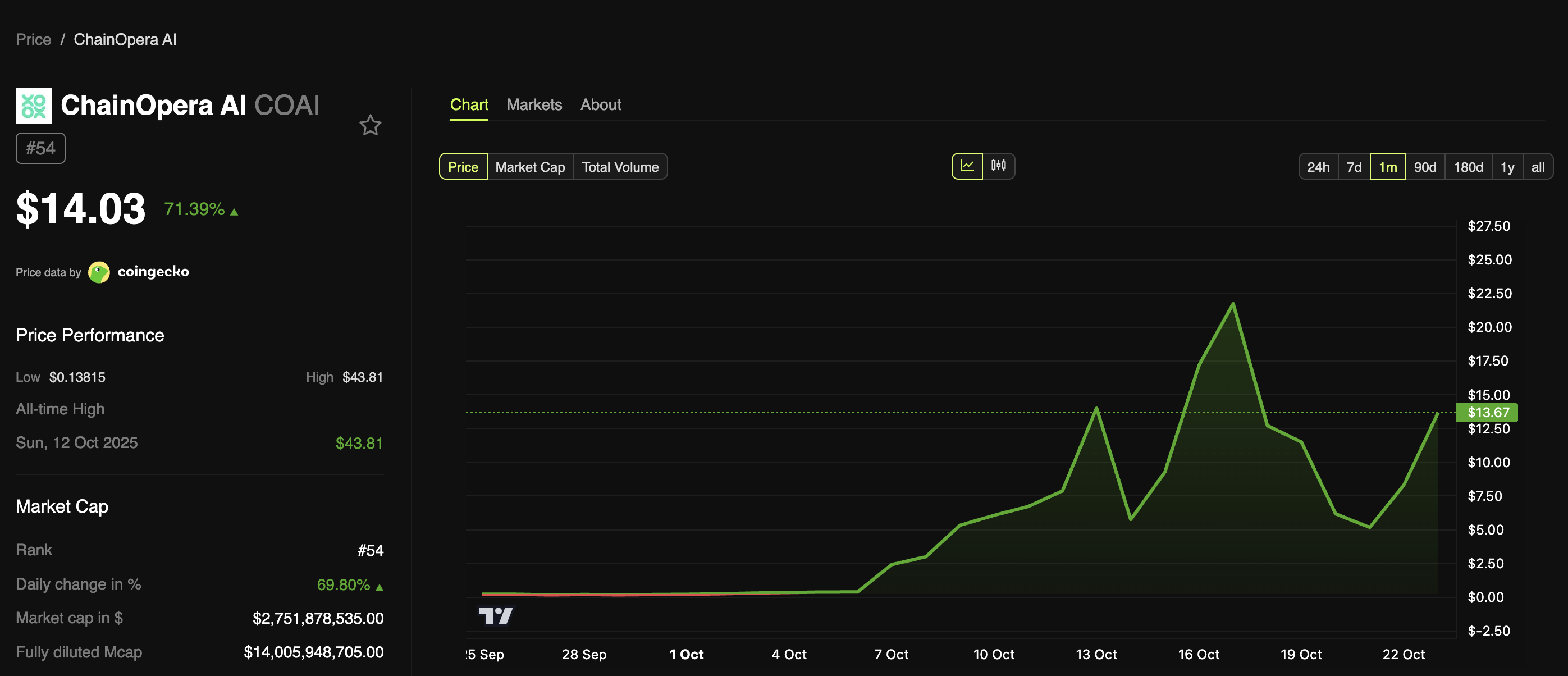

The COAI token has staged a serious comeback after experiencing a post-all-time excessive correction. BeInCrypto Markets knowledge confirmed that the altcoin has pumped 71.39% over the previous 24 hours, outperforming the broader crypto market.

COAI’s efficiency positioned it as the best each day gainer among the many prime 300 cash on CoinGecko. Moreover, 77% of the merchants keep a bullish stance on the token. On the time of writing, it traded at $14.

Along with worth, COAI can also be seeing broader investor adoption. Regardless of solely being a month previous, the token has drawn over 50,000 holders.

“Thanks for the love of our neighborhood. Now COAI has greater than 50000 holders!” the workforce posted.

Moreover, the token has additionally captured large curiosity from the neighborhood. Information from analytics platform LunarCrush reveals the COAI was talked about 2,393 occasions in a single day, marking a 1,308% bounce from its standard each day exercise.

Sponsored

Sponsored

A current evaluation of over 2,000 COAI posts indicated that sentiment was pushed by three themes: buying and selling alternative (35%), the Bitget itemizing (30%), and ChainOpera’s deal with decentralized AI (20%).

“Merchants see $COAI as a possible funding alternative, with many posts highlighting the potential for positive factors and the venture’s deal with AI…..The venture’s deal with AI and its integration with blockchain is seen as a optimistic issue, with many customers selling it as a possible ‘subsequent massive factor.’” LunarCrush said.

Specialists Warn COAI Might Be the Subsequent Main Crypto Rip-off Amid Speedy Rise

Regardless of COAI’s sharp rise, skepticism stays. Information highlighted that ten wallets maintain 87.9% of tokens, elevating centralization issues. Beforehand, blockchain analytics agency Bubblemaps claimed {that a} single entity is behind half of the top-earning COAI wallets.

“I assumed COAI was simply one other hype coin, however seems it was worse- a full on rip-off in movement. Faux product with a made-up AI story. Faux decentralization….And CEXs helped it by itemizing this rubbish. Retail will get dumped on whereas insiders stroll away wealthy. It’s time this area stops rewarding frauds,” an analyst remarked.

One other analyst, Viktor, drew parallels between COAI and MYX Finance (MYX), calling the previous ‘the highest rip-off of October.’

“I’m very a lot of the opinion that the size of the scams which can be allowed on Binance and Bybit perps is now unprecedented, after seeing M, MYX, AIA and COAI all occur in two months,” he wrote.

Whereas proponents see COAI as a promising venture on the intersection of AI and blockchain, critics warn it may very well be one other short-lived hype or worse — a coordinated rip-off. As debates intensify, solely time will inform whether or not COAI proves its legitimacy or fades as simply one other cautionary story within the crypto market.