Bitcoin (BTC) worth is buying and selling close to $111,000, up virtually 2% prior to now 24 hours and about 63% greater year-on-year. The broader pattern stays bullish, however one acquainted sign has reappeared – the identical one which sparked a 15% rally final month.

Now, the one factor standing in the best way is one important resistance degree.

Sponsored

The Similar Bullish RSI Sign Is Again

The Relative Energy Index (RSI), which tracks shopping for versus promoting momentum, is flashing a hidden bullish divergence, a setup that always alerts pattern continuation.

Between June 22 and October 17, Bitcoin’s worth shaped greater lows, whereas the RSI printed decrease lows, a sample exhibiting fading promoting stress whilst the value stays regular.

This precise setup appeared between June 22 and September 25, simply earlier than BTC jumped 15.7% towards its current excessive. If the identical share transfer is revered, this BTC worth bounce may settle round $119,900 this time.

The repeated sign now means that patrons are quietly regaining energy and that one other upside transfer could also be forming.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Sponsored

On-Chain Metrics Again the Bullish Case

Two on-chain indicators strengthen this outlook. The primary is Internet Unrealized Revenue/Loss (NUPL), which measures how a lot revenue holders have on paper. When NUPL is low, there’s much less motive for traders to promote.

As of October 23, NUPL sits near its three-month low of 0.48. The final time it touched this degree, Bitcoin’s worth gained 3.8% inside days.

Sponsored

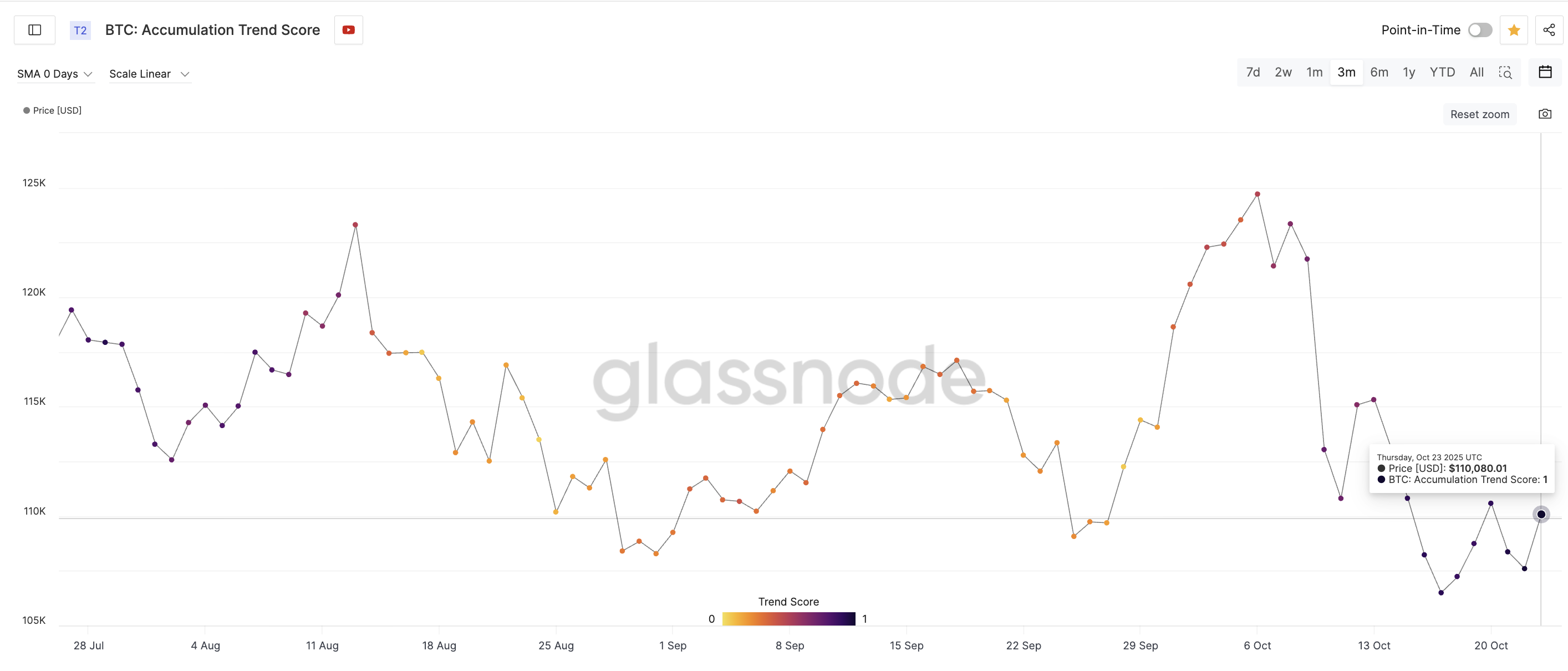

The second is the Accumulation Pattern Rating. This metric tracks how actively completely different teams of traders are shopping for or promoting Bitcoin primarily based on pockets measurement. It considers each the dimensions of every entity’s holdings (participation rating) and the way a lot they’ve added or offered prior to now month (steadiness change rating).

A price nearer to 1 means bigger entities — akin to whales or funds — are aggressively accumulating, whereas a worth close to 0 alerts distribution or inactivity. The metric gives a transparent image of how the most important market contributors are positioning on-chain.

As of October 23, Bitcoin’s Accumulation Pattern Rating has climbed again to 1, exhibiting that giant holders are as soon as once more in lively purchase mode. This shift confirms renewed confidence and helps the broader bullish construction forming on the charts.

This reinforces that the present bounce isn’t retail-driven alone; stronger palms are stepping in.

Sponsored

$116,500: This Bitcoin Value Degree That Decides the Subsequent Transfer

Whereas the alerts are promising, Bitcoin’s $116,500 degree stays the make-or-break zone. Each rally try since October 11 has stalled there.

A every day shut above it may affirm the RSI’s bullish setup and set off a transfer towards $119,700, aligning with the RSI-driven rally projection of over 15%. Past that, even $125,700 comes into view as a Bitcoin worth goal.

On the draw back, assist rests close to $110,050, and shedding that would push BTC towards $108,500 and even $106,600.