- U.S. CPI rose 0.3% in September, barely under expectations, with annual inflation at 3.0%.

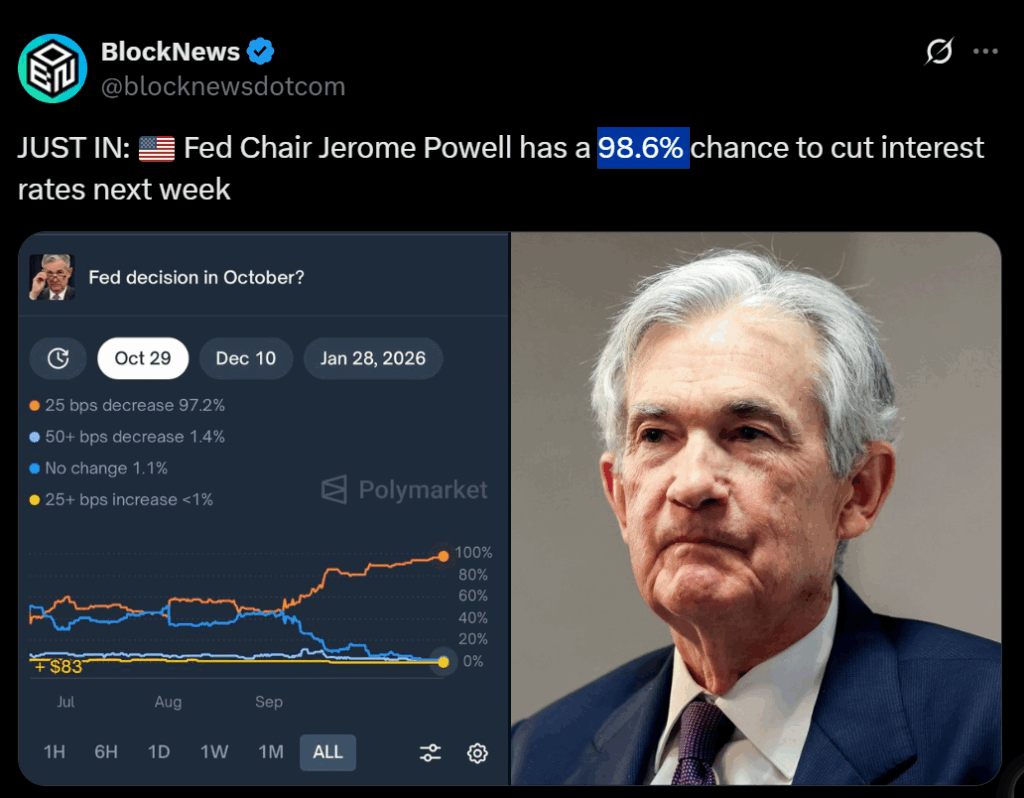

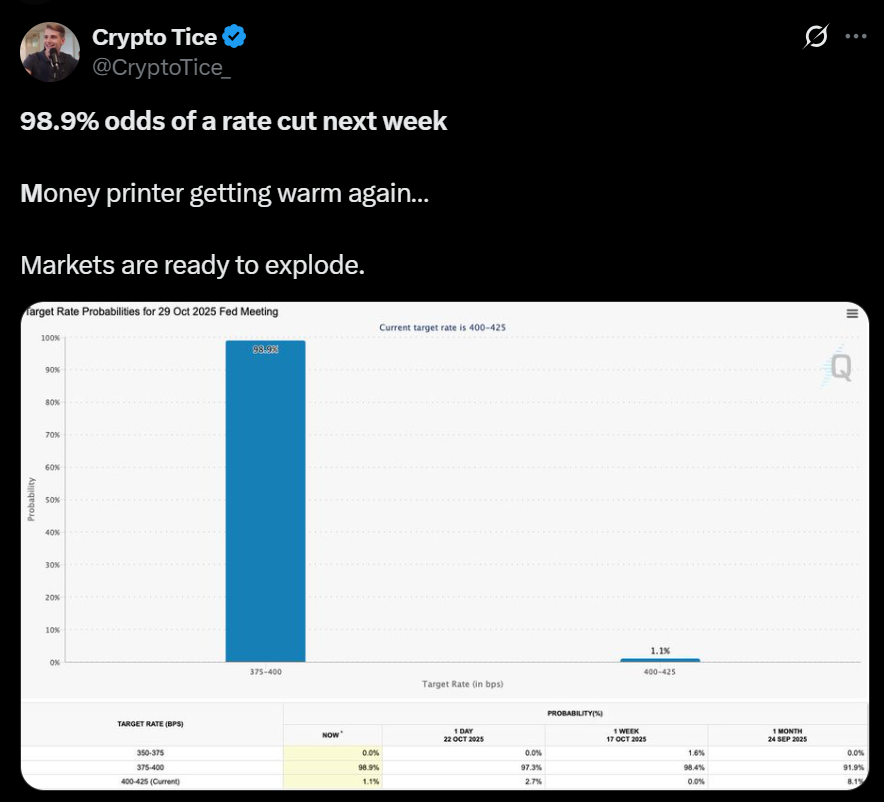

- Charge lower odds hit 98.6% for October and 94.5% for December, per CME FedWatch knowledge.

- Trump’s new tariffs may threaten to reaccelerate inflation regardless of easing traits.

The Federal Reserve is broadly anticipated to chop rates of interest by 25 foundation factors subsequent week, as new knowledge confirmed U.S. inflation cooled barely in September. The Client Value Index (CPI) rose 0.3% month-over-month, easing from August’s 0.4% improve and coming in slightly below expectations. Yr-over-year, inflation stood at 3.0%, whereas core inflation — which excludes meals and vitality — additionally rose 3.0%, its lowest degree since early 2024.

The CPI report confirmed that rising gasoline costs (+4.1%) have been the primary driver of inflation in September, whereas meals and housing prices grew at a extra reasonable tempo. In the meantime, classes like used vehicles, communication, and car insurance coverage noticed declines, indicating a broad cooling in value pressures throughout client sectors.

Market Bets Surge on Consecutive Cuts

Following the inflation knowledge, merchants boosted bets that the Fed will ship two charge cuts earlier than year-end. In accordance with the CME FedWatch Software, the chance of an October charge lower jumped to 98.6%, whereas the percentages of one other in December reached 94.5%. Futures markets are even pricing in a possible third lower in January 2026, as policymakers search to steadiness slower progress with easing inflation.

Nonetheless, uncertainty stays. Fed Chair Jerome Powell has struck a cautious tone, warning that the trail of charge reductions will rely upon sustained progress in inflation and labor circumstances. In the meantime, hiring has slowed modestly, elevating issues that overly aggressive cuts may unsettle wage and employment dynamics.

Trump’s Tariffs Add a New Inflation Threat

Regardless of optimism across the charge lower cycle, analysts warn that President Donald Trump’s proposed tariffs on Chinese language imports — set to start November 1 — may complicate the inflation image. Economists say the brand new tariffs may reignite value pressures in sectors tied to imports, similar to electronics and autos, partially offsetting the Fed’s efforts to tame inflation.

The central financial institution’s upcoming determination is anticipated to sign whether or not it prioritizes short-term progress over preemptive inflation management. For now, markets are bracing for a dovish tone, with equities and crypto belongings each displaying reduction rallies forward of the announcement.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.