- A “good dealer” boosted ETH lengthy place to $131M, signaling confidence in a breakout.

- ETH should break $4,100 resistance to verify bullish continuation towards $4,750.

- Change reserves hit multi-year lows, hinting at a provide squeeze and long-term accumulation.

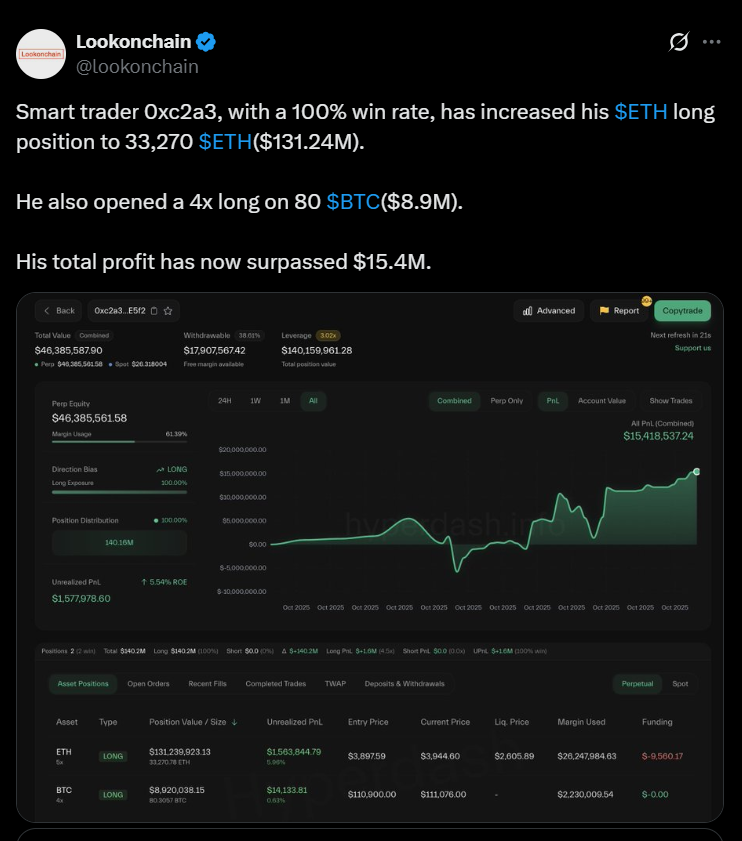

Ethereum (ETH) surged again towards the $4,000 mark on Friday as on-chain analysts tracked a “good dealer” who elevated their lengthy place to 33,270 ETH — value about $131 million. The transfer reignited optimism amongst merchants that ETH may escape of its multi-week consolidation zone.

Knowledge from Cointelegraph Markets Professional and TradingView confirmed ETH/USD hitting an intraday excessive of $4,025, earlier than stabilizing close to $3,940. The dealer behind the $131M lengthy has a 100% win charge over the previous two weeks, reportedly pocketing $16 million in income, in accordance with consumer Uncover on X. This wager coincides with whale accumulation exercise, as addresses holding 10,000–100,000 ETH have begun including to their positions.

Merchants Eye $4,100 and $4,750 Targets

Analysts say ETH must reclaim $4,100 to verify a breakout from its latest “flush” and arrange for a stronger rally. Dealer Daan Crypto Trades famous that clearing this stage may flip market construction right into a “large deviation,” opening room for sustained upside momentum.

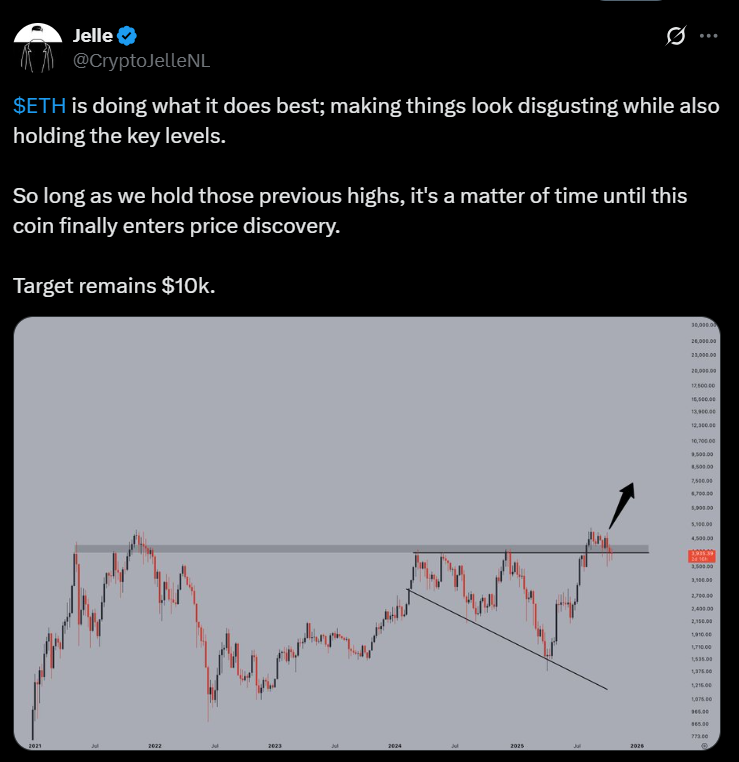

In the meantime, Crypto Zee initiatives a gradual climb by way of $4,250 resistance, concentrating on a $4,750 demand zone, whereas Jelle reiterated that ETH stays on observe towards a possible $10,000 cycle excessive if it maintains assist above earlier highs.

Provide Squeeze Builds as Change Reserves Fall

A bullish provide story can be unfolding beneath the floor. Knowledge from CryptoQuant exhibits ETH reserves on exchanges have fallen to their lowest ranges in years, suggesting traders are more and more shifting holdings into long-term storage or DeFi protocols.

Analyst Grasp of Crypto commented, “Individuals are holding, not promoting. When this occurs, costs normally explode.” Mixed with whale accumulation and a good macro backdrop — together with 94% odds of one other Federal Reserve charge reduce — Ethereum’s setup appears to be like primed for a renewed push above $4K.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.